Apple FY 2024’s first quarter accounted for approximately $7.78 billion from Mac computer sales.

There’s no doubt that more and more people are buying iOS laptops due to their advantages in many aspects. One of them is how easily they communicate with accounting software and other company networks.

It might be difficult to find the best Mac accounting software, however. We have done some research and picked the top 10 accounting software for Mac in India to help you with that.

All of these software offer basic accounting features such as inventory and invoicing. To assist you in making an informed decision, we will now present the pros and cons of each.

How To Select Best Accounting Software for Mac in India

While going through your own specific software selection process, remember the following:

- Mac OS compatibility: Make sure the software is compatible with Mac OS. There are some accounting software that have limited functionality on Mac than on Windows.For instance, both Xero and QuickBooks Online possess good Mac support, including straightforward integration of the Mac features such as iCloud and Apple Watch applications.It’s critical to make sure you obtain all the features without restriction.

- Ease of Use: The software must be easy to use, even by non-technical or non-accounting individuals. FreshBooks, for instance, is highly commended for simplicity, and it is an excellent option for freelancers and small business owners who do not necessarily have an army of accountants on their payroll. A user-friendly interface can reduce the learning curve and increase overall productivity.

- Scalability: Your accounting program must be scalable with your business. Xero, for example, has unlimited users per subscription level, perfect for companies that are going to grow. This way, when your business expands, your program can handle more data and more sophisticated accounting requirements without needing to switch to another system.

- Cost and Pricing Plans: Also think about the cost of the software and how that is going to fit within your budget.Wave includes a free option with basic accounting, so it will be suitable for low-budget startups or small businesses. In contrast, feature-loaded ones like QuickBooks Online come in more than one price bracket to accommodate different sizes of business and needs. Price needs to be weighed against the needs you have.

- Integration Capabilities: It needs to integrate with other business tools and applications. Zoho Books, for instance, integrates easily with other Zoho tools and some third-party apps, which boosts its functionality. This can simplify your workflow by making it easy to transfer data from one system to another, minimizing manual data entry and errors.

The Top 10 Accounting Software for Mac in India

There are plenty of accounting programs for Mac. Due to this, it at times becomes overwhelming to choose the best one.

Don’t worry! By compiling the top 10 accounting software for Mac in India 2025, we’ve made it simpler to choose.

We will look into their main characteristics, pros, and cons . This will allow you to skip time-testing various solutions and discover a suitable solution for your needs in a flash.

Of course, below are the best Mac accounting software that you might be interested in.

1. QuickBooks Online

QuickBooks Online is a feature-rich accounting solution for Mac used by businesses of every size. You can manage payrolls, create business financial statements, manage billings and expenses, and keep tabs on income.

Furthermore, you also have access to expert tax assistance while doing your taxes. And, being new to QuickBooks, the website offers professional assistance from bookkeeping experts.

This regular support makes it easy for you to review your business reports and balance your accounts. You can also automate your financial management processes, such as tax calculations, based on your business needs.

Another fantastic feature of QuickBooks Online is that it integrates easily with 750 business apps such as Salesforce, Zoho, and PayPal. This means you don’t have to manually enter data.

Key Features

- Seamlessly integrates with online sales platforms like Shopify, Amazon, and Etsy.

- Custom access feature for collaborating with ecommerce accountants, tracking employee time, and sharing reports with investors and stakeholders.

- Automates sales tax calculations to identify non-taxable and taxable sales.

- Automatic smart invoicing to track payments.

- Easily tracks expenses, incomes, and receipts.

- Automatically reconciles and syncs bank transactions

- Allows real-time inventory tracking to avoid overstocking or understocking.

- Cash flow management for a comprehensive view of your balances.

Pros

- It’s scalable, making it suitable for businesses of various sizes.

- Offer robust security features for protecting your sensitive financial data.

- Offers a 30-day free trial.

- Its user-friendly interface allows non-accountants to navigate the solution easily.

Cons

- Limited users in all its pricing tiers.

- Some advanced add-ons and features incur extra costs.

- Slight learning curve for novices

Pricing

QuickBooks offers a free 30-day trial and three paid plans.

- Simple Start: $17 per month

- Essentials: $26 per month

- Plus: $36 per month

2. Zoho Books

Zoho Books is a budget-friendly accounting software for Mac with a 2-in-1 offering. You are provided with customer relationship management tools and inventory and project management solutions.

Even better, with Zoho Books, you can automate your financial tasks such as payroll, time tracking, and invoicing. Besides, you can create your own invoices and track your bills and expenses. But these are features that are also offered by most of the Zoho Books alternatives.

The system also has a good integration with other business solutions, which makes your accounting processes smooth. And, it enables better financial planning by allowing you to manage your accounts payable.

Moreover, Zoho Books gives you an understanding of how your business resources are utilized. And you can link your bank account to the platform to collect and organize your business transactions.

Key Features

- A document management system that matches your bank transactions with uploaded files for easy online access.

- Schedulable financial reporting tools for insights into your cash flow, balance sheets, and profit and loss.

- Advanced inventory management features for organizing and monitoring stocks and products.

- Bill management feature for tracking accounts payable.

- A customer portal that provides you with a comprehensive view of payments, transactions, and feedback.

- Online sales order processing and management feature for customizing and converting sales orders into purchase orders or invoices.

- A project feature for tracking billable hours and managing multiple projects and their matching expenses.

- Customizable invoices for online payments.

- Sales Tax liability tracking that allows you to stay compliant.

- A vendor portal for notifying vendors of payments.

Pros

- Intuitive and easy-to-use interface.

- Seamless integration with Zoho’s suite for better financial operations management.

- Its two-factor encryption and authentication ensure secure transactions.

- Provides a 14-day free trial for its paid subscriptions.

Cons

- Its highest subscription plan is limited to 15 users.

- Limited integration with third-party apps outside of the Zoho suite.

Pricing

Zoho Books offers a limited free plan and five paid plans that come with a 14-day free trial.

- Free: 1 user and 1 accountant

- Standard: $20 per month for 3 users

- Professional: $50 per month for 5 users

- Premium: $70 per month for 10 users

- Elite: $150 per month for 10 users

- Ultimate: $275 per month for 15 users

3. Wave Accounting

Wave Accounting is among the best accounting software for Macs designed for freelancers and small companies. You are offered access to main accounting software features at no cost, which is a great deal if you’re working on a limited budget.

The platform also has paid plans with no usage limitations. You can work with as many individuals as you need. And you can create as many invoices as you need for your customers.

Wave Accounting also extends beyond simple small business bookkeeping. You have access to financial reports, billing, and estimates.

But you have to pay for additional features such as online payment acceptance, mobile receipts, and payroll, based on your business requirements.

Wave Accounting also secures your financial information and guards its servers electronically and physically. This provides robust data security.

Key Features

- Bookkeeping support that allows you to outsource your bookkeeping.

- Payroll, accounting, and tax coaching for easy setup.

- Recurring billing feature for batching invoicing, time zone control, and flexible scheduling.

- Secure payment links for processing online payments via bank deposits, credit cards, and Apple Pay.

- Automated bank reconciliation by connecting bank accounts and credit cards.

- Invoice tool for automatically syncing your payment information.

- Receipt scanning allows you to track sales and expenses.

Pros

- Allows you to add an unlimited number of partners and collaborators with different permission levels, making it one of the best free accounting software programs for Mac.

- Has an intuitive and easy-to-navigate interface.

- Simplifies complex financial operations so you can perform tasks easily.

- Free, unlimited access to basic accounting capabilities.

Cons

- Round-the-clock customer support is only available when you pay for an add-on or one of its subscription plans.

- May lack advanced inventory management and time tracking capabilities.

- You pay an extra fee for uploading and scanning receipts.

Pricing

- Starter Plan: Free

- Pro Plan: $16 per month

4. Oracle NetSuite

NetSuite is also a paid accounting software for Mac that assists you in managing your payables and receivables and recording your transactions. It also makes it easier for you to collect your taxes and close your financial banks.

The site also provides you with more control over your financial assets and generates accurate reports.

Even more, it provides you with instant access to your financial information. In this way, you can quickly address issues and always remain compliant with regulations such as ASC 606 and GAAP.

Moreover, NetSuite offers you instant insights into various metrics such as cash positions, taxes, fixed assets, and margins of inventory.

