No more so in the complex world of law is precision the most important aspect. This is not restricted to the making of arguments and navigating statutes but to the financial management which also forms the backbone of the whole exercise. In small law firms, which in many cases do not separate the functions of the partners, who tend to fulfill various roles, financial administration can be a frightening and risky exercise. The era of using manual ledgers, scattered spreadsheets and off the shelf accounting tools are soon disappearing. Such outdated approaches are not only not efficient but are full of risks particularly regarding the strict ethical regulations of handling of client funds. The specifics of the law firm’s precarious financial system that includes client trust accounts, time lags in the complex billing cycle, or the strict regulatory environment prove that the specific solution is needed.

A small law firm accounting software is a complex field to navigate; this guide is made to do just that in 2025. We will understand why generic solutions are inadequate, which features your small firm needs to pay the most attention to, and what the concrete advantages of using a purpose-built platform are. We shall do a detailed analysis of the leading software products in the market today including their detailed descriptions, feature breakdown and pricing analysis to equip you with the power to make an informed buy on the software product. Selection of the software is far more than an operational improvement, it is an investment in the outcome of your firm; its efficiency, its compliance and profitability, and its viability as a long-term enterprise.

Why Law Firms Need Specialized Accounting Software

Trying to use a generic accounting program such as a common version of QuickBooks or Xero in a law firm is akin to using a family sedan to do construction work, it will shuffle some things about, but it is not geared to the heavy, specialized lifting that is needed. Financial practices of a law firm are not the same as those of a normal business. The main cause of such deviation is that it is morally and legally required to handle client funds in a separate account and with a lot of care.

Here, interest on lawyers trust accounts (IOLTA), or client trust accounts for the larger picture, enters the picture. These are not the assets of the firm but monies in trust of clients to be used in future in legal charges, court expenses or settlement payments. Mingling of these funds with the operating revenue of the firm is one of the most severe ethical offences a lawyer can commit and usually results in a heavy penalty including loss of license to practice.

This is a key requirement, which is designed into specialized small law firm accounting software. It maintains individual ledgers between operating and trust accounts, and this avoids co-mingling funds and gives a clear and audit trail of each transaction. It automates payments to the firm invoices through the trust account and the money is only transferred once it is earned. It is this one characteristic, the strong, compliant trust accounting, that makes legal-specific software the best choice. In addition to this, these platforms support additional legal-focused requirements such as conflict of interest search, industry-specific billing formats (e.g. LEDES) and in-depth reporting on case profitability and attorney productivity.

Key Features to Look For in Small Law Firm Accounting Software

- Comprehensive Trust Accounting (IOLTA/IOLA): This is not optional. Its software should be capable of handling multiple trust accounts, avoid overdrafts on a client-by-client basis, and produce detailed client ledger reports, and be able to reconcile three-way, i.e. between the trust bank statement, the trust cash book, and the individual client trust ledgers, and achieve perfect balance and compliance.

- Tracking Time and Expenses: Billable hour is the blood of most companies. The program must ensure that law firms can easily capture time on any device (desktop, tablet, or phone) by their attorneys and paralegals. It must also enable one to easily track soft costs (e.g. photocopies) and hard costs (e.g. filling fees) so that they are billed back to the client appropriately.

- Legal Billing and Invoicing: Seek flexibility. Other billing models such as hourly, flat fee, contingency, and blended rates should be supported by the system. It should be able to produce professional invoices that can be issued in bulk and have clear information of all the charges. It is important to integrate with online payment processors (such as LawPay) to enhance cash flow.

- Reporting and Analytics: In order to manage your firm as a business, you require data. Important reports are Accounts Receivable (A/R) aging, client payment history, attorney productivity and realization rates, and case profitability. These insights allow you to know the most profitable clients and practice areas and the areas of inefficiencies.

- Conflict of Interest Checking: Firms have to make sure that there is no conflict of interest before accepting a new case. An effective system will include an inbuilt search mechanism that will trawl through your entire database of existing and former clients and others connected to them to detect possible conflicts within a short time.

Benefits of Using Accounting Software for Lawyers

The effect of the proper small law firm accounting software implementation is much more than easy bookkeeping. It changes the nature of operations of a firm, and it brings quantifiable returns to all aspects.

