The private banking industry in India has become a key platform of the Indian financial sector in terms of innovation, efficiency, and customer-oriented services. There are more and more private banks in India and they have transformed the banking system through technology and outstanding service delivery. These banks have been part and parcel of the growth of the Indian economy with millions of customers in urban and rural locations.

The sector has proven to be very resilient and adaptable with 21 Private Bank List operating in India as of 2025. The final list of the detailed list of the private banks demonstrates the institutions that have been performing better than the traditional bank models by focusing on digitalization, customer experience and innovative financial products that address the needs of different demographics.

Importance of Private Sector Banks in India’s Economy

The role of private sector banks in the economic development of India is pivotal because they positively contribute to aspects of financial inclusion, innovation and competitive banking services. These banks have revolutionized the banking industry with the implementation of advanced technology, streamlined processes, and customer-oriented strategies that have set the industry standards higher.

The list of private banks illustrates that these institutions have effectively acquired a large share of the market due to effective operations and creative products. They account for about 35 percent of the Indian banking assets and have played a major role in the process of digitization of banking in India. They have focused on risk management and capital adequacy as well as the efficiency of their operations, which has endeared them to both the retail and corporate customers, and this has enhanced the financial system in India and boosted growth.

What are Private Banks in India?

Definition of Private Sector Banks

The private sector banks in India are financial organizations in which the government owns a minority interest. These banks fall within the regulatory framework of the Reserve Bank of India (RBI), and can be defined by their profit oriented model, innovative services and customer focused business model.

The list of the private banks contains the banks that have been set up by a privately held investment and are being run by similar proprietors with professional management structures.

Difference Between Private Banks vs Government Banks

There are vast dissimilarities between the private banks and the government banks in terms of its ownership, management and its way of functioning. Government banks are owned and controlled by the government whereas in other banks, they are owned by the private shareholders and operated more freely.

The services provided by the private banks are usually fast, with higher levels of technology adoption and customer experiences than those offered by the public banks. They are also more aggressive in terms of growth strategies and their product offerings.

Growth of Private Banks in India After Liberalization (Post-1990s)

The opening of the Indian economy in 1991 marked a new threshold in the development of the private banking domain. The policy changes adopted by the RBI enabled entry of new banks in the private sector which resulted in competition and innovation.

After liberation, the list of private banks increased tremendously through the incorporation of banks such as HDFC Bank, ICICI Bank, and Axis Bank. It is the era that saw technological development, better standards of customer service and modern ways of banking which have changed the face of the Indian banking system.

Types of Private Banks in India

The Indian banking industry has two types of private banks:

- Old Private Sector Banks: These are the old banks that were in existence prior to the nationalization wave of 1969. They comprise banks such as Federal Bank, Karnataka Bank and South Indian Bank, which have continued to be in the private bank category during the history of banking in India.

- New Banks in the Private Sector: These banks have been introduced in the post liberalization of the economy in 1991, and they show a contemporary style of banking. Among the banks that have adopted the technology and the modern way of banking are HDFC Bank, ICICI Bank and Axis Bank among others.

The two categories play a major role in the overall list of private banks and the services provided by them vary widely, including retail banking, and corporate finance with their own strengths and market positioning tactics.

Private banks are key players in India’s financial system, offering savings, lending, and digital services. Alongside them, Non-Banking Financial Companies (NBFCs) provide lending and asset financing without full banking licenses. Explore the broader credit landscape in our list of NBFC Companies in India

How Many Private Banks are There in India (2025)?

The banking sector in India has 21 private banks in the country as at August 2025. The list of this private bank has both old and new private sector banks and serves different market segments.

Current Statistics:

- Total Private Banks: 21

- New Commercial Banks: 9

- Old Private Sector Banks: 12

- Total branch network: More than 30,000 branches

- ATM network: There are over 50,000 ATMs in this country

The number of private banks keeps changing with the regulations and the dynamic market structure, making up a substantial part of the Indian banking system and adding to the Indian financial services industry at large.

Top 10 Private Banks in India Based On Market Cap

| Rank | Bank Name | Market Capitalization (In Rs. Crore) |

| 1 | HDFC Bank | 12,81,100 |

| 2 | ICICI Bank | 8,50,000 |

| 3 | Axis Bank | 3,91,100 |

| 4 | Kotak Mahindra Bank | 3,75,000 |

| 5 | IndusInd Bank | 1,85,000 |

| 6 | Bandhan Bank | 95,000 |

| 7 | Federal Bank | 28,000 |

| 8 | IDFC FIRST Bank | 25,000 |

| 9 | RBL Bank | 18,000 |

| 10 | YES Bank | 15,000 |

Market capitalization figures are approximate and based on 2025 data

Private Bank List in India (2025)

A) New Private Sector Banks

1. Axis Bank

- Year Founded: 1993

- Number of Branches: 5,100+

- Chairperson: