AP procedures are a part of any type of business, so proper management ensures efficient cooperation with the vendors and the maintenance of the proper financial balance. However, a manual approach when it comes to managing AP can be very disadvantageous as it poses time consumption, a high risk of errors, and is expensive. Introducing automation software – the best tool to work with invoices, disinfect approvals, and enhance organizational fluidity.

In the table below, we list and compare the 12 leading accounts payable automation software solutions and explain the criteria we used to sort the list to help the reader make a decision. Ranging from solid artificial business intelligence platforms to cheap and affordable tools that can be adopted by any organization, it is very likely you will find what you need.

What is Accounts Payable Automation Software?

Accounts payable automation tool are all technologies that remove the manual management of multiple AP tasks without regard to the variety of applications. It reduces the human factors involved in the financial process, enhances the operation efficiency, and provides constantly updated information.

Equations like formula Invoice matching, Vendor Analysis, and Risk compliance assessment assist organizations in bringing down their payment period, improving accuracy, and controlling cash flows. This supports other data acquired from an ERP program to achieve total real-time information regarding AP performance.

Key Features of Accounts Payable Automation Software

- Integration with ERP and Accounting Systems: Integrate easily with other solutions and applications such as Quickbooks, SAP, or Oracle to match financial information in order to avoid information duplication.

- Advanced Invoice Data Capture: Read data from several folders, texts, PDFs, emails, and other documents through the help of OCR and AI.

- Customizable Workflow Automation: Subsequently, define approval processes depending on organizational requirements in an effort to address delays in payments or slow down the processes.

- Real-Time Reporting and Analytics: Obtain real-time payment information to analyze payment behavior, vendors’ results, and processing delays that will help make better decisions.

- Enhanced Security Features: Encrypt the financial information whenever possible; allow access to the information only to those who need it; employ reasonable mechanisms of fraud prevention.

Benefits of Accounts Payable Automation Software

- Increased Efficiency: Saves time for processing large quantities of work in a short time, freeing staff’s time for core functions.

- Error Reduction: Reduces the number of mistakes that could be made during manual handling of invoices matching, and payments.

- Cost Savings: Reduces the loss that results from employing many employees to process it or failure to pay for duplicate narrow services.

- Improved Vendor Relationships: Volatility is also controlled and prompt payments to vendors are made thus improving their trust.

- Regulatory Compliance: It eliminates the great challenge of having to manually go through tax and legal requirements to ensure compliance.

Quick Comparison

| Tool Name | Best Fit | Why Useful |

| HighRadius | Mid-to-large-sized companies | Advanced AI-powered invoice capture, exception handling, and ERP integration. |

| Tipalti | Global businesses | Streamlines cross-border payments, automates tax compliance, and supports supplier self-service. |

| QuickBooks Online | Small to mid-sized businesses | Affordable AP automation tools with integration options and real-time reporting. |

| Sage Intacct | Semi-large to large organizations | GAAP compliance, customizable workflows, and multidimensional reporting. |

| NetSuite | Small to mid-sized organizations | Real-time invoice tracking, ERP software, and robust reporting. |

| Microsoft Dynamics 365 | Businesses using Microsoft solutions | Combines ERP, CRM Software, and scalable AP workflows with seamless Microsoft integration. |

| Acumatica | Mid-tier organizations | Unlimited user access, collaboration-friendly tools, and customizable workflows. |

| Epicor | Industry-specific organizations | Offers tailored solutions for manufacturing, retail, and distribution with end-to-end payables tracking. |

| Zoho Books | Freelancers and small businesses | User-friendly platform with invoice management service, approval workflows, and vendor tracking. |

| SAP Concur | Enterprises needing high scalability | Automates invoice matching, compliance management, and expense tracking. |

| Bill.com | Small to medium-sized businesses | Simplifies AP automation tools processes with automated payments, invoice capture, and syncs with accounting tools. |

