Which companies are owned by Disney? Disney’s portfolio spans across different businesses, including entertainment, media, and innovation, making it a worldwide powerhouse. Through vital acquisitions, Disney has gained possession of various high-profile brands and services, essentially expanding its impact.

As of 2024, Disney’s simplifying platforms collectively attract over 200 million subscribers, whereas its extensive media networks reach millions of viewers around the world. This vast network of assets contributes to Disney’s amazing advert esteem, which surpasses $160 billion, setting its position as one of the foremost influential and fiscally effective corporations within the world.

In this article, we are going to look at all the distinctive companies owned by Disney, along with their net worth.

About Disney Company

- Founding: The Walt Disney Company was set up in 1923 by Walt and Roy Disney as a little animation studio, progressing into a worldwide entertainment aggregate.

- Core Businesses: Disney operates over different sectors, including film, TV, theme parks, streaming, and consumer items, making it an expanded excitement giant.

- Iconic Brands: Disney owns universally recognized brands such as Pixar, Wonder, Lucasfilm, 21st Century Fox, ABC, and ESPN, upgrading its content portfolio.

- Theme Parks: Disney’s theme parks, including Disneyland and Walt Disney World, are among the foremost gone by visitor destinations all around, contributing basically to its income.

- Streaming Services: Disney’s streaming services, such as Disney+, ESPN+, and Hulu, combined have more than 200 million subscribers, fueling its improvement in the digital space.

- Financial Strength: As of 2024, Disney’s market esteem outperforms $160 billion, showing its solid brand recognition, extended resources, and solid income generation.

- Cultural Impact: Disney’s movies, TV programs, and items have a lasting effect on culture, impacting generations around the globe.

Disney’s Acquisition Strategy

Disney’s acquisition strategy is central to its development, focusing on acquiring brands with strong content and fan bases. This approach improves Disney’s center strengths in storytelling and content distribution. By deliberately acquiring companies, Disney grows its content library and fortifies its presence in film, television, and streaming, making significant cross-platform synergies.

The strategy also emphasises international expansion, allowing Disney to increase its global reach. Acquisitions often target companies with broad universal appeal and developing technologies, keeping Disney competitive in a fast-evolving media scene.

Recent acquisitions have reinforced Disney’s streaming administrations, driving subscriber growth and upgrading content offerings. By integrating these resources into its existing portfolio, Disney maximises incentive collaboration and distribution opportunities. This acquisition-driven development strategy positions Disney as a prevailing player in worldwide entertainment, ensuring long-term sustainability and advancing market leadership through diversification and technological advancement.

List of 16 Companies Owned by Disney

1. Pixar

- Animation Excellence: Pixar may be a pioneer in 3D activity, making iconic motion pictures that revolutionised the development industry.

- Storytelling: Celebrated for its really heartfelt storytelling, Pixar appeals to both kids and grown-ups.

- Acquisition: Disney bought Pixar for $7.4 billion in 2006.

- Creative Influence: Pixar has significantly affected Disney’s animated film approach by combining art with development.

- Net Worth: Pixar’s assessed esteem is around $15 billion, reflecting its part in Disney’s long-term profitability.

2. Marvel Entertainment

- Superhero Universe: Marvel manages a vast universe of superheroes, contributing to a highly profitable film franchise.

- Cinematic Success: Its films have generated the highest revenues all of the time and thus increasing Disney’s market share worldwide.

- Acquisition: Disney later bought Marvel in 2009 at $4 billion.

- Cross-Platform Synergies: This makes Marvel content relevant for revenues, in films, television series, comic books, as well as merchandise.

- Net Worth: Marvel is valued at approximately $53 billion, reflecting its immense global brand power.

3. Lucasfilm

- Franchise Legacy: As being the owner of Star Wars franchise, Lucasfilm has cultural significance and followers.

- Acquisition: Disney purchased LucasFilm in 2012 for a whopping $4.5 billion.

- Content Expansion: Lucasfilm remains to create massively successful motion pictures and television, which improves Disney’s science fiction filter.

- Innovation: Lucasfilm’s pioneering visual effects have been critical to modern filmmaking.

- Net Worth: Lucasfilm’s estimated value is around $10 billion, driven by its iconic franchises.

4. 21st Century Fox

- Media Empire: Walmart acquired a diverse portfolio of resources at 21st Century Fox – film studios, TV networks and franchises.

- Acquisition: Disney bought 21st Century Fox at $71. 3 billion its biggest acquisition up to date in the year 2019.

- Content Library: This acquisition brought thousands of films and shows into Disney’s library, which benefited its streaming platforms.

- Global Reach: Fox’s international channels expanded Disney’s global distribution capabilities.

- Net Worth: Post-acquisition, the value of the Fox assets under Disney is estimated to be around $65 billion.

5. ABC

- Television Network: ABC is another famous American TV network that broadcasts numerous popular shows.

- Content Influence: ABC is a major network that broadcasts news, entertainment and sports programs.

- Historical Acquisition: Disney later on acquired ABC in 1996 to expand its media and communication wing along with other arms.

- Revenue Source: ABC is a significant source of advertising revenue for Disney.

- Net Worth: ABC’s estimated esteem is around $10 billion, reflecting its significance in Disney’s media portfolio.

6. ESPN

- Sports Broadcasting: ESPN is a well-known sports channel, which gives its viewers live broadcasting of different sports and occasions.

- Market Influence: ESPN is strategic for Disney’s overall business approach because ESPN exercises its near monopoly in the field of sports media significantly.

- Acquisition: ESPN was owned by Disney after they bought Capital Cities/ABC in 1996.

- Cross-Platform Presence: ESPN produces content across different multimedia channels including cable, streaming, and digital.

- Net Worth: ESPN is currently estimated to be worth roughly $50 billion and therefore it is a significant asset for Disney.

7. National Geographic

- Educational Content: National geographic is renowned for its documentaries and programs on nature, science and history.

- Global Reach: It helps the brand go international which is valuable for Disney Company.

- Acquisition: National geographic is under Disney after Disney bought National Geographic in the year 2019.

- Content Collaboration: Content related to National Geographic is a part of Disney and is easily available on Disney’s streaming services.

- Net Worth: National Geographic’s brand is valued at around $1 billion, reflecting its niche but influential market.

8. FX Networks

- Premium Content: FX Networks is known for critically acclaimed dramas and comedies, appealing to a mature audience.

- Market Position: It strengthens Disney’s presence in premium cable television.

- Acquisition: Disney acquired FX Networks as part of the 21st Century Fox deal.

- Original Programming: FX could be a key player in unique scripted content, gaining various awards.

- Net Worth: FX Networks is evaluated to be worth $4 billion, contributing important content to Disney’s portfolio.

9. Hulu

- Streaming Platform: Hulu is a driving streaming benefit that advertises a mix of live TV, unique content, and licensed shows.

- User Base: It draws in millions of subscribers, complementing Disney’s other streaming administrations.

- Ownership: Disney gained full control of Hulu in 2019.

- Content Library: Hulu’s diverse offerings enhance Disney’s digital strategy.

- Net Worth: Hulu is valued at approximately $19 billion, highlighting its significance in Disney’s streaming portfolio.

10. Touchstone Pictures

- Film Production: Touchstone Pictures was established to produce more mature films under Disney’s umbrella.

- Notable Releases: It produced many commercially successful and critically acclaimed films.

- Content Focus: Touchstone allowed Disney to diversify into different genres.

- Current Status: Although production has slowed, Touchstone’s legacy remains influential.

- Net Worth: Touchstone’s historical value is integrated into Disney’s overall media portfolio, contributing significantly in its prime.

11. Disney Channel

- Youth Entertainment: Disney Channel is a key provider of family-friendly programming, especially for children and teens.

- Global Reach: The channel broadcasts in numerous countries, expanding Disney’s global influence.

- Content Creation: It produces popular original series, movies, and specials.

- Brand Loyalty: The channel fosters strong brand loyalty from a young audience.

- Net Worth: Disney Channel’s value is estimated at $10 billion, based on its reach and influence.

12. Walt Disney Pictures

- Flagship Studio: Walt Disney Pictures is Disney’s main film studio, creating blockbuster energised and live-action movies.

- Iconic Films: The studio is known for making beloved classics that have shaped worldwide culture.

- Global Impact: Its films dominate box office revenue worldwide.

- Creative Leadership: The studio sets the standard for family amusement and storytelling.

- Net Worth: Walt Disney Pictures is esteemed at approximately $30 billion, exhibiting its important part in Disney’s success.

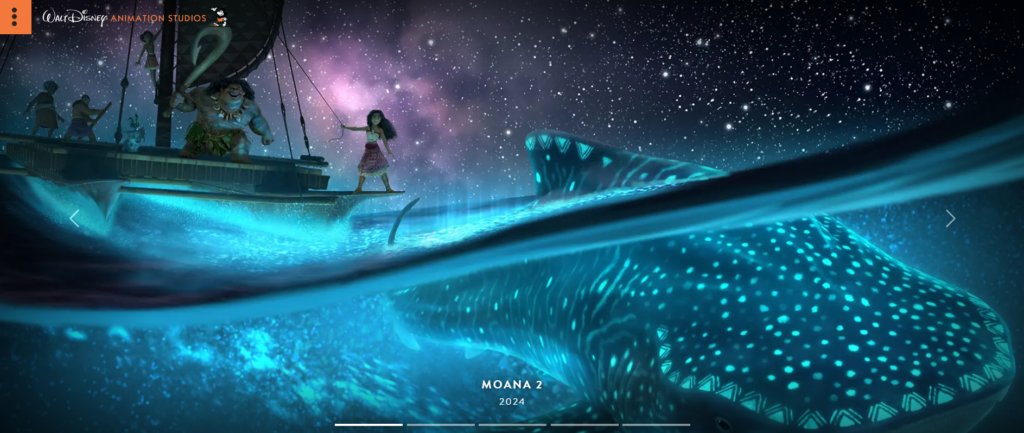

13. Walt Disney Animation Studios

- Animation Legacy: The studio is the origin of Disney’s unique animated classics.

- Technological Innovation: It continues to push boundaries in animation technology and storytelling.

- Cultural Impact: Its films resonate across generations and cultures.

- Awards: The studio has won various awards for its animated highlights.

- Net Worth: Walt Disney Animation Studios’ estimated esteem is $25 billion, underscoring its foundational part in Disney’s brand.

14. Disney Music Group

- Music Production: Disney Music Group manages the production, distribution, and licensing of music for Disney’s motion pictures, TV appears, and theme parks.

- Label Success: It includes successful labels like Walt Disney Records and Hollywood Records.

- Soundtrack Success: The group produces hit soundtracks that often top charts.

- Global Distribution: Music from Disney’s portfolio is distributed worldwide, enhancing brand recognition.

- Net Worth: Disney Music Group is valued at approximately $2 billion, driven by its extensive catalogue.

15. Buena Vista Theatrical Group

- Theater Productions: Buena Vista Theatrical Group is Disney’s live theatre production arm, responsible for Broadway hits.

- Adaptations: It brings popular Disney films to the stage, creating new revenue streams.

- Award-Winning: Its productions have won multiple Tony Awards, solidifying its reputation.

- Global Reach: Productions tour globally, extending Disney’s influence in the theatre world.

- Net Worth: Buena Vista Theatrical Group is valued at around $1 billion, reflecting its niche but profitable market.

16. Disney Media Distribution

- Global Content Sales: Disney Media Distribution handles the global sales of Disney’s content across multiple platforms.

- Partnerships: It manages licensing deals with broadcasters, streaming platforms, and syndicators worldwide.

- Strategic Distribution: The division is key to maximising Disney’s content reach and revenue.

- Digital Expansion: Focuses on digital and on-demand services, adapting to changing consumer behaviour.

- Net Worth: The division’s value is integrated into Disney’s broader media operations, significantly contributing to overall revenue.

Ending Note

Disney’s extensive portfolio of companies showcases its dominance across different amusement and media sectors. Through key acquisitions, Disney has extended its impact from animation to streaming, sports, and live entertainment. Each company beneath its umbrella not only strengthens Disney’s core offerings but also improves its worldwide reach and income potential. These diverse assets contribute to Disney’s status as a leading global entertainment giant, continually innovating and setting industry standards. The combined value and cultural impact of these companies underscore Disney’s strategic foresight and its commitment to delivering compelling content worldwide.

Read more:

FAQs

What was Disney’s largest acquisition?

Disney’s largest acquisition was 21st Century Fox in 2019, valued at $71.3 billion. This deal significantly expanded Disney’s content library and global media influence.

Why does Disney acquire companies?

Disney secures companies to upgrade its content portfolio, extend global reach, use new technologies, and reinforce its position as a driving entertainment provider across numerous platforms.

What effect have acquisitions had on Disney?

Acquisitions have altogether boosted Disney’s market value, content offerings, and worldwide impact, solidifying its status as a prevailing player in entertainment, media, and streaming services.