Picture closing your books at quarter’s end only to discover mistakes that take days to correct. Your antiquated accounting software is incompatible with other systems, reports lag, and compliance issues mount up.

If your financial information is inaccurate or not readily available, decision-making takes a hit. You want an accounting program that serves you, not sabotages you—one that streamlines work, enhances precision, and provides real-time information.

To be successful, an organisation usually monitors its money. There are plenty of accounting software platforms, but they might not necessarily have the same capabilities at the same price. You need to find accounting software that is suitable for you so you can take care of tasks, such as invoicing and payment receipt, that assist the company. Here, we present a list of 10 best corporate accounting software available in India along with descriptions of their uses and features.

List of Top 10 Corporate Accounting Software

1. Xero

Xero is cloud-first, intuitive with robust automation, and an affordable multi-entity capability. It’s perfect for organizations seeking flexibility with collaboration at an affordable cost.

It features document management via abilities such as the integration of Hubdoc. Upload and attach documents to transactions to keep your records organized.

You also have cost tracking using the “Tracking Categories” feature. This will allow you to assign expenses to particular projects, departments, or categories but might not be as granular as enterprise-grade cost allocation systems.

Key Features:

- Automated Transaction Syncing: Automatically imports sales data from various eCommerce platforms.

- Real-Time Financial Reporting: Provides up-to-date financial statements and insights.

- Multi-Currency Support: Handles transactions in multiple currencies, ideal for global sellers.

- Multiple Company Management: Supports multiple organizations under a single account, allowing users to manage various companies.

- Advanced User Permissions: Allows setting user roles and permissions to control access.

- Audit Trails: Maintains logs of user activities for auditing purposes.

- Fraud Detection: Offers basic fraud detection tools, additional features are available through integrations.

- Compliance Certifications: Complies with GDPR and other data protection regulations.

- Custom Integrations: Supports custom integrations through its API and third-party apps.

- Dedicated Support: Offers 24/7 online support and phone support.

- Implementation Assistance: Resources and partner programs for implementation support.

Pros:

- Real-time collaboration

- Unlimited users allowed

- Strong payment features

- Clean and simple UI

Cons:

- Limited customizations

- Multi-currency not available on all plans

2. QuickBooks

QuickBooks is a very popular corporate accounting software. if your business requires advanced cost allocation, industry-specific features, and heavy transaction volume handling. It’s best for businesses that need extensive reporting and solid document management.

It has in-built document management capabilities, especially in QuickBooks Online Advanced and Enterprise. You can upload, store, and associate documents with transactions directly. You can also set up custom workflows for document approval and processing using integrated apps.

It features powerful cost allocation utilities, particularly within its Enterprise product. Class tracking, job costing, and deep reporting capabilities let you allocate cost among various entities, projects, or departments at a high degree of granularity.

It suits companies with a sophisticated cost-allocation requirement as it has onboard tools for thorough expense tracking and reporting.

Key Features:

- Client Management: Easily manage multiple client accounts within a single platform.

- Automated Data Import: Seamlessly imports sales data from various eCommerce platforms.

- Advanced Reporting: Generates detailed financial reports that can be viewed in real time.

- Global Currency Handling: Offers multi-currency support in advanced plans.

- High-Volume Transaction Processing: The Enterprise version handles higher transaction volumes, suitable for larger businesses.

- Advanced User Permissions: Provides detailed user permission settings, especially in the Enterprise version.

- Audit Trails: Includes audit trail features to track changes and user activities.

- Fraud Detection: Provides fraud detection features, with enhanced capabilities in higher-tier plans.

- Compliance Certifications: Adheres to various compliance standards, including GDPR.

- Custom Integrations: Allows for custom integrations via APIs and third-party applications.

- Dedicated Support: Offers 24/7 support, especially for Enterprise customers.

- Implementation Assistance: Provides implementation assistance, particularly for Enterprise clients.

Pros:

- Automated bank reconciliation features

- Easy to learn and use

- Offers both cloud-based and desktop solutions

Cons:

- Pricier than industry peers

- Must upgrade to add users

3. Sage Intacct

Sage Intacct is an adaptable project accounting solution that suits all types of industries and company sizes, especially those with project-based companies. It’s best accounting software for large organisations , for the enterprises that deal in the following industries: construction, consulting, engineering, software development, hospitality, healthcare, and real estate development.

