SaaS accounting software makes financial management easier because its cloud-based solutions use automation along with real-time tracking functions and they offer smooth integrations between different systems. There are 15 leading SaaS accounting tools in this guide that serve businesses of various sizes including freelancers and small businesses along with growing enterprises.

Such tools serve businesses by improving their bookkeeping processes as well as invoicing functions and tax compliance reporting together with financial reporting capabilities and by eliminating repetitive manual tasks. The audience consisting of entrepreneurs and freelancers together with small business owners and accountants and their finance teams requires dependable financial solution management. The selected software met essential requirements including simplicity of use, automation functionality, flexibility, connection options, security measures and market-focused features and budget plans for multiple business models.

Criteria to Select SaaS Accounting Software

Multiple important factors must be considered for selecting the perfect SaaS accounting software solution.

1. User friendly: The software needs a user-friendly interface that enables non-accountants to use it with minimal training effort.

2. Functionality: A comprehensive assessment should focus on two areas: essential features that include invoicing and expense tracking as well as payroll alongside R&D tax compliance and financial reporting, which should be part of the requirements for businesses engaging in research-driven activities.

3. Scalable: A growing business should select software that provides growing capabilities along with high-level features to match operational requirements.

4. Artificial intelligence: A system that implements automated workflows for bookkeeping automated billing processes and expense tagging and tax processing operations helps reduce manual work.

5. Integration: The system needs to connect with payment gateways and business management tools as well as CRM and inventory applications.

6. Security & Compliance: Check for data encryption, secure backups, and compliance with regulations like GDPR or SOC 2.

7. Accessibility: Cloud-based access through financial management systems provides real-time data updates which can be accessed through devices of any type while permitting mobile operations.

8. Cost: Businesses should evaluate price plans through an analysis of features together with transaction limits and all costs associated with payroll software and more intricate toolsets.

9. Support: Expand the features with accessible customer support alongside training resources, knowledge bases and forums that will help users with troubleshooting needs.

10. Customisation: The ability to create personalized reports, monitor important performance indicators and modify standard financial processes.

Businesses can select a suitable SaaS accounting solution by assessing this set of criteria to achieve alignment with their operational and financial targets.

List of 15 Saas Accounting Softwares

1. QuickBooks Online

Small and medium businesses use QuickBooks Online because it operates through cloud computing technology. The application provides users with invoicing functions combined with expense tracking and payroll as well as tax management tools and financial reporting capabilities. Financial management along with bookkeeping becomes simpler because of automation features that connect to multiple third-party applications. The software offers an easy-to-use platform with mobile compatibility that attracts businesses that want to optimize their accounting processes.

Key Features:

- Invoicing and billing

- Expense tracking

- Bank reconciliation

- Payroll integration

- Tax calculations and reports

- Multi-user access

Pros:

✔️ User-friendly interface

✔️ Strong reporting features

✔️ Integrates with many third-party apps

Cons:

❌ Can be expensive for larger teams

❌ Limited automation compared to advanced ERPs

Pricing: Starts at $17.50/month

Who Should Use It: Small to mid-sized businesses looking for a comprehensive yet easy-to-use accounting solution.

2. Xero

As a SaaS accounting solution, Xero delivers a user-friendly platform that includes automatic functionality. This system delivers simultaneous financial updates in addition to automated billing and payment functions, payroll processing, bank comparison abilities and currency exchange capabilities. Small businesses alongside accountants find Xero to be an optimal solution because it links with multiple business software programs. The software delivers cloud accessibility which enables people to handle finances from multiple locations and ensures effortless teamwork between business owners and their accounting professionals.

Key Features:

- Automated bank feeds

- Inventory management

- Multi-currency support

- Payroll processing

- Expense management

Pros:

✔️ Unlimited users on all plans

✔️ Excellent automation and integrations

Cons:

❌ Learning curve for new users

❌ Limited customer support options

Pricing: Starts at $2.90/month

Who Should Use It: Businesses that need strong automation and scalability.

3. FreshBooks

Freelancers along with small businesses find FreshBooks particularly useful because it operates through cloud-based software. The software includes tools for billable hours tracking together with automated invoicing and expense control along with teamwork functions. FreshBooks software creates automated billing through its payment reminder and recurring invoice functionalities. The user interface of FreshBooks features a dashboard that connects with payment processors to enhance financial operation streamlining in addition to tracking profitability and effective client relationship management.

Key Features:

- Time tracking

- Invoice customization

- Project management

- Expense tracking

- Automated reminders

Pros:

✔️ Very user-friendly

✔️ Great for freelancers and service-based businesses

Cons:

❌ Limited features for inventory-heavy businesses

❌ No payroll feature

Pricing: Starts at $7.60/month

Who Should Use It: Freelancers and small service-based businesses.

4. Zoho Books

The cloud-based Zoho Books software provides businesses with affordable accounting capabilities that handle invoicing while monitoring expenses and managing inventories as well as tax compliance. The software provides smooth integration with other Zoho applications so it becomes an excellent choice for businesses that already use Zoho applications in their operations. Small businesses benefit from Zoho Books through its automatic features and multiple currency support system which enables them to automate financial recordkeeping processes smoothly.

Key Features:

- Automated workflows

- GST and VAT compliance

- Client portal

- Bank reconciliation

- Mobile app

Pros:

✔️ Affordable pricing

✔️ Deep integration with other Zoho apps

Cons:

❌ Limited payroll support in some regions

❌ Fewer third-party integrations

Pricing: Starts at ₹749/Org/Month Billed Annually

Who Should Use It: Small businesses that use other Zoho products.

5. Wave Accounting

Wave Accounting presents itself as a cost-free cloud accounting software dedicated to freelancers and corporations with minimal operations. The application enables users to create invoices track expenses and generate financial reports without monthly billing fees. Additional paid functions including payroll and payment processing are available for users of Wave Accounting. The interface of Wave provides businesses with a simple experience for their bookkeeping processes at affordable prices for basic yet strong accounting capabilities.

Key Features:

- Free invoicing and accounting

- Bank reconciliation

- Basic financial reports

- Payroll (paid add-on)

Pros:

✔️ Completely free for accounting

✔️ Simple and beginner-friendly

Cons:

❌ Limited scalability

❌ Fewer integrations

Pricing: Free for accounting, starts at $16/month

Who Should Use It: Freelancers and very small businesses with basic needs.

6. Sage Business Cloud Accounting

The comprehensive solution of Sage Business Cloud Accounting functions well for businesses in both small and medium size categories. Business users can track cash flow process invoices and reconcile bank transactions within Sage Business Cloud Accounting. Real-time financial data analysis features are available through the software together with connectivity to multiple business systems. Sage offers businesses the ability to access cloud-based services through which multiple users collaborate while automating financial operations to help them maintain financial oversight for better decision-making.

Key Features:

- Cash flow forecasting

- Invoice automation

- Multi-currency support

- Bank feeds

Pros:

✔️ Strong financial reporting

✔️ Scalable plans

Cons:

❌ Dated user interface

❌ Can be expensive for premium features

Pricing: Starts at £15/month

Who Should Use It: Growing businesses that need scalability.

7. NetSuite ERP

NetSuite ERP presents a full platform of enterprise resource planning as a cloud-based solution that features sophisticated accounting capabilities for financial management. The system integrates automatic procedures that handle billing and revenue recognition in addition to tax regulations and time-sensitive reporting. Large enterprises together with growing businesses should use NetSuite as their comprehensive solution because it provides adaptable functions that join seamlessly with CRM, eCommerce and inventory management platforms.

Key Features:

- Advanced financial management

- Inventory and order management

- Tax compliance tools

- Multi-company and multi-currency support

Pros:

✔️ Enterprise-level features

✔️ Fully customizable

Cons:

❌ Expensive

❌ Requires training

Pricing: Custom pricing

Who Should Use It: Large businesses and enterprises.

8. Kashoo

Kashoo provides small businesses and freelancers with basic yet diligent cloud accounting tools. Kashoo provides its users with automated bank feed capabilities alongside invoicing tax monitoring and financial reporting benefits. Kashoo delivers an uncomplicated interface that helps non-accountants conduct bookkeeping easily. The software provides AI-based categorization functions real-time workflow capabilities and mobile platform compatibility thus making it ideal for basic accounting operations in businesses.

Key Features:

- Automated bookkeeping

- Real-time reporting

- Multi-user support

Pros:

✔️ Simple and affordable

✔️ Good automation

Cons:

❌ Limited advanced features

❌ Basic reporting

Pricing: Starts at $216/year

Who Should Use It: Small businesses looking for a no-frills solution.

9. FreeAgent

FreeAgent provides an accounting platform via the cloud that targets freelancers together with small companies and contractors. FreeAgent provides a suite of features that enable users to create invoices while tracking expenses and times worked as well as handling tax computations and managing projects. FreeAgent keeps track of bank statement reconciliations while connecting to many tools used in business operations. Partnerships between users and UK tax compliance regulations are simplified through FreeAgent’s dashboard interface which serves the financial management needs of self-employed professionals and businesses in growth stages.

Key Features

- Tax calculation

- Invoicing and time tracking

- Bank integration

Pros:

✔️ Easy to use

✔️ Good UK tax support

Cons:

❌ Limited features outside the UK

❌ No payroll support

Pricing: Starts at $14/month

Who Should Use It: UK-based freelancers and small businesses.

10. ZipBooks

Users can access ZipBooks’ intuitive accounting solution through the cloud where they receive features for smart invoicing and expense tracking, financial reporting and online payments. Business users can benefit from machine learning components that deliver financial insights together with business recommendations. Freelancers and small businesses can use ZipBooks because the platform includes free basic plans and premium options which make it an economical substitute for standard accounting software solutions.

Key Features:

- Smart invoicing

- Expense tracking

- Financial insights

Pros:

✔️ Free basic plan

✔️ Smart categorization

Cons:

❌ Limited advanced features

❌The free version has restricted functionality.

Pricing: Free; premium starts at $15/month

Who Should Use It: Small businesses needing a budget-friendly option.

11. Bench

Bench offers online bookkeeping support through a software integration system that links with professional bookkeepers. The service takes care of financial record keeping and reconciliation tasks and tax preparation to enable business owners to concentrate on strategic business development. Bench delivers expert book management services through a dedicated team, unlike conventional DIY accounting software platforms. The platform serves small companies that want minimal involvement with their bookkeeping procedures.

Key Features:

- Automated bookkeeping

- Monthly reports

Pros:

✔️ Hands-off bookkeeping

✔️ Personalized support

Cons:

❌ Expensive for small businesses

❌ lacks advanced accounting features

Pricing: Starts at $349/month

Who Should Use It: Businesses that prefer outsourcing bookkeeping.

12. OneUp

OneUp functions as an artificial intelligence-based accounting system with a focus on small businesses and their accounting needs. This software performs automated bookkeeping as well as bank reconciliation tasks, generates invoices and handles inventory management alongside CRM operations. Automatic expense categorization occurs through the software’s learning process of previous transactions which decreases the need for manual work. Businesses focused on accounting automation will find OneUp to be an optimal solution because it combines real-time insight with responsive design targeted for mobile operations.

Key Features

- Automated invoicing

- CRM integration

Pros:

✔️ AI-powered automation

✔️It a versatile all-in-one solution

Cons:

❌ Not well-known

❌ Challenging for beginners

Pricing: upon request

Who Should Use It: Small businesses wanting automation.

13. MYOB Essentials

The Australian and New Zealand market focuses on MYOB Essentials as a cloud-based accounting software solution. Users can use this software for invoicing as well as expense tracking, payroll management and tax compliance tasks. The bookkeeping requirements of small businesses become simpler through MYOB because of its automatic bank feeds combined with GST/BAS tracking alongside real-time financial reporting functions. The software provides integration capabilities for different business applications and mobile accessibility together with this allows simpler and more efficient financial management.

Key Features:

- GST reporting

- Payroll integration

Pros:

✔️ User-friendly interface

✔️Automated bank feeds

Cons:

❌ Dated UI

❌ Limited customization

Pricing: Starts at $5.50/month

Who Should Use It: Australian small businesses.

14. Clear Books

The UK software company Clear Books provides cloud accounting solutions that serve business clients and accountants. The software solution provides users with invoicing features as well as bank reconciliation capabilities, VAT return filing functions and financial reporting capabilities. HMRC-compliance with the software ensures that UK businesses can file taxes without difficulty. Clear Books provides businesses access to multiple users at once and real-time understanding together with payment processor integration while maintaining accurate records and tax compliance without effort.

Key Features:

- VAT reporting

- Invoicing

Pros:

✔️ Simple to use

✔️Multi-user access

Cons:

❌ Limited integrations

❌ lacks advanced automation features

Pricing: Starts at £6.25/month

Who Should Use It: UK-based small businesses.

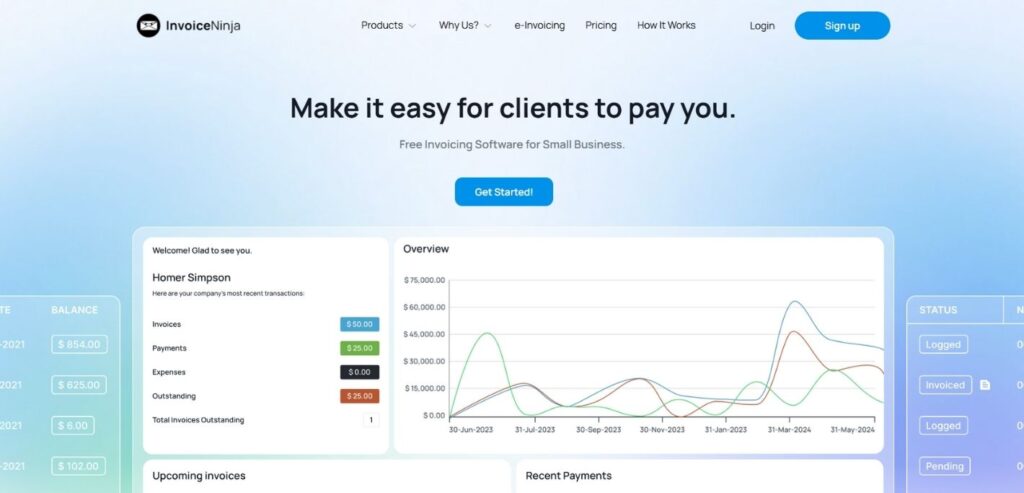

15. Invoice Ninja

The cloud platform Invoice Ninja was designed specifically to meet the needs of freelancers together with small companies. Invoice Ninja provides users with three essential components: customizable invoices and time tracking capabilities and expense management and client portal features. The software can work with different payment gateway options that enable smooth money transfers. Invoice Ninja serves as an excellent financial management tool for businesses through its free and premium plans at budget-friendly rates.

Key Features:

- Customizable invoices

- Time tracking

Pros:

✔️ Great for invoicing

✔️ Integrates with multiple payment gateways

Cons:

❌ Not a full accounting suite

❌ Less automation for bookkeeping

Pricing: Free; premium starts at $120/year

Who Should Use It: Freelancers and service businesses.

Comparison Between SaaS Accounting Softwares

Below is a detailed comparison of these 15 SaaS accounting software solutions, covering features, pricing, use cases, and official websites.

| Software | Key Features | Pricing | Best For | Website |

| QuickBooks Online | Invoicing, expense tracking, payroll, tax management, integrations | Starts at $17.50/month | Small to medium businesses | quickbooks.intuit.com |

| Xero | Bank reconciliation, multi-currency, invoicing, project tracking | Starts at $2.90/month | Small businesses, accountants | xero.com |

| FreshBooks | Time tracking, invoicing, project management, expense tracking | Starts at $7.60/month | Freelancers, small businesses | freshbooks.com |

| Zoho Books | Automation, invoicing, inventory tracking, tax management | Starts at ₹749/Org/Month Billed Annually | Small businesses, Zoho ecosystem users | zoho.com/books |

| Wave Accounting | Free accounting, invoicing, receipts, optional paid payroll | Free (paid payroll starts at $16/month) | Freelancers, startups | waveapps.com |

| Sage Business Cloud Accounting | Cash flow tracking, bank feeds, invoicing, tax reporting | Starts at £15/month | Small to medium businesses | sage.com |

| NetSuite ERP | Advanced financials, inventory, multi-company support, automation | Custom pricing | Large enterprises, scaling businesses | netsuite.com |

| Kashoo | AI-driven bookkeeping, invoicing, tax reports, multi-user access | Starts at $216/Year | Freelancers, solopreneurs | kashoo.com |

| FreeAgent | UK tax compliance, invoicing, expense tracking, bank reconciliation | Starts at $14/month | UK freelancers, contractors, small businesses | freeagent.com |

| ZipBooks | Smart financial insights, invoicing, expense tracking, free plan available | Free (paid plans from $15/month) | Freelancers, small businesses | zipbooks.com |

| Bench | Done-for-you bookkeeping, financial reports, tax filing support | Starts at $349/month | Small businesses that prefer outsourced bookkeeping | bench.co |

| OneUp | AI-driven accounting, invoicing, CRM, inventory management | Upon request | Small businesses, accountants | oneup.com |

| MYOB Essentials | Invoicing, payroll, tax reporting, GST/BAS compliance (AU/NZ) | Starts at $5.50/month(Solo) | Australian & New Zealand businesses | myob.com |

| Clear Books | UK-based, VAT returns, bank feeds, invoicing, project tracking | Starts at £6.75/month | UK small businesses, accountants | clearbooks.co.uk |

| Invoice Ninja | Free invoicing, expense tracking, time tracking, open-source option | Free ($120 Per year) | Freelancers, agencies, small businesses | invoiceninja.com |

Conclusion

The selection of SaaS accounting software depends on your business dimensions along with your industry type and special financial requirements. FreshBooks serves small businesses and freelancers along with Wave Accounting which provides a great free version to users. Growing businesses that need powerful financial tools together with automated solutions and flexible features should use either QuickBooks Online or Xero. The feature-rich Zoho Books offers users high value through its integration capabilities at an affordable price point.

Businesses with extensive financial management needs can find appropriate solutions in Sage Business Cloud Accounting and FreeAgent, particularly for UK-based small enterprises. Larger organizations should choose NetSuite ERP because it delivers complete accounting features alongside enterprise-level functions. Australian and New Zealand businesses can find an ideal solution for localized compliance features with MYOB Essentials as their strong contender.

Bookkeeper automation and AI analytics functions find their best representation in OneUp and ZipBooks platform services. Users who need simple accounting without additional features will find Kashoo to be their suitable solution. Businesses looking for software combined with human bookkeeping support can use Bench to combine their financial management expertise with modern technology.

Businesses focused on invoicing can use Invoice Ninja as their lightweight invoicing solution because it provides outstanding client management features along with customization abilities. Businesses operating in the UK with tax compliance requirements together with easy-to-use accounting tools should consider Clear Books.

Select the platform that matches your requirements between advanced capabilities and affordability as well as automation and personalized bookkeeping support. Analyze your business needs to select software that matches your objectives for expansion and monetary growth.

FAQs

1. What is SaaS accounting software?

Businesses can access and manage bookkeeping along with invoicing tax compliance and financial reporting through SaaS (Software as a Service) accounting software that exists in cloud computing systems. Users gain access to real-time software capabilities by eliminating the requirement for on-premise installations and can access their operations through any device.

2. Does cloud computing bring enough protection to accounting software solutions?

Most SaaS accounting solutions maintain security through a combination of strong encryption together with multi-factor authentication and automated regular data backup protocols. Financial data in leading provider platforms is secured by their commitment to protect data through standards that fulfill GDPR and SOC 2 requirements.

3. What advantages does SaaS accounting software delivery offer users?

Mounting SaaS accounting software introduces automatic processes while delivering instant access to financial information to users through flexible costs and expansion possibilities. The tool connects with various business tools to enhance financial operations and supply more precise results.

4. Considering tax regulations, how well do SaaS accounting platforms comply with tax necessities?

Most SaaS accounting platforms provide tax calculation with GST/VAT tracking and they support automatic tax filings. Tax compliance features for country-specific requirements are available in the software solutions provided by QuickBooks Online and Xero.

5. What is the top SaaS accounting solution suitable for companies with limited sizes?

Among the best choices for small businesses, one can find QuickBooks Online and Xero coupled with FreshBooks and Wave Accounting. A business requires specific needs as the base for choosing its SaaS accounting platform.