AI-powered Saas accounting tools is an internet-based solution. It assists companies to manage finances, automate procedures, and view current financial information at any location.

Cloud-based accounting systems remove manual data entry needs and offer real-time financial data. This makes bookkeeping and financial management straightforward — allowing efficient collaboration among colleagues.

When compared to conventional downloadable software, there is no concern about security risks, data backups, or program updates. Cloud accounting can be accessed from any device and in many cases even offers APIs to integrate third-party software.

Throughout this article, we will have a look at the top 10 cloud accounting software for small business products for small companies. We will outline their essential features, price, the perfect use case scenario for each software, advantages & disadvantages, and more.

How to Chose the Best Cloud Accounting Software for Small Businesses

There are several features to consider while deciding on the most suitable Online payroll management system for companies of every kind, which will help you navigate through the technicalities. Here’s how you can compare various options:

Software Features: the most appropriate Cloud-based financial reporting with necessary features such as invoicing, tracking of expenses, bank reconciliation, financial reporting, and inventory management.

User Interface and Usability: A user-friendly interface is crucial for accounting professionals and small business owners.

Security and Integration: Security of financial data is one of the issues that affect financial accounting companies.

Scalability and Growth: An application that would expand with your business expansion, accommodating increased user volumes and more sophisticated financial capabilities.

Affordability: Various free accounting programs for vital accounting tasks and business cloud accounting packages that accommodate different needs.

10 Best Cloud Accounting Software tools for Small Business

Whether you are a small company or a multinational corporation, leveraging the power of Multi-user accounting software tools can assist you in managing your funds with ease and accuracy.

Online accounting software provides various features such as invoicing tools, tracking expenses, paying bills, real-time financial reports, etc. By utilizing these functions, you can automate accounting tasks and reduce the time spent on manual data entry.

These are the top 10 cloud accounting tools for small enterprises to look into for their business:

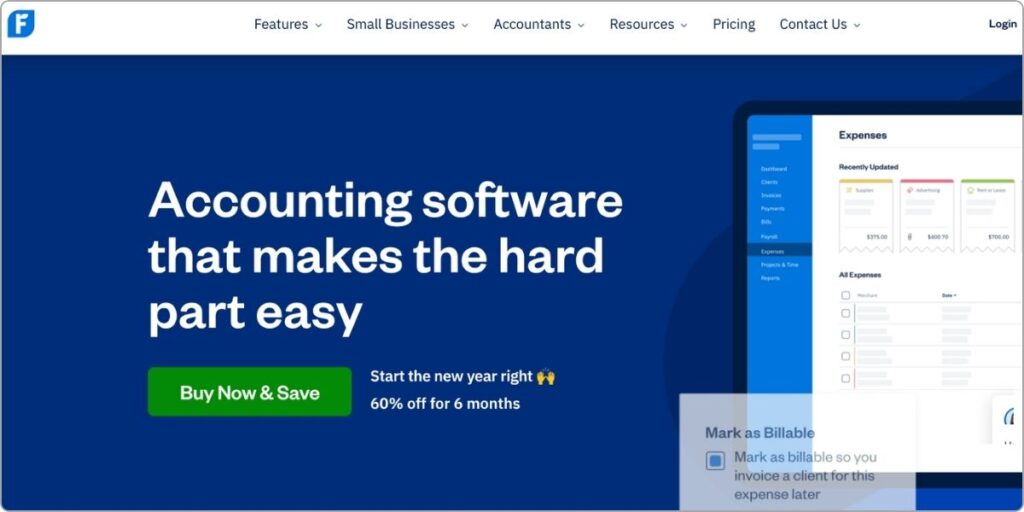

1. FreshBooks

Freshbooks is a cloud accounting software tool intended for small and medium-sized companies.

It streamlines the process of accounting through functions such as invoicing, expense tracking, time tracking, and payment management. As it supports only a single user per subscription, it suits sole proprietors and freelancers.

But it also accommodates all the features that a bigger business may need. Freshbook is simple to install & operate and has a simple User Interface.

Additionally, Freshbook also has a mobile application to keep working on the move. Furthermore, it employs advanced SSL technology for data protection. It is a decent accounting software for service based companies.