You can automate routine accounting procedures, such as reconciling account statements and journal entries. And, being cloud-based, NetSuite accounting software allows you to access your information from anywhere you have an internet connection.

Key Features

- Payment management tool that lets you accept payments via ACH transfers, direct deposit, and debit and credit cards.

- Fixed assets management allows asset tracking and lease and depreciation accounting.

- Tax management capabilities enable you to stay compliant with global tax regulations in 110 countries.

- Automatic account reconciliation helps you match transactions quickly and identify discrepancies in your financial statements.

- Accounts payable and receivable feature for automating your entire procure-to-pay workflow and generating invoices.

- Cash management feature for optimizing cash flows, monitoring bank accounts, and managing liquidity.

- Close management helps you accelerate the financial close by automating tasks like intercompany transactions and variance analysis.

Pros

- Supports multiple payment channels.

- Easily access to financial data in real time.

- Its automated processes help you reduce the risks that come with manual financial management tasks.

- Offers a comprehensive knowledge center that helps with using the platform.

- All its subscriptions come with 24/7 customer support.

Cons

- Comes with a one-time implementation fee for your initial setup which counts as extra costs.

- May have a learning curve for smaller businesses that need only basic accounting features.

Pricing

Oracle NetSuite’s pricing plan comprises a one-time implementation fee for initial setup, an annual license fee made up of the core platform, optional modules, and the number of users you need.

5. Xero

Xero is cloud accounting for Mac with automatic features that enable you to structure and streamline your accounting processes.

The system leverages AI to do your bank reconciliation. And, similar to Xero alternatives, the application has other features for accounting and managing finances such as bill paying, reporting, and invoicing.

Xero also has project implementation and planning features. In this manner, you can monitor your project profitability based on project account metrics. And, you can enjoy the advantage of financial planning when you resource projects appropriately.

Even better, this solution is integrated with payroll solutions such as Gusto seamlessly. In addition, it provides cloud storage and offers automatic backup for key financial documents.

Key Features

- Analytics for tracking future and short-term cash flows to assess your business’s financial performance.

- Multi-currency support for converting transactions into over 160 currencies, enabling proper international business accounting.

- Sales tax management tool for setting up sales tax rates, calculating sales tax, and completing sales tax returns.

- Supports invoice generation for online payments via debit and credit cards.

- Online fixed asset management for tracking and updating your books and accessing financial reports from a single place.

- Simplified accounting dashboard that allows you to track outstanding invoices, cash flow, reconciliations, and account balances.

- Customer management feature for storing suppliers’ and customers’ contacts, payments, and invoices.

- Expense management tools for reimbursing expense claims and managing your spending.

Pros

- Allows unlimited users on a single account.

- Provides multi-layer protection for securing your personal and financial information.

- Offers a huge knowledge center with useful webinars, videos, and courses.

- Seamless integration with third-party services and apps.

- Provides cloud-based storage for real-time financial data access and management.

Cons

- Its entry plan only comes with 5 bills and 20 quotes and invoices.

- Multi-currency support, expense claiming, and project tracking only come with its highest subscription plan.

Pricing

Xero has three paid plans that each come with a 30-day free trial.

- Starter: $29 per month

- Standard: $46 per month

- Premium: $62 per month

6. Neat

Our next entry is Neat – a accounting software for Mac in India that integrates accounting functionality with document management. This allows you to organize the way you work with your paperwork while maximizing your financial chores.

The software also enables you to pull accounting data from your documents and sort scanned receipts. And, you can monitor your sales, expenses, income, and spending. This makes it easy for you to report and file taxes.

Also, Neat keeps you organized. You can upload documents that matter and organize folders and subfolders by month, client, or project.

And the platform supports multiple users on a single account. This way, you can share folders and files and work with others, whether they are Neat users or not.

Key Features

- Invoicing tool that lets you create personalized invoices and send reminders to clients and vendors.

- Sufficient data storage capability for storing and sharing unlimited files with clients, vendors, or other team members.

- Tax Prep tool that matches your receipts and invoices to your bank transactions or credit card to file taxes accurately and more efficiently.

- Reconciliation features for consolidating your financial data on a single dashboard for a comprehensive view.