Top 12 Accounts Payable Automation Software

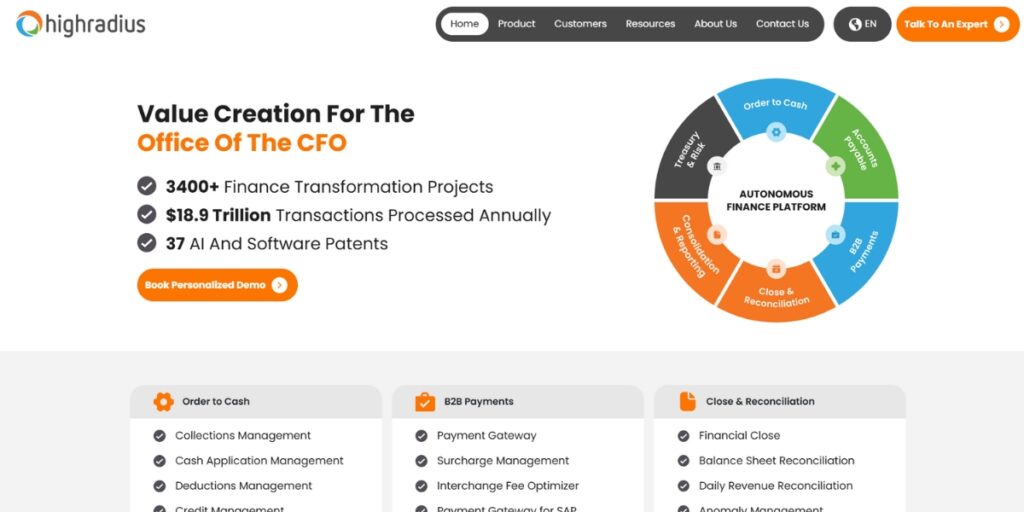

1. HighRadius

HighRadius is a market leader in AP automation tools. With intelligence incorporated, it probably provides organizations with exceptional value propositions in terms of processing accuracy, handling of exceptions, and integration with ERP systems.

They enhance the AP operations, reduce the input of people across the process, and generally strengthen the financial capabilities. Real-time tracking and compliance tools make the HighRadius system transparent credible and ideal for mid to large enterprises.

Key Features:

- Gen AI-Powered Invoice Data Capture: An essential feature of efficient procurement is that it extracts invoice data from various sources like emails and/or suppliers’ portals mechanically, which means that the data entry will be accurate and as up-to-date as the system can make it.

- Automated Exception Handling: Reports and adjusts inconsistencies, and routes problems to the right channel for immediate troubleshooting.

- Seamless ERP Integration: Connects seamlessly to other popular Enterprise Resource management systems such as System, R/3, and Oracle Application, thereby ensuring an uninterruption of the flow of data.

Pros:

- Advanced AI capabilities

- Effective reporting and analysis

- Robust exception management

Cons:

- Complicated layout for diffident small-scale groups

- A steep learning curve in getting started

Ideal For: Ideal for mid-to-large-sized companies that require extended levels of automation and integration to compliance solutions.

Pricing: Customized pricing based on business size and requirements.

Rating: 4.8/5

2. Tipalti

Tipalti streamlines global accounts payable with its automation technology as it is a cloud-based enterprise solution. It enables supplier rationalization by automating onboarding, payment invoice processing for suppliers, and tax management, especially for multi-sourced businesses with operations in different parts of the world.

Due to its simple navigation, Tipalti assists in mass global payments and lowers the occurrence of errors and delays.

Key Features:

- Global Payment Processing: This enables payment in both its own currency and other currencies and also in the physical and electronic form to avoid hitches and cross-border transfers.

- Tax Compliance Automation: It automatically gathers and verifies tax forms thus lowering compliance hazards.

- Supplier Self-Service: Offers suppliers a friendly interface through which they can enter payment information and review their billing.

Pros:

- Ideal for global businesses

- Instruments explaining types of compliance in detail

- Efficient management of suppliers

Cons:

- High setup costs

- Cannot be easily customized, and this needs technical skills.

Ideal For: The players involved in international payments and suppliers.

Pricing: Contact For Pricing

Rating: 4.7/5

3. QuickBooks Online

Introducing Quickbooks online Accounts Payable Automation Software for small to mid-sized businesses to improve practicing efficiently. As one of the popular platforms, it has a simplified platform that supports integration with other applications to help improve service delivery. Using QuickBooks, it is easy to control payments and expenses while receiving real-time reports.

Key Features:

- Simple Interface: We have an effective dashboard where you can track all the invoices and also the approval of their payments.

- Integration with Third-Party Tools: Integrates with others like Bill.com to improve the AP automation tool experience.

- Real-Time Reporting: Helps track payment statuses, cash flows, and the history of the vendors.

Pros:

- Affordable pricing

- Perfect for small businesses

- Excellent customer support

Cons:

- It may not be very suitable for large-scale organizations or for businesses having a very large number of visitors.

- Comparison of basic features of AP with advanced tools

Ideal For: Anyone who requires fundamental automatization of AP operations at their company or personally.

Pricing: Starts at US$5.70 per month.

Rating: 4.5/5

4. Sage Intacct

Sage Intacct is a cloud-based financial management solution that provides sophisticated AP automation tool capabilities. Acknowledged for its GAAP compliance it provides multi-hybrid reporting with customizable processes suitable for diverse financial scenarios.

Key Features:

- GAAP Compliance: Helps you meet all accounting standards for your AP processes.