Key Features

- Freshbook supports double entry accounting system

- It has mobile app access

- Accept payments directly from clients

- Integrated time tracking system

- Strong invoice customization features

- Has customer service offering like phone and email support

- Has project management features that are integrated directly with its invoicing tool

- Easy to track expenses even with the photos of receipts

- Connection with bank account to import transactions automatically.

Pros

- Affordable pricing plans

- Provides a good mobile app access

- Payroll software integration option

- Built in project and time tracking system

- Customizable invoicing option

Cons

- Extra costs for additional users

- Lack features for quickly growing business needs

- Weak in inventory tracking

- Does not have document sharing feature

- No initial training option

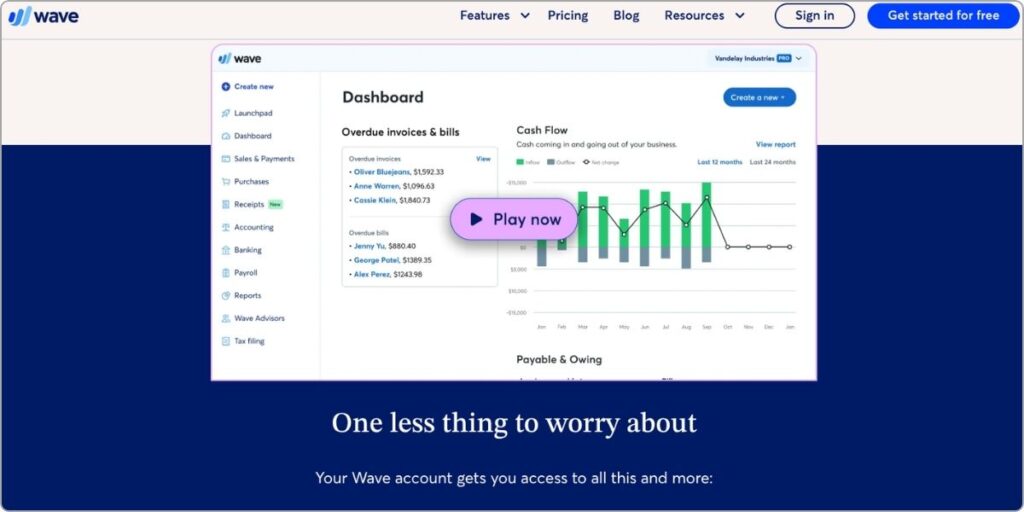

2. Wave

Wave is a free cloud accounting Software for small business with plenty of invoicing. But if you have to scan expense receipts or payroll functionality it will cost you money.

There are plenty of features on the paid plan. As business increases for more complicated transactions Wave has paid plan solutions.

It is multi currency supported and offers selected features for extremely small businesses. It lacks a time tracking feature and inventory management but provides so many great services for free.

It is easy to use and has a simple interface. Unlimited bank accounts, clients and invoicing make it an ideal selection of businesses on a tight budget.

Key Highlights

- Customizable and automated invoicing

- Simple financial reports

- Mobile app access for simple accounting and invoicing

- Wave Advisor program for bookkeeping assistance

- Receipt scanning and uploading features

- Has optical character recognition (OCR) capabilities to extract data from receipts

- Sales and sales tax tracking available

Pros

- User-friendly interface

- Robust features for invoicing and financial management

- Affordable pricing for small businesses and entrepreneurs

- Integration with other business software, such as payment processors and payroll systems.

Cons

- Users with complex accounting needs may find Wave’s capabilities limited.

- Limited integration with other tools.

Pricing

Wave accounting software offers a tiered pricing structure with a free plan and a paid option:

- Starter: $0/month

- Pro: $16/month

3. Xero

Xero is distinguished by its ease of use, real-time financial information, and compatibility with various third-party softwares.

Even if you have never used any accounting software in your life, working with Xero won’t be difficult.

This Cloud Accounting Software provides functionalities such as financial reporting, project and time tracking, document management, expense management, inventory and payroll.

Xero has unlimited users. This is beneficial for companies that have more than one user requiring access. Xero has multi factor authentication (MFA), user access setup that can be tailored, and data encryption.

Key Features

- Invoice

- Inventory Management

- Payroll

- Business Reports

- Multiple Billing Formats

- Multi-currency Support

- Credit and Cashflow Management

Pros

- It offers a comprehensive feature set covering various aspects of financial operations

- Allows integration with numerous third-party applications for enhanced functionality

- Offers multi-currency support which facilitates international business operations

- It automates accounting tasks, saving time and reducing human error

Cons

- May not be suitable for businesses with complex inventory needs.