- Automatic report generation allows you to view insights and trends from your total sales, expenses, and cash balance.

- Receipt management tool that lets you upload receipts and group them into categories.

Pros

- Seamlessly integrates with third-party business apps like Turbotax, Mailchimp, and Microsoft Outlook.

- Provides a knowledge center and 24/7 customer support via email and chat.

- Offers unlimited monthly data storage.

- Comes with a 14-day free trial.

Cons

- Doesn’t come with payroll capabilities.

- You need an add-on for invoicing, automated reports, and premium assistance.

- No monthly subscription plan.

Pricing

Along with its 14-day free trial, Neat has just one pricing plan.

- Neat: $200 per year

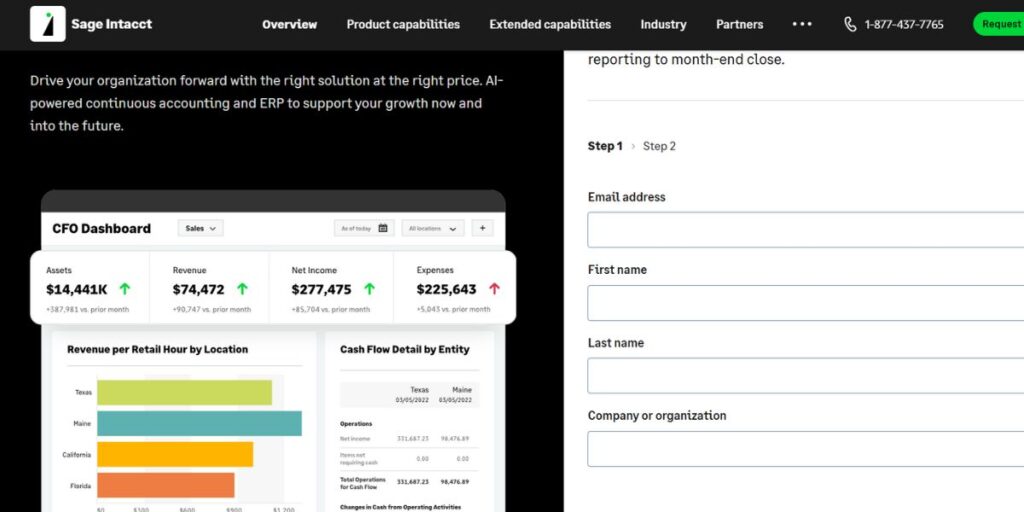

7. Sage Intacct

Sage Intacct is a accounting software for Mac business with an easy-to-use interface. The solution combines enterprise resource planning (ERP) and artificial intelligence-driven continuous accounting functionality.

Add to that, Sage Intacct is scalable as it has the tools to support your business according to your requirements as you grow. It is equipped with HR, payroll, and accounting tools, such as automated invoice handling, where you can automate your manual workflows.

In addition, the platform integrates easily with other business software such as Salesforce. And, it offers real-time, multi-dimensional reports and dashboards. This provides you with insight into your business’s financial performance.

Key Features

- Spend management tools that ensure you are always within your budget while streamlining your purchasing processes.

- Expense and time management for reducing revenue leaks and streamlining your project accounting.

- Sales and use tax compliance tool that helps you simplify your digital tax workflows and ensure you’re always compliant.

- Salesforce integration helps you connect your finance, revenue operations, and sales without needing a third-party service.

- Dimensions tool that helps you categorize your transactions with tags.

- An AI-powered General Ledger feature that scans your transactions to identify and flag anomalies.

- Reporting and Dashboard features that help you turn data into insights and generate real-time financial reports and dashboards.

- Multi-entity insights for simplifying and streamlining your multi-entity or multi-national business from a single platform.

Pros

- Allows you to add an unlimited number of users on a single account.

- Provides online training, a vast resource center, and 24/7 expert human support.

- Offers tailored solutions for small and medium-sized businesses in different industries, like Construction, Healthcare, Manufacturing, and more.

- Has a community that helps you connect with peers and industry experts.

Cons

- Initial setup may require a Sage reseller or partner to ensure accuracy.

- No standard pricing plan.

Pricing

- Contact Sage Intacct’s customer support.