- Customizable Workflows: Adapts business-specific requirements in terms of approval and payment chains.

- Multidimensional Reporting: Provides comprehensive analyses of either functional or geographical data.

Pros:

- In this area, it has the most excellent reporting.

- Highly customizable

- Especially suitable for industries that require it as a review criterion

Cons:

- Higher pricing tiers

- Sleek learning slope for fewer individuals

Ideal For: Semi-large to large organizations with elaborate requirements in the area of financial management.

Pricing: Request Pricing

Rating: 4.6/5

5. NetSuite

Oracle ERP called NetSuite offers a mature Accounts Payable Automation Software for mid-sized and growing companies. It affords a Real-time view of invoices, and payments and includes detailed measurements. The software offers great features of integration and customization, which are valuable if a company is using highly developing financial systems.

Key Features:

- Real-Time Invoice Tracking: Provides organizations an instantaneous insight into the status of invoices in addition to the manner in which payments are being processed hence gripping the cash flows proficiently.

- Broad ERP Integration: Integration with third-party systems, including Oracle ERP for efficient financial processes.

- Comprehensive Reporting: Provides standard and custom reports on payables, vendor scorecards, and other relative cash flow Analysis.

Pros:

- The solution is highly scalable meaning it can support expanding organizations incredibly well.

- Real-time data visibility

- A more significant level of integration prowess

Cons:

- Expensive for small companies

- May need professional help to do some level of customization

Ideal For: Small to mid-sized organizations that require a higher level of Accounts Payable Automation Tool and more capability than basic products offered by some of the leaders can provide.

Pricing: Customized pricing based on company size and requirements.

Rating: 4.7/5

6. Microsoft Dynamics 365

ERP, CRM, Sales Order Processing, and other specializations including strong automated AP operations can be found in Dynamics 365. Several features are provided which are adaptable working methods in its capabilities combined with real-time data processing; moreover, it is compatible with Microsoft products which is good for businesses that are already using Microsoft solutions.

Key Features:

- Scalable Workflows: Enables multiple-invoice approval workflows as well as payments so that operations run smoothly.

- Seamless Microsoft Integration: Complements other Microsoft solutions, including Excel and Teams, so as to enhance the workflows.

- ERP and CRM Capabilities: Combines the financial and customer relationship aspects in an organization with a single emphasis.

Pros:

- Refer to MFI’s strong integration with MicrosoftChess Club.

- Scalable for business growth

- User-friendly interface

Cons:

- It also assists that the prices are higher than the competition.

- To realize its full potential necessitates considerable training from the user’s end.

Ideal For: Organizations that deploy Microsoft applications to address their financial and business requirements.

Pricing: Starts at $190 per user per month.

Rating: 4.6/5

7. Acumatica

Acumatica is a Cloud ERP designed to organizations that require an unlimited number of users, and sophisticated AP automation. It is especially useful for teams that use many communication tools during the invoice approval process because of its friendly interface.

Key Features:

- Unlimited User Access: A pricing model for an unlimited number of users is unique as it does not charge extra for the extended team.

- Collaboration-Friendly Features: Such as – includes tools for sharing communications and tasks that are related to the AP process within a team.

- Customizable Workflows: In a business scenario allows the domains to design different approval and payment models to suit their needs.

Pros:

- Affordable for growing teams

- Strong collaboration tools

- Highly customizable workflows

Cons:

- Expensive if used in small-scale businesses

- Does require a specific setup that is best delegated to IT personnel

Ideal For: Mid-tier organizations requiring flexible Accounts Payable Automation Software that can also include the factor of consensus.

Pricing: Contact For Pricing.

Rating: 4.5/5

8. Epicor

Naturally, Epicor offers solutions that address the unique needs of the industry verticals, specifically, manufacturing, retail, and distribution. It provides real-time tracking across the entire payables spectrum, configurable processes, as well as cash management applications.

Key Features:

- Industry-Specific Customizations: Special material AP solutions for manufacturing and distribution centers, and retail businesses.

- End-to-End Payables Visibility: This alone tracks the initiation of an invoice and follows it right through to a vendor’s payment.

- Cash Flow Management Tools: Assists users with predicting and managing the best cash flow.

Pros:

- Industry-focused features

- In this platform, details of all payables are captured

- Can be used by large organizations

Cons:

- Paid more complicated for small-scale companies

- Higher implementation costs

Ideal For: Industries focused on manufacturing, retail, and distribution which require specific solutions for AP.

Pricing: Customized pricing based on industry and business size.

Rating: 4.6/5

9. Oracle EPM Cloud

Oracle EPM Cloud is an ultramodern solution that focuses on the organization’s multiple demands and needs of large enterprises related to Accounts Payable Automation Software, financial forecasting, and compliance solutions. It aligns very well with Oracle ERP products and provides the best analytic and control system.