- Assured Compliance and Minimized Risk: Automating the trust accounting rules and offering clear audit trails, the software significantly minimizes the risks of any human error that may result in an ethical violation and malpractice claims. A very important, though not measurable, advantage is peace of mind.

- Higher Profitability: Proper tracking of time and expenses will translate to reduced loss of revenues. All the minutes and all the expenses are charged and invoiced, which directly improves the bottom line. Companies tend to record an impressive rise in revenue collected in months of switching.

- Better Cash Flow: Functions such as batch invoicing, auto payment reminders and online payment capabilities allow you to get paid quicker. Shortening the period between the time of work and payment of the same is very essential in the financial condition of any small firm.

- Increased Productivity and Time: Automation of routine tasks, such as invoice generation, payments tracking, and account reconciliation, leaves more time to the attorneys and the staff. This time can be used in billable work or business development instead of being wasted in administrative overhead.

- Data-Driven Decision Making: Small law firm accounting software partners will be able to make strategic decisions using hard data as real-time financial and productivity reports are available. This may inform staffing and compensation, marketing and client intake.

- Enhanced Client Relations: Client trust and loyalty is established through clear, professional and correct invoices. A typical characteristic of client portals is that it enables clients to access their case files, monitor the status of their invoices, and pay them online, resulting in a feeling of involvement and satisfaction.

Best Small Law Firm Accounting Software (2025 Picks)

1. CosmoLex

CosmoLex positions itself as the first and only cloud-based all-in-one platform that does not need integration with other accounting systems such as QuickBooks. It is constructed bottom up with the central assumption that legal accounting is not an additional activity but a part of practice management. This integrated solution implies that all the activities, including time tracking and uploading a document, are directly linked to the accounting system. This removes the problem of data syncing and makes sure that information regarding the case, concerning finances, is current and accurate.

Its main strength is its powerful and integrated accounting features especially in trust account management which is foolproof and fully in line with the guidelines of the Bar Association. CosmoLex is also suitable to companies that seek one source of truth of all their practice and financial information where they do not have to deal and pay several subscriptions to different software.

Key Features:

- Built-in Legal Accounting (Operating and Trust)

- Time and Expense Tracking

- Billing and Invoicing

- Case Management

- Document Management

- Client Portal

- Conflict Checking

- Calendar and Task Management.

Pros:

- Truly all-in-one system with no need for QuickBooks.

- Excellent, compliance-focused trust accounting.

- Strong billing and collection features.

- User-friendly interface.

Cons:

- Can be more expensive than other options if you don’t need all the features.

- Some users find the reporting features could be more customizable.

Pricing: Typically starts around $99 per user/month (billed annually).

Website: https://www.cosmolex.com/

2. Clio

Clio is possibly the most well known in the legal practice management software market and they provide a full feature tool set to manage just about every part of a law firm. The platform has two major products, namely, Clio Manage (practice management) and Clio Grow (client intake and CRM). Clio Manage has powerful time tracking, expense management, and advanced billing capabilities, which is useful in accounting. It has a rich, two-way integration with QuickBooks Online, so that firms can use Clio to manage billing and trusts on a legal-specific basis and use QuickBooks to manage their general ledger and business accounting.

This method provides flexibility, in that the bookkeeper or an accountant of a firm can work in a comfortable environment. Clio has a simple interface, a large number of integrations, and a high level of security and customer support, which makes it one of the best competitors across the board of any company size.

Key Features:

- Time and Expense Tracking

- Customizable Billing

- Client Portal with Online Payments (Clio Payments)

- Robust QuickBooks Online Integration

- Trust Account Management

- Case Management

- Extensive App Marketplace.

Pros:

- Market leader with a polished interface and extensive features.

- Huge number of integrations with other legal tech tools.

- Excellent customer support and training resources. Strong mobile apps.

Cons:

- Relies on QuickBooks Online for full general ledger accounting.

- The cost can add up, especially when using both Clio Manage and Clio Grow.

Pricing: Clio Manage starts at approximately $39-$69 per user/month for basic plans, with more popular plans around $109 per user/month.

- Website: https://www.clio.com/

3. Zola Suite

Zola Suite, formerly of the AbacusNext family, competes with CosmoLex in the all-in-one market because it also includes a fully integrated platform with a comprehensive built-in accounting system. It is made to be an all-in-one solution to case management and financial administration needs and thus there is no need of using an additional accounting software such as QuickBooks. The main characteristics of Zola are an advanced email management system, which connects communications directly to matters and a robust Business Intelligence (BI) reporting engine, which offers valuable insight into the performance of the firm.