8. Kashoo

Kashoo is a personalized accounting program for independent professionals and small business owners.

The site enables you to file tax returns with ease, keep track of your expenses, monitor business transactions, and create customized invoices.

Kashoo offers color-coded charts and graphs that provide you with insights into pertinent financial information. In addition, you can match transactions to the corresponding project to compare clients and projects.

Also, the platform enables you to sort your transactions based on IRS and CRA categories. In this manner, you can be highly ready for tax audits and avoid expensive tax errors common among self-employed persons.

Kashoo also features multi-level security features such as non-storage of bank login credentials and two-factor authentication.

Key Features

- Advanced accounting tools that let you upload receipts, auto-import bank transactions from multiple accounts, and check the status of transactions.

- TrulySmall Accounting feature that automatically categorizes and sorts your transactions.

- KashooPay tool that lets you send payment links with your invoices.

- Income and expense tracking capabilities help you separate personal and business. expenses and create budgets that notify you when you’re getting to your limit.

- Downloadable customized invoicing templates for creating and sending professional invoices.

Pros

- Seamlessly integrates with Google Workspace and third-party payroll platforms like Stripe.

- Provides downloadable resources and helpful guides for growing your business.

- Offers multiple customer support channels, like phone, email, and live chat.

Cons

- Doesn’t provide advanced accounting features like document management, payroll, and time tracking.

Pricing

Kashoo provides a 14-day free trial and two subscription plans.

- Trulysmall. Accounting: $216 per year

- Kashoo: $324 per year

9. KashFlow

KashFlow is another Mac accounting software for small businesses. You have access to accounting functionalities such as invoices, quotes, and bank feeds for enhancing your accounting processes.

The software also gives you pre-made reports for tracking various aspects of your accounting process. Additionally, you can use Payroll functionality and an Apps section for linking third-party apps such as PayPal.

Also, as opposed to KashFlow alternatives, this software provides integration with your Dropbox account so you can store receipts and invoices. This enables you to monitor your sales and expenses.

The platform also accommodates various payment channels. And you can include a “pay now” button on your invoices so that customers can pay online.

Key Features

- Ability to generate and customize purchase invoices.

- Bank reconciliation tool for ensuring accurate and up-to-date financial records.

- Seamless integration with HMRC for submitting VAT returns easily.

- Cloud-based accounting for getting real-time financial reports from anywhere.

Pros

- Allows you to create and convert estimates and quotes into invoices.

- Seamlessly integrates with third-party apps and payroll platforms, which streamlines your payroll workflows.

- You have access to unlimited quotes in all its pricing plans.

- Easy-to-use, intuitive interface.

- Allows you to link your bank accounts to reconcile bank transactions.

Cons

- Payroll features are only available in its highest subscription plan with a 5-employee cap.

- Limited entry plan with access to only 10 invoices.

Pricing

KashFlow offers a 14-day trial and three pricing plans.

- Starter: £10.50 per month + VAT

- Business: £22 per month + VAT

- Business + Payroll: £29 per month + VAT

10. Odoo

Odoo another accounting software for Mac computers designed for solopreneurs and small business owners who want the advantages of cloud-based accounting automation.

The software enables you to automate routine accounting tasks, such as recurring invoices and bank feed synchronization.

Odoo also supports integration with 28,000 banks globally. This enables you to connect your bank account and import bank statements automatically. Even better, the tool applies intelligent AI matching to reconcile financial records with transactions.

One of the greatest features of Odoo is how globally compatible it is. The platform is set to solve your individual country needs, such as fiscal positions, audit files, and taxes.

Key Features

- Automated follow-ups for scheduling and sending reminders and identifying late payments.

- Expense and revenue recognition capabilities for managing multi-year contracts and automating expense entries and deferred revenue.

- Electronic invoicing feature that allows you to receive and send electronic invoices in different formats and standards, like Peppol.

- Dynamic accounts and taxes that help you calculate the right taxes from expense or income accounts.

- A real-time reporting tool that provides you with up-to-date financial performance reports.

- Pay Bills features that automate wire transfers and allow batch payments.

- Bank and Cash tools for automating bank feeds, managing cash registers, and importing bank statements.