Sage Intacct is an all-inclusive accounting and financial management software designed for big business. Sage Intacct, with its robust accounting capabilities, is perfect for finance teams requiring accuracy in financial management and reporting.

Key Features:

- Core Financials: Provides robust accounting features, including accounts payable/receivable and cash management.

- Advanced Reporting: Delivers customizable financial reports and dashboards.

- Multi-Entity Management: Simplifies accounting across multiple locations or entities.

- Automation: Automates routine tasks to enhance efficiency and reduce errors.

- Time and Expense Management: Automates employee time tracking and expense reporting.

- Revenue Recognition Compliance: Ensures compliance with ASC 606 and IFRS 15.

- Budgeting and Planning Module: Facilitates collaborative financial planning across teams.

- Project Accounting: Tracks project costs, profitability, and resources in real time.

- Role-Based Dashboards: Customizable dashboards for CFOs, controllers, and other roles.

- Scalability: Designed to grow with your business needs.

Pros:

- Extensive configurations and automation features

- Cloud deployment

- Shared chart of accounts

Cons:

- May not be ideal for smaller businesses

- Extensive features may come with a learning curve

4. Acumatica

Acumatica is one of the fantastic corporate accounting software, a cloud-based ERP solution designed to serve mid-sized companies, allowing easy handling of key business functions remotely. It offers key accounting tools as well as powerful modules for CRM, distribution, and project management.

Key Features:

- Comprehensive Financial Management: Includes general ledger, accounts payable/receivable, and cash management.

- Advanced Reporting: Offers customizable financial reports and dashboards.

- Global Capabilities: Supports multi-currency and multi-language operations.

- AI-Powered Insights: Provides actionable analytics with built-in AI tools.

- Custom Workflow Automation: Enables enterprises to create custom workflows for specific needs.

- Field Service Management: Includes scheduling, dispatching, and service tracking for field teams.

- Warehouse Management: Offers real-time inventory tracking and automated replenishment.

- Multi-Cloud Integration: Integrates with other cloud platforms like Salesforce and AWS.

- User-Friendly Interface: Provides an intuitive experience for users.

Pros:

- Flexible deployment options

- Supports multiple industries

- Cloud access from any device

Cons:

- Limited offline capabilities

- May require an initial setup time

5. SAP S/4HANA Finance

SAP S/4HANA may be used by large corporations, an enterprise resource planning system. It has embedded supply chain management, human capital, and financial modules among other business functions.

Through the fact that it helps keep companies in compliance and lowers their risks, SAP S/4HANA Finance is the market leader as far as compliance and risk is concerned.

Key Features:

- Real-Time Analytics: Utilizes in-memory computing to provide instant insights, enabling swift decision-making.

- Integrated Business Processes: Seamlessly connects finance, supply chain, and customer management for streamlined operations.

- Integrated Risk Management: Identifies, analyzes, and mitigates risks across enterprise processes.

- Embedded IoT (Internet of Things) Integration: Connects IoT data directly to financial and operational processes for real-time insights.

- Advanced Procurement Features: Includes supplier collaboration and contract management within the system.

- Blockchain Technology: Supports secure and transparent financial transactions using blockchain.

- Scalability: Designed to grow with your business, accommodating increasing data and user demands.

- Advanced Compliance Management: Ensures adherence to global regulatory standards through comprehensive compliance tools.

- User-Friendly Interface: Features the SAP Fiori interface for an intuitive user experience.

Pros:

- Integrated analytics

- Comprehensive risk management

- Advanced compliance features

Cons:

- High cost

- Complex setup

6. FreshBooks

FreshBooks is most suited for solopreneurs and independent contractors. Even small businesses with two to five employees will find the application beneficial in managing cash flow, invoicing, and time and expense tracking.

The largest advantages of FreshBooks are the add-ons that are offered at the price point. Instead of a cut-down starter package, their “Lite” plan has unlimited invoices, expense entries, estimating, and time tracking. With an integrated automatic bank import feature, FreshBooks can also take credit card payments and ACH bank transfers.