It has a complete accounting module with full operating and trust accounting, bank reconciliation and ability to control both soft and hard costs. Zola Suite is also a good fit when it comes to data-driven firms that are interested in a modern, powerful, end-to-end solution that will allow them to run their whole business and not mix and match software subscriptions.

Key Features:

- Full Built-in Accounting (No QuickBooks needed)

- Sophisticated BI Reporting

- Integrated Email Management

- Time and Billing

- Case Management

- Document Management

- Task Management.

Pros:

- Powerful, all-in-one system with advanced reporting capabilities.

- Built-in accounting is robust and comprehensive.

- Strong email integration is a key differentiator.

Cons:

- Can have a steeper learning curve due to its extensive feature set.

- Maybe more than a solo practitioner needs.

Pricing: Starts around $79 per user/month (billed annually).

- Website: https://www.zolasuite.com/

4. PracticePanther

PracticePanther is a critically acclaimed legal practice management software with remarkable ease of use and clean and intuitive interface. Although it lacks a complete, integrated general ledger, it is financially powerful enough in terms of day-to-day use. The platform is also good in time tracking, expense tracking, and generating customized professional invoices. It has great trust accounting capabilities which means firms can handle the funds of clients as per the regulations.

The main accounting concept of PracticePanther is to have a two-way, seamless sync with QuickBooks Online so that a firm can process legal-specific billing in PracticePanther and the accountant can take care of the rest of the books in QuickBooks Online. It is also compatible to LawPay and other payment processors. It is an excellent choice of small companies that have user experience and desire to use a system that the team can learn in a short period of time.

Key Features:

- Intuitive Time and Expense Tracking

- Trust Accounting

- Customizable Invoicing

- Seamless QuickBooks Online Integration

- Case Management

- Client Portal

- Workflow Automation

Pros:

- Extremely user-friendly and easy to learn.

- Clean, modern interface

- Excellent customer support

- Strong automation features for intake and workflows.

Cons:

- Requires QuickBooks Online for full general ledger accounting

- Some advanced reporting is only available on higher-tier plans.

Pricing: Plans start around $59 per user/month (billed annually).

- Website: https://www.practicepanther.com/

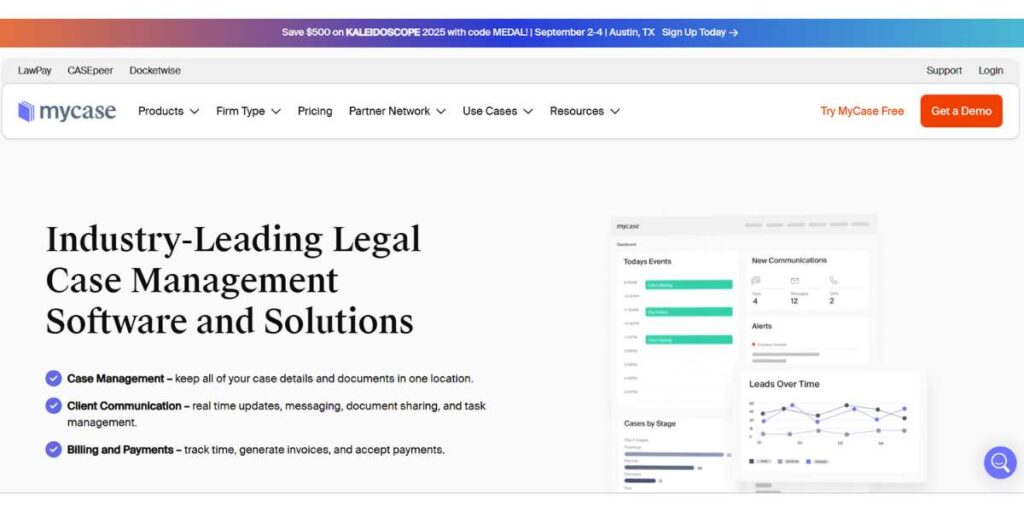

5. MyCase

Another major all-in-one legal practice management product is MyCase, which provides a balanced set of functions suitable to small to mid-sized law firms. It has a strong case management platform, client communication and a well rounded feature base of financial management tools. In terms of accounting, MyCase offers all that a firm requires in terms of billing and trust management such as time and expense tracking, batch invoicing and trust account reconciliation. One of the distinguishing factors is the client portal and internal communication tools that are integrated and facilitate collaboration.

MyCase also contains its own in-house payments solution (MyCase Payments) and provides a decent connection with QuickBooks Online to companies that would like to use it as their general ledger. It is also an excellent compromise between the power and ease of use, and an overall solid option, which any firm can use to modernise their whole workflow.

Key Features:

- Time Tracking and Billing

- Trust Account Management

- MyCase Payments (Integrated)

- QuickBooks Integration

- Case Management

- Lead Management

- Excellent Client Portal.

Pros:

- Comprehensive, all-in-one feature set.

- Strong focus on client communication and collaboration.

- User-friendly design

- Good value for the features offered.

Cons:

- Some users feel the reporting could be more advanced.

- Like others, it relies on QuickBooks for full-blown business accounting.

Pricing: Starts at approximately $59 per user/month (billed annually).

- Website: https://www.mycase.com/

6. LeanLaw

LeanLaw is a specialist and a niche in the market because it is not marketed as the alternative to QuickBooks, but rather the best QuickBooks supplement to the law firms. It is aimed only at companies which either use or are interested in using QuickBooks Online and fills the gap by introducing all the required legal-specific functionality. LeanLaw is a highly integrated app with QBO, which brings powerful trust accounting, legal-specific time tracking, and flexible invoicing to the QuickBooks platform.

This enables the bookkeeper or fractional CFO of the firm to operate in a system that they are comfortable in, QuickBooks, whereas the attorneys operate in LeanLaw, which is a streamlined, lawyer-friendly workflow. It is the ideal solution to those companies who hold the belief of a best of breed solution and want the strength of the world leading small business accounting software, yet with the compliance and billing functionality that the legal industry requires.

Key Features:

- Deep Two-Way QuickBooks Online Sync

- Advanced Trust Accounting

- Legal-Specific Timekeeping

- Flexible Invoicing

- Profitability Reporting

- Compensation Tracking.

Pros:

- Best-in-class QuickBooks Online integration.

- Allows accountants to stay in their preferred software.

- Excellent reporting and profitability analysis.

- Scalable for growing firms.

Cons:

- It is not an all-in-one practice management tool (lacks case management).

- Requires a QuickBooks Online subscription, which is an additional cost.

Pricing: Starts around $49 per user/month, plus the cost of QuickBooks Online.

- Website: https://www.leanlaw.co/

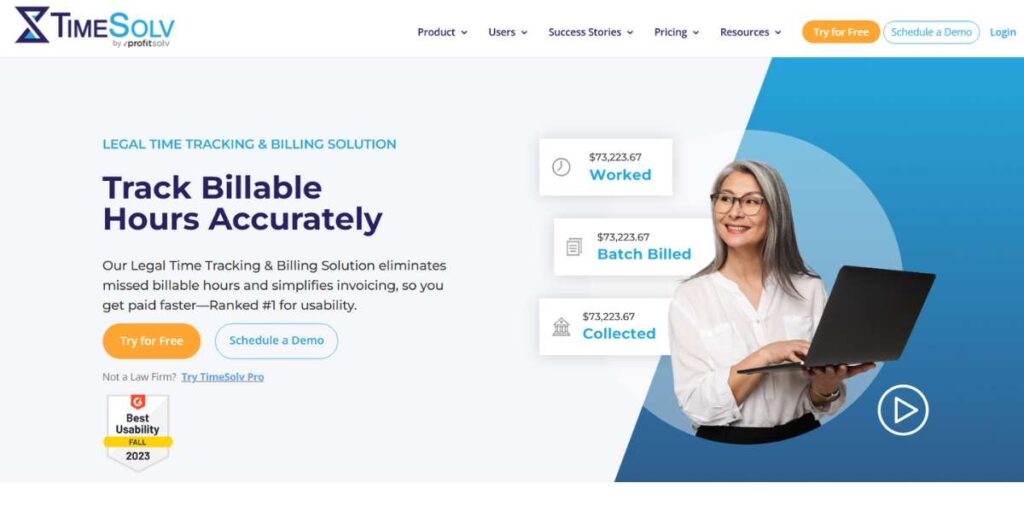

7. TimeSolv

TimeSolv is a long-established legal tech company that was originally a time and billing app but has since grown to be a practice management system. The strongest point of its core is its time tracking and invoicing functions being very strong and very flexible. The software supports complex billing systems and tracking of expenses, which makes it appropriate to firms that have complex billing requirements.