Key Features:

- Advanced Analytics: gives a clear understanding of processes related to AP and allows to improve financial planning.

- Integration with Oracle ERP: Sequential integration, allowing proper data exchange between various Oracle’s financial means.

- Compliance Tools: It contains elements for compliance with global tax and accounting requirements.

Pros:

- Effective quantitative methods in terms of analysis and future prognosis

- Organisation integration with the Oracle tools

- Advanced compliance features

Cons:

- High cost

- It has a complex implementation process

Ideal For: High-end businesses who want to implement complex and stringent financial management and reporting solutions.

Pricing: Contact For Pricing.

Rating: 4.8/5

10. SAP

SAP is a full-service ERP system that contains efficient accounts payable automation software. It caters to requested solutions to businesses involving scalable solutions and executes within the cloud and on-premises.

Key Features:

- Scalable AP Automation: This can stand the growth of businesses and the difference in the amount of invoices at certain periods.

- Flexible Deployment: We offer both cloud solutions and corporate solutions depending on the needs of the business organization.

- Comprehensive Vendor Management: Organizes and maintains vendor information and payment, compliance information efficiently.

Pros:

- Ideal for small, medium and large companies

- Highly scalable

- Flexible deployment options

Cons:

- Expensive particularly for small companies

- Slow learning curve

Ideal For: Mobile payments provider for enterprises that require a flexible and easily scalable Accounts Payable automation solution.

Pricing: Customized pricing based on business requirements.

Rating: 4.7/5

11. Stampli

Regarding the organizational procedure of simplification of the AP process, Stampli offers a smooth collaboration feature through its AI-driven invoice approval. It also permits teams to manage exceptions and their approval in one single place thus eliminating the common delays.

Key Features:

- Collaborative Invoice Processing: It fosters cooperation because communication instruments are included within the AP course.

- AI-Driven Approval Workflows: Reduces human interception of the approval process by incorporating AI.

- Customizable Automation: It makes it possible to adapt to those particular business processes depending on the settable parameters.

Pros:

- Enhances collaboration

- Simplifies invoice approvals

- User-friendly interface

Cons:

- Limited PO functionality

- Basic reporting features

Ideal For: Affordable to moderate teams that require an AP collaborative system.

Pricing: Request Quote

Rating: 4.6/5

12. FreshBooks

FreshBooks is an easy-to-use online accounting software that is suitable for self-employed people and corporations. It has simple AP automation tools features such as invoicing and expense tracking and is easy to use.

Key Features:

- Invoicing and Expense Tracking: Simplifies some of the routine money-related activities that small businesses may undertake.

- Simple Payment Processing: Provides convenient means of payment approval and payments.

- User-Friendly Interface: It makes the interaction to be more friendly to users who may not be so conversant with computer systems.

Pros:

- Affordable pricing

- Ideal for freelance workers and for start-up businesses

- Intuitive interface

Cons:

- Limited advanced features

- Not suitable for larger teams

Ideal For: Freelancers, small businesses who do not require complex automation of their Accounts Payable department.

Pricing: Starts at $7.60 per month.

Rating: 4.4/5

How to Choose the Best Accounts Payable Automation Software

- Assess Business Needs: Determine for instance if an organization is facing a high number of invoices, delays in approvals, or compliance concerns.

- Check Integration Capabilities: Make sure that the software in question works along with the company’s current ERP or accounting system.

- Evaluate Scalability: Make sure you go for a plan that you can scale up as the company expands and evolves.

- Analyze Reporting Features: Focus on the tools that provide analysis of the ads in terms of details and provide a real-time reporting system.

- Consider Budget: Do not confuse balance with buying too much it may lead to breaking the bank.

Conclusion

Selecting the right accounts payable automation tool is a game changer to your financial processing because of the efficiency, cost savings, and accuracy it brings to your financial processing. This is because there are many solutions available; therefore, it is very essential that organizations assess what they wish to achieve and what they need for them to achieve it.

FAQs

1. What are Accounts payable automation software

It is an application that enables organizations to perform activities such as invoice processing and approval of payments electronically.

2. What are the primary reasons for employing AP automation software in businesses?

For administrative purposes, the accuracy of detailed task performance and transparency of financial information.

3. Is AP automation software costly in its operations?

Some of the tools provided here are free with basic features while others come at a premium if you wish to use sophisticated options.

4. Is AP automation tool possible for small businesses?

Absolutely! See how these simple tools can minimize risk and improve efficiency for small businesses.

5. What steps have to be taken to guarantee that change is effective?

Select the interface that is easy for your team to use, get them trained, and integrate this tool with other frameworks.