- Additional features require separate subscriptions.

- Limited offline functionality as it is reliant on an internet connection.

Pricing

Xero offers tiered pricing plans for small businesses, including:

- Early: Usually $15 per month (currently $0.75)

- Growing: Usually $42 per month (currently $2.10)

- Established: Usually $78 per month (currently $3.90)

4. Kashoo

Kashoo is small business accounting software that provides a low-cost method of handling finances. With its easy-to-use interface, automatic capabilities, and mobile application, it ranks as one of the top cloud accounting software to keep your books up to date.

Kashoo also has an Inbox for looking at and editing imported bank transactions, creating a central repository for financial information.

Key Features

- Invoicing with customizable templates and automated late payment reminders

- Expense tracking with bank reconciliation and categorization

- Multi-currency support

- Basic inventory management tools

- Customizable chart of accounts

- Financial reports, including profit and loss charts, balance sheets, and history logs, are exported to Excel, CSV, HTML, PDF, and Google Sheets

- Project management and expense tracking by project

- Offers a mobile app with transaction recording features

- Supports double-entry accounting for organized financial records

Pros

- It offers integration options to connect with other business software and services

- It is mobile-accessible

- Several accounting tasks can be automated on Kashoo which saves time

- Offers customization options for reporting

Cons

- Lacks time tracking

- No advanced inventory management

Pricing

Kashoo offers a free trial period of 14 days which you can use to try out all the features. The paid plans are billed annually, and they include:

- Trulysmall.accounting: $216 per year

- Kashoo: $324 per year

5. Quickbooks

Quickbooks Online is one of the widely used accounting programs. Its sophisticated features it offers include customized reporting for construction firms, nonprofits, manufacturers, wholesalers and distributors.

QuickBooks has various plans for subscription according to the size of businesses. It’s also useful in collaborating with bookkeepers or accountants since it makes them remotely accessible to your financial information, a key advantage of Cloud Accounting Software.

It doesn’t have a client portal but you can insert notes and documents you wish to share with them. Quickbooks has mobile application access to resume accounting tasks.

Key Features

- Create professional invoices and estimates, send them to clients electronically, and track outstanding payments.

- Real-time financial data insights monitoring and customizable reports.

- Multi-currency support for financial transactions.

- Sales tax tracking and automatic calculations.

- Customizable invoices and automated payment reminders

- Bank feeds and automatic transaction reconciliation and management

- CSV imports into QuickBooks. For larger CSV migrations into QuickBooks, some teams use a bulk import tool such as SaasAnt to bring the data in with fewer manual edits afterward.

- Mobile accounting app for managing accounting transactions and reports on the go.

- Integration with ecommerce data tools, CRM, expense management, time tracking software.

Pros

- It integrates with several third-party applications, allowing for seamless data transfer.

- It’s easy to track income and expenses

- Securely stores your financial data in the cloud

- Accessible from any device

- Offers a free 30-day trial

- Allows easy collaboration.

Cons

- Limited features are available on the mobile app.

- Lacks payroll and project management features.

Pricing

QuickBooks offers four pricing tiers.

New customers can enjoy a 50% discount on all plans for the first 3 months. New users are also entitled to a 30-day free trial period on all plans.

- Simple Start: $35 per month (currently $17.50)

- Essentials: $65 per month (currently $32.50)

- Plus: $99 per month (currently $49.50)

- Advanced: $235 per month (currently $117.50)

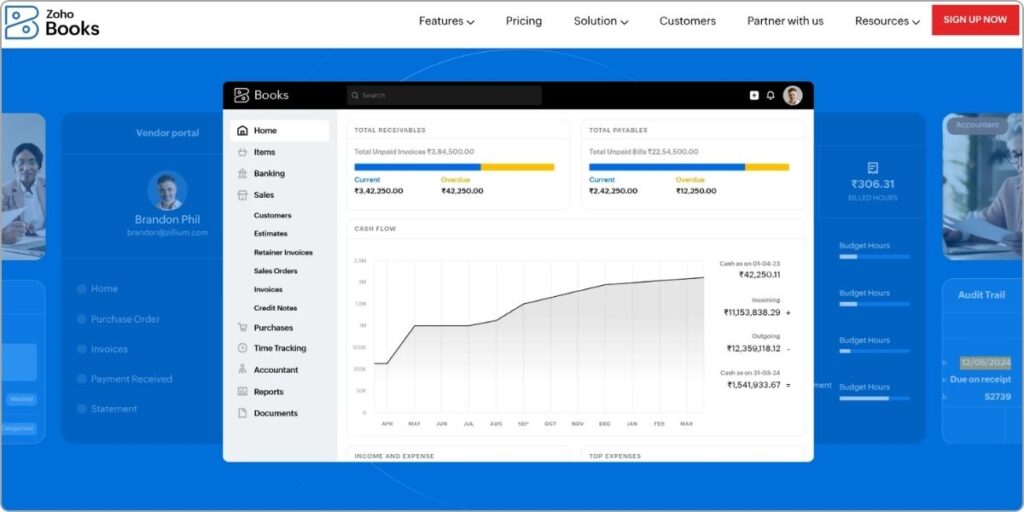

6. Zoho Books

Zoho contains a range of different business management softwares and Zoho Books is one among them.

Zoho Books is an all-round cloud accounting solution. It has features such as sending bills, reconciling accounts, expense tracking, budgeting, inventory management and report generation.

It has a free option and is ideal for companies that utilize other Zoho products. It is suitable for larger small businesses, developing businesses, and established companies that need tailored accounting features. This Cloud Accounting Software offers seamless integration, making financial management easier and more efficient for growing enterprises.

Zoho Books has multilingual support and can handle 10 languages. It can manage outstanding bills, track time spent by employees and allocate project works.

Key Features

- Has a mobile app access

- Provides live support

- Inventory tracking available

- Users can contact the company by phone for support

- Invoicing and estimate features

- Has solid project management features

- Integration option with business management software

Pros

- Zoho Books offers robust customization options to fit your specific business needs.

- It integrates well with several business tools such as payment gateways, CRM software, and project management tools.

- It has an intuitive interface that makes it easy for beginners to navigate and manage their finances.

- Offers a free plan.

Cons

- Zoho Books only allows a maximum number of 15 users per organization even for the highest paid plan. Adding more users incurs additional costs.

- Some advanced features are limited and require add-ons to extend their usage limits.

Pricing

Zoho Books offers a free plan in addition to five paid plans. Here’s a breakdown of their pricing:

- Free: $0 per month

- Standard: $20 per month

- Professional: $50 per month

- Premium: $70 per month

- Elite: $150 per month

- Ultimate: $275 per month

7. Sage

Sage cloud accounting is an enormous small business accounting program. It possesses a great deal more than a small business would need.

It’s usually a desktop application. The application needs to be installed over a desktop or a laptop. It supports customized integrations and extensions as per business requirements.

It is very affordable and has the most number of features required by small businesses, such as invoicing, banking, and project accounting. Also, this Cloud Accounting Software contains a customer portal through which customers can monitor their transactions.

Key Features

- Customizable through its open API structure

- Automated workflows like auto-post expenses and payments

- Customized invoicing

- Connection with bank account to import bank transactions, and record bank credits and debits

- Has a audit trail feature to track a transaction

Pros

- Offers robust inventory management features

- Integrates with a variety of business apps

- Sage Accounting accepts multiple currencies, making it suitable for international business operations

- It offers a 30-day free trial to try out to the features.

Cons

- Lacks time tracking features compared to other online accounting software.

Pricing

Sage Accounting is a subscription-based service with three tiers:

- Pro Accounting: $61.92 per month

- Premium Accounting: $103.92 per month

- Quantum Accounting: $177.17 per month

8. Patriot

Patriot is an excellent bookkeeping software for small businesses that have straightforward financial transactions. Patriot is inexpensive, easy and intuitive.

The application has mobile web access to extend work on the move. With its Cloud Accounting Software, company owners can easily manage payroll and tax filings. Patriot includes its own software as integrations, such as Patriot’s native time tracking and HR software, ensuring seamless financial management.

Its high-end plan gives unlimited users. It also gives Patriot Smart Suggestion to automatically categorize your bank transactions in order to save clicks and time.

Key Features

- Offers payroll, HR and time tracking add ons

- Provides tax management

- Create and send invoices to unlimited customers

- Track unpaid invoices

- Unlimited Payments to Vendors

- Accept Credit Card Payments

- Automatically Import Bank Transactions

- Allows unlimited user on premium plan

Pros

- Affordable Pricing

- User friendly interface

- Has mobile browser access

- HR and payroll software integration option

- Tax management option available

- Unlimited payroll runs

Cons

- No inventory tracking

- Customized reporting not available

- No mobile app available

- Only US-based payroll processing

- Limited third-party software integrations

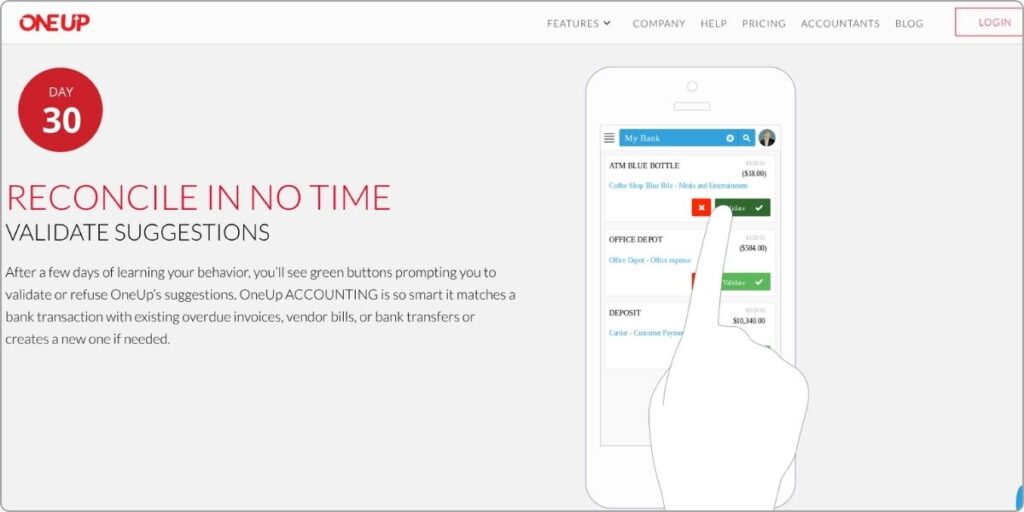

9. Oneup

Being a cloud accounting software, OneUp provides an array of features that make accounting, inventory management, invoicing, CRM, and more, easy.

One of the USPs of OneUp is its inventory management functionality, which enables users to monitor inventory levels, manage purchase orders, and generate invoices.

Irrespective of whether you are an individual entrepreneur, a startup, or a growing business, OneUp has the flexibility and scalability to accommodate your particular online accounting requirements.

Key Features

- Syncs with your bank for automatic transaction categorization and record keeping.

- Invoicing and inventory management, including monitoring stock levels, automating reordering, and validating orders.

- Customizable client portal and CRM integration for digital marketing.

- Quote templates and customization options

Pros

- Saves time with automation and streamlined business operations

- Offers a 30-day free trial with unlimited users and features included.

- Offers similar features across different devices for seamless user experience.

- Offers scalability for growing businesses.

Cons

- May not be as feature-rich as other online accounting software as it has no payroll functionality

- Limited integration with third-party apps

Pricing

OneUp offers a 30-day free trial with no credit card required and no hidden costs. It also offers a range of pricing plans tailored to different business needs. The pricing plans are as follows:

- Self: $9 per month for 1 user

- Pro: $19 per month for 2 users

- Plus: $29 per month for 3 users

- Team: $69 per month for 7 users

- Unlimited: $169 per month for unlimited users

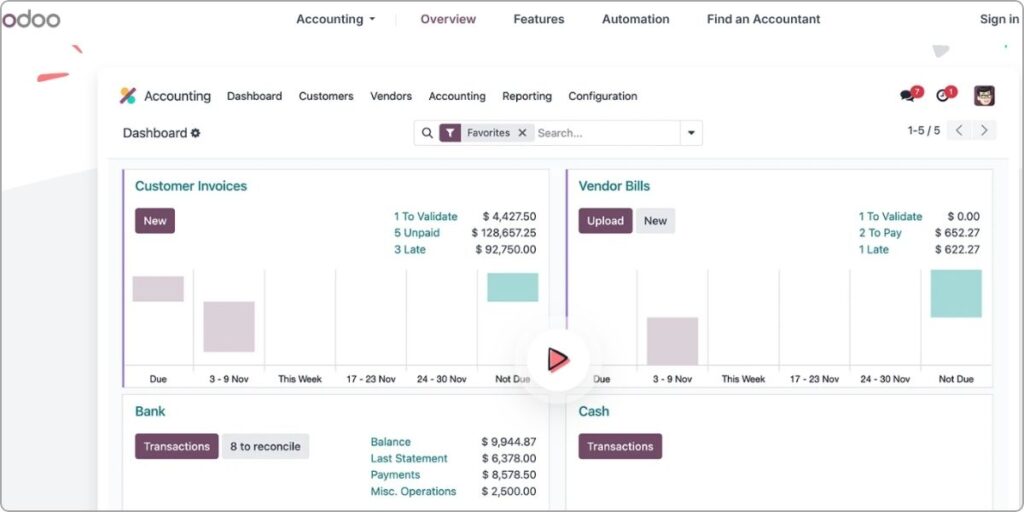

10. Odoo

Odoo is an adaptable and tightly integrated business software suite. Odoo has an exhaustive accounting module with intuitive presentation and robust functions.

It also includes financial reporting, bank syncing with automation, and AI-powered capture of invoices’ data. Odoo’s accounting module covers multi-currency transactions, calculation of taxes, and electronic billing.

It offers mobile app access to manage finances remotely. It also boasts its no data entry method in the Cloud Accounting Software module of Odoo. In this module, transactions are automatically matched in most cases.

Key Features

- Supports unlimited users

- Native iOS and Android apps covering 100% of features

- Automatically encodes uploaded scanned PDFs or image files

- Attractive invoice templates and automatic draft invoice creation

- Multi-currency support

- Integration with major online payment gateways

- Client portal to manage invoices, subscriptions, and orders online

- Fixed asset management & inventory tracking

- Automated emails, letters, SMS, and tasks for credit collection

- Strong financial reporting

Pros

- Easy to use, even for non-accountants.

- It is suitable for businesses of all sizes, from startups to large enterprises.

- Flexible platform that can be customized to fit business operations

- Odoo saves time and reduces errors with automated accounting tasks.

- It integrates with other Odoo apps to create a unified business management system

- Offers a free plan with basic accounting features.

Cons

- The free tier has limitations on features and data storage.

- Integrating with other apps requires additional subscriptions.

Pricing

Odoo Accounting offers a free plan and paid subscriptions. Pricing for paid plans depends on the number of users and features needed.

- One App Free: $0

- Standard: $31.10/user per month

- Custom: $46.80/user per month

Wrapping Up

With numerous choices, you can select the most suitable cloud accounting software for small business that meets your needs.

Keep in mind that these Cloud ERP software for small business is determined by your particular needs. You may want to consider your company size, business type, budget, and features you use the most.

You can utilize the free trial or plan to test-drive the program before deciding.

FAQs

What is typically the price for cloud ERP software?

A. Automated accounting software prices vary according to features and number of users you need. All the software comes with a free version containing fewer features and a paid version with several layers.

What are some of the considerations I should make in selecting cloud-based business accounting software?

A. The following are some of the most important things to take into consideration while selecting Cloud-based invoicing software for your business:

Ease of Use: Think about how easy the software is to use, particularly if you don’t have much accounting experience

Features: Ensure that the software has the features you require, including invoicing, expense tracking, and reporting.

Scalability: Choose software that will be able to grow with your business.

Integration: Consider if the software is integrated with other business applications you use, such as your payment processor or CRM.

Cost: Compare the various software and their pricing to see if it will be budget-friendly for your business.

Is cloud accounting tools safe?

A. Cloud accounting tools has the latest security features to keep your financial information safe. Nevertheless, you have to select good quality software and follow best practices to keep your data safe, for example, by using strong passwords and having two-factor login authentication.

Am I able to use my online accounting software offline?

A. Many of the best cloud accounting packages need to be connected to the internet in order to operate in full functionality. That being said, a few do have limited offline support with synchronization of data once online.

How do small business owners migrate from conventional to cloud accounting packages?

A. Most online accounting systems provide migration software and support to help transfer your existing financial data. Most include free trials to test the system before fully converting your finances.