TimeSolv has powerful trust accounting capabilities to provide compliance and connects with QuickBooks (Online and Desktop) and Xero to manage general ledgers. It is a good, stable solution to small companies who are mainly interested in tracking all the billable hours and be able to handle complex billing situations adequately. It offers most of the capabilities of the bigger platforms and usually at a lower cost, which makes it an excellent deal to low-cost companies.

Key Features:

- Flexible Time and Expense Tracking

- Budgeting on a Per-Matter Basis

- Trust Accounting

- Invoicing and Billing

- QuickBooks and Xero Integration

- Project Management

Pros:

- Very powerful and flexible time and billing features.

- Supports both QuickBooks Online and Desktop.

- Competitive pricing.

Cons:

- The user interface can feel a bit dated compared to newer competitors.

- Lacks some of the broader case management features of all-in-one suites.

Pricing: Starts at approximately $49.95 per user/month.

- Website: https://www.timesolv.com/

8. PCLaw by LEAP

PCLaw is an older and one of the most well-established on-premise legal accounting and practice management software systems. It has been the workhorse of law firms across the country over the last decades. Over the last few years, it has been purchased by LEAP and is currently sold together with a cloud version. PCLaw has the reputation of having very deep and detailed accounting functionality which integrates billing, trust accounting, and general ledger into a single package. It is a powerful system that is able to manage complicated financial situations easily.

The conventional PCLaw is a desktop application, thus it can be of interest to companies that want to keep their data locally. The integration with LEAP provides a route to the cloud to companies that are interested in modernization. It is most appropriate to companies that require a high level of control over their accounting and are not afraid of an older software interface.

Key Features:

- All-in-One Accounting (Billing, Trust, GL)

- Detailed Financial Reporting

- Check Writing

- Bank Reconciliation

- Case and Document Management.

Pros:

- Deep, comprehensive accounting features. Long-standing reputation for reliability.

- Does not require a separate accounting program.

- Option for on-premise deployment.

Cons:

- The interface is dated compared to modern cloud software.

- The on-premise version lacks the accessibility of cloud tools.

- Can have a steeper learning curve.

Pricing: Pricing is typically quote-based and can be higher than many cloud-only competitors.

- Website: https://www.leap.us/pclaw/

9. Bill4Time

Bill4Time is what the name implies a time and billing software and it has been successful at that. Since then it has added additional practice management features, but its core competency has not been diluted. The software offers an efficient, simple interface to track time and expenses on any device. It provides a flexible billing and online payment integrations and robust trust accounting features to be compliant. Bill4Time is integrated with QuickBooks by the companies that wish to synchronize their general ledger.

It is an extremely powerful alternative to solo practitioners and small firms whose main interest is in billing efficiency and cash flow, but who are not likely to require the comprehensive case management capabilities of more expensive all-in-one suites. It is a good choice due to its simple style and affordable prices.

Key Features:

- Simple Time and Expense Tracking

- Customizable Invoicing

- Trust Accounting

- Client Portal

- QuickBooks Integration

- Productivity Reporting.

Pros:

- Very easy to use and set up.

- Excellent time tracking features.

- Affordable pricing structure.

- Good mobile application.

Cons:

- Less comprehensive on case management features compared to Clio or MyCase.

- Reporting is good but may not be as deep as some competitors.

Pricing: Starts around $30 per user/month (billed annually).

- Website: https://www.bill4time.com/

10. QuickBooks Online (with a Legal Integration)

QuickBooks Online (QBO) is the most popular small business accounting software in the world, and yet, by itself, it is not a good fit to law firms because it does not provide safeguards to trust accounting. Nevertheless, it is an engine when combined with a legal-specific integration. Other tools such as LeanLaw, Clio or PracticePanther are meant to rest on top of QBO and provide the all-important legal layer.

This hub and spoke system enables the law firm to do all its billing, trust accounts, and matters related finances in the legal software whereas the core business accounting (payroll, rent, office supplies) and financial reporting at a higher level are done by the industry standard QBO. It is the favorite workflow of most accountants and bookkeepers. This would be the best option to go with in case the firms have already trained their accounting personnel on QuickBooks and are interested in getting the best solutions in both legal billing and general accounting.

Key Features:

- (When integrated) Full General Ledger

- Bank Feeds and Reconciliation

- Payroll Management

- Financial Reporting

- Tax Preparation Support.

- The legal features are provided by the integrated app.

Pros:

- It’s the industry standard for small business accounting.

- Most accountants are already experts in it.

- Extensive reporting and features for overall business health.

Cons:

- Requires a third-party integration for compliant trust accounting.

- Can be dangerous and lead to compliance issues if used improperly on its own.

- Total cost includes two subscriptions.

Pricing: QuickBooks Online plans range from ~$30 to $200 per month, plus the cost of the legal integration software.

- Website: https://quickbooks.intuit.com/online/

Comparison Table: Top 5 Small Law Firm Accounting Tools

| Software | Best For | Trust Accounting | Starting Price (Approx.) | Key Differentiator |

| CosmoLex | Firms wanting a true all-in-one system with no other software needed. | Built-in & Compliance-Focused | $99/user/month | Fully integrated accounting eliminates the need for QuickBooks. |

| Clio | Firms wanting a polished, feature-rich platform with maximum integrations. | Robust, via QBO Sync | $69/user/month | The largest app marketplace and most recognized brand in legal tech. |

| Zola Suite | Data-driven firms wanting powerful, built-in reporting and email management. | Built-in & Comprehensive | $79/user/month | Advanced Business Intelligence (BI) reporting and integrated email. |

| PracticePanther | Firms that prioritize ease of use and a modern, intuitive interface. | Robust, via QBO Sync | $59/user/month | Unmatched user-friendliness and workflow automation. |

| LeanLaw | Firms that love QuickBooks and want to enhance it for legal practice. | Deep Integration with QBO | $49/user/month + QBO | Best-in-class, deep two-way sync with QuickBooks Online. |

How to Choose the Right Small Law Firm Accounting Software

- Evaluate Your Present and Future Requirements: Are you a one-man firm or a group of 5? Are you going to expand? What are your focus areas of practice? A law firm that deals with complicated litigation will not need the same thing as a firm that specializes in flat-fee estate planning. Write down the list of your must-have and nice-to-have features.

- Set Your Budget: Estimate a workable monthly or annual budget per user. Don t forget to include any other expenditure in the form of a separate QuickBooks subscription, implementation costs or data migration. Look at this as an investment not as an expense.

- Focus on the Core Four: regardless of the choice, it must be excellent in the four most important functions: Trust Accounting, Time Tracking, Billing, and Reporting. When one of these areas happens to be weak, then a system is not the right fit.

- Assess the Ecosystem: Look at the other software you depend upon. Can you easily connect the new platform with your email, calendar, document storage and e-signature tools? An integrated system is time saving and has fewer errors.

- DEMAND Demos and Free Trials: Never purchase any software without trying it out. Book live demonstrations with your 2-3 favorites. Make use of free trials and put some actual (or realistic) data. Experience how it is to carry out normal activities. This is the most crucial step towards the evaluation process.

- Read Reviews and Request Referrals: Read reviews on Capterra, G2 and Lawyerist. More to the point, ask people in your practice area (or similar) what they are using, what they love (or hate) about it.

FAQs

Is it possible to use QuickBooks in a law firm?

No. A typical QuickBooks subscription alone is both inadequate and risky to a law firm due to the absence of the compliant client trust (IOLTA) account safeguards.

Is the all-in-one platform more effective than the best-of-breed tools?

It varies on the preference of your firm. All-in-one solution will enable you to have a smooth workflow and only one place to contact, whereas the best-of-breed approach (e.g., PracticePanther + QuickBooks + Dropbox).

What is the price of a legal accounting software?

The average cost of a quality cloud-based solution is $50 to $110 per user, per month. On the upper end of that scale will be all-in-one platforms or more sophisticated levels with more features.

Which is the most difficult aspect of software swapping?

The two largest issues tend to be data migration (transferring your client and financial history to the new program) and user adoption (making everyone in the firm use the new program consistently and correctly).