- Legal statement capabilities for managing advanced tax computations and generating tax reports, dynamic and in-depth reports, and reporting expenses and income.

- Assets management tool for automatically generating amortization entries and tracking assets.

Pros

- Supports multiple currencies with currency rates that are updated daily.

- Comes with emergency lines and support tickets for customer support.

- Provides a 15-day free trial for its paid subscriptions.

Cons

- Lacks payroll capabilities.

Pricing

Odoo provides a free plan and two paid plans with a 15-day trial.

- One App Free: $0

- Standard: $31.10/user per month

- Custom: $46.80/user per month

Advantages of Accounting Software of Mac in India

Mac accounting software provides several advantages that are vital in guaranteeing effectiveness and precision in finances management by both organizations and individuals. A few of the five fundamental advantages of utilizing Mac accounting software are:

- Seamless Apple Ecosystem Integration: Mac accounting software seamlessly integrates with other Apple devices and services such as iCloud, Calendar, and Contacts. This allows users to synchronize their finance information across different devices, becoming more productive and having all the financial information updated and easily accessible.

- Increased Security Features: Mac accounting software usually adheres to Apple’s high security requirements, providing strong protection for sensitive financial information. Data encryption, secure tokenization of passwords, and automatic backup are some of the features that protect against data breaches and the integrity and confidentiality of financial information.

- User-Friendly Interface: Mac-compatible bookkeeping software user interfaces emulate the design philosophy of macOS and produce intuitive and easy-to-use applications. This user-friendliness lessens the learning curve for new users and enables businesses to be more efficient with their finances without the need for extensive training.

- Automation of Financial Transactions: Most of the accounting solutions for Mac support automation capabilities, which automate key financial tasks such as invoicing, payroll preparation, and banking reconciliation. Automatic routine work performed has made it possible for it to decrease human mistakes, conserve time, and enjoy time spent on strategy activities that promote growth.

- Scalability and Customization: Mac accounting programs are mostly scalable, which can support small businesses, freelance, and big corporations. Solutions are customization-favored and possess price plans capable of scaling according to the growing size of business to keep the software effective and relevant as the business grows larger.

Accounting software of Mac in India has the capability to transform your finances management. Capitalizing on what Mac computers provide, organizations unlock the potential to better improve for greater efficiency, precision, and monitoring of financial information, which translates to enhanced business results.

Conclusion

Having gone through our reviews of top 10 best accounting software for Macs in India for 2025, you should have an idea which one is perfect for you.

But just remember to also look at its accounting features, cost, how easy it is to use, and data safeguarding features before making a decision. You can easily determine affordable, scalable, and very functional solutions from our list.

And don’t forget to exploit their free trials too. Check their features for yourselves to make certain that they tick all boxes necessary for you. And then if you ever sign up for the paid membership, make certain it has everything checked off which needs to do with your personal financial management.

FAQs

1. Can other business applications integrate with my Mac accounting software?

Yes, most Mac accounting software offers integrations with other business software. For example, QuickBooks Online supports payment gateways like PayPal and Square, and Xero supports CRM software like HubSpot.These integrations improve your business processes since they synchronize the data across platforms.

2.Can Windows accounting software import data to Mac?

Yes, for the most part, it can be transferred from Windows accounting packages. The majority of the sellers of the software have guidebooks or support to import data. For instance, there is a step-by-step process in QuickBooks to bring in QuickBooks Desktop (Windows) data to QuickBooks Online, which can be accessed on Mac.

3. How safe is my financial information in Mac accounting programs?

Safety matters to accounting programs. The majority of programs have robust encryption methods to secure your information. In addition, they offer capabilities such as two-step verification and common security patches to protect your finances.

4. Is there a chance I can use more than one device with my accounting software?

Yes, most contemporary accounting software packages have cloud access, and you can log in with any range of devices, such as your Mac, iPhone, or iPad.This allows the ability to perform your finances off-site, without having to remain attached to a single device.

5. Are there Mac-only accounting features within accounting software?

Though all the accounting softwares are platform-independent, some of them also support Mac-specific features. QuickBooks Online is one of the accounting softwares that actually does have a native Mac app to offer a natively experienced solution, with features such as keyboard commands and macOS feature integration, including Spotlight search.