Key Features:

- Highly intuitive invoicing tools

- Recurring invoices

- Most functions available on a single dashboard

- Mobile app

- Organised expenses

- Automatic deposits

- Easy to access customer support

Pros:

- Several features for managing projects and clients

- Easy to learn

- High degree of invoice customization

Cons:

- No inventory management

- Limited mobile app

7. Kashoo

Kashoo has positioned itself as the world’s easiest and best corporate accounting software. Kashoo is best suited for freelancers and small businesses with fewer annual transactions.

Kashoo is a cloud-based accounting program specifically tailored for small business owners. It provides a variety of features that make financial management easy, such as invoicing, tracking expenses, and automatic bookkeeping.

Key Features

- Unlimited number of users

- Income and expense tracking

- Categorisation of debits and credits

- Automatic reconciliation

- Online invoice payments

- Connection to bank accounts

- Collaboration features with other accountants and bookkeepers

Pros:

- Mobile app available

- Complies with both Canadian and U.S. regulations

- Good automated features

Cons:

- Does not offer integrated payroll management

- Limited advanced features

8. Wave

Wave cloud-based accounting software that is simple to use for business owners who have no bookkeeping or accounting experience. It is a great choice for businesses on a budget since it has a free version. Its greatest features of the free

Wave is small business, freelance, and entrepreneurial accounting software. It provides tools necessary to take care of money management, so it is affordable for those in need of uncomplicated yet useful accounting tools.

Key Features:

- Tracking of transactions

- Receipt scanning

- Invoice management

- Offers a paid monthly subscription if you need payroll processing

Pros:

- Automated bookkeeping features

- User-friendly interface for non-technical users

- Offers a free forever plan

Cons:

- Limited integrations

- Not ideal for larger businesses

9. Microsoft Dynamics 365 Finance

Microsoft Dynamics 365 Business Central is an all-in-one ERP solution that merges finance with operations, sales, and customer service within a friendly Microsoft environment. It’s a good option for businesses that require extensive integration with other Microsoft products such as Office 365, Power BI, and Azure.

Users can also turn on predictive analytics and AI-based insights to be able to predict future situations more accurately. Accountants, however, will find it easier. For instance, it needs one to know debits and credits.

Key Features:

- Comprehensive Financial Management: Covers general ledger, accounts payable/receivable, and fixed assets.

- AI-Driven Insights: Leverages artificial intelligence for predictive analytics and decision support.

- Seamless Integration: Integrates with other Microsoft products like Office 365 and Power BI.

- Cash Flow Forecasting: Offers AI-powered cash flow analysis and projections.

- Expense Management Integration: Simplifies employee expense reporting and reimbursement.

- Customer Payment Insights: Predicts customer payment behaviour using AI to improve collections.

- Vendor Collaboration: Streamlines communication with vendors for invoice approvals and payments.

- Global Compliance: Supports multiple currencies and languages, ensuring international compliance.

- Global Tax Engine: Provides compliance for tax regulations in over 140 countries.

- Flexible Deployment: Offers both cloud and on-premises deployment options.

Pros:

- Robust integration options

- Comprehensive financial management

- Advanced AI capabilities

Cons:

- Complex setup

- High cost

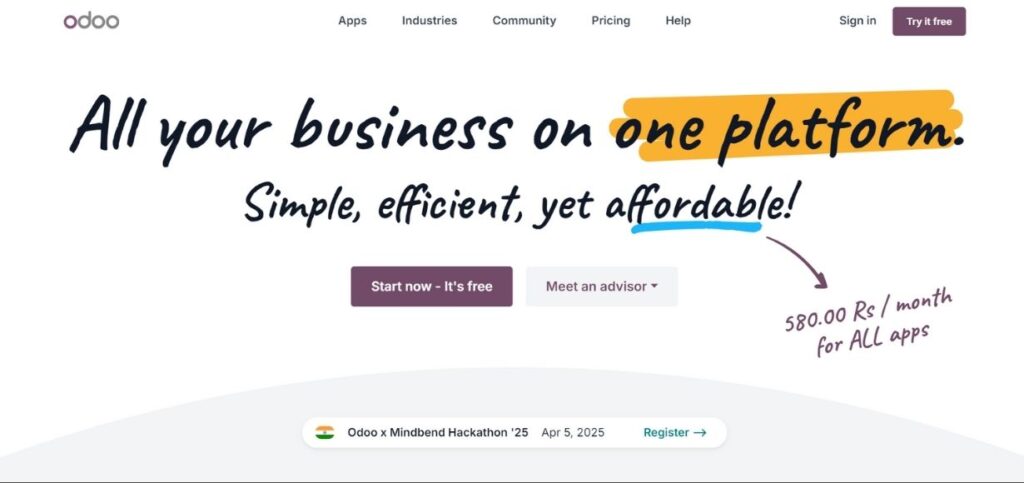

10. Odoo

Odoo has CRM, sales, and finance applications, such as accounting, invoicing, and expenses. Although bank synchronisation is slightly inconvenient, it’s easy to generate and even send invoices within the system.

Odoo has a Community edition that’s free and open-source with no licensing costs. But installing the software and altering the source code need technical know-how. Yet, Odoo’s wide array of modules and integration capabilities render it extremely customisable for SMBs.

Odoo can compute taxes automatically on the basis of product categories and geographical locations. Its accounting module accommodates multiple currencies, which is useful for businesses with clients across the world. The product also includes in-built payment gateways with leading platforms such as PayPal, Stripe, and Buckaroo.

Key Features:

- Automated follow-ups for scheduling and sending reminders and identifying late payments.

- Expense and revenue recognition capabilities for managing multi-year contracts and automating expense entries and deferred revenue.

- Electronic invoicing feature that allows you to receive and send electronic invoices in different formats and standards, like Peppol.

- Dynamic accounts and taxes that help you calculate the right taxes from expense or income accounts.

- A real-time reporting tool that provides you with up-to-date financial performance reports.

- Pay Bills features that automate wire transfers and allow batch payments.

- Bank and Cash tools for automating bank feeds, managing cash registers, and importing bank statements.

- Legal statement capabilities for managing advanced tax computations and generating tax reports, dynamic and in-depth reports, and reporting expenses and income.

- Assets management tool for automatically generating amortization entries and tracking assets.

Pros:

- Open-source flexibility

- Supports multiple business functions

- Highly customizable modules

Cons:

- Complexity increases with more modules

- May need additional support

Benefits of Corporate Accounting Software Programs

Accounting software has various advantages for your organization and your employees. The following are some that you can expect:

- Time Saving: Automates recurring tasks such as payroll and invoicing, giving you time for other crucial business actions.

- Accuracy: Eradicates human errors with computerized computation and data entry, delivering correct books of account.

- Financial Data: Gives you live reports and information so that you can take good business decisions.

- Tax Compliance: Simplifies tax processes with inherent tax functionality that ensures legal compliance.

- Cash Flow Management: Tracks expenses and income in real-time to better manage your cash flow and financial health.

- Expense Tracking: Is able to easily categorize and track expenses, allowing you to see exactly where the funds are going.

- Scalability: Increases exponentially with business expansion through abilities to process growing levels of transactions and data.

FAQs

1.Which is the best small business corporate accounting software?

Quickbooks, FreshBooks, Wave, Xero, and Zoho Books are the easiest to use small business accounting software. These are meant for smaller businesses with minimal accounting work.

2.Is accounting software worth it for a freelancer or sole proprietor?

Yes! Accounting software is simple to use to track income and expenses, tax reporting, and have a clear view of your finances, even for freelancers or sole proprietors.

3. Can you add users as your business grows?

As your business expands, you might need additional members to join your team to utilize the accounting software.Plans of most platforms are scalable such that you can add users with minimal inconvenience. See the cost and terms of adding users to ascertain whether it is in line with your growth strategy.

4. How safe is your financial data with accounting software?

Security is paramount when handling sensitive financial data. The majority of accounting software is encrypted and contains other security measures to protect your information. Research how the software is protected and see if they follow industry standards in protecting your information.

Conclusion

With our top 10 best corporate accounting software in 2025 reviews that we have taken through, you would now have a clue on which one suits you best.

Just remember, though, to check its accounting options, pricing, ease of usage, and features for protecting your data as well before coming up with your verdict. It’s easy enough for you to rule out expensive, scalable, yet highly functional offerings from the given list.

Try out their features yourselves to ensure they check all the boxes that are required of you. And then whenever you take their paid membership, ensure it checks off all which has to do with your individual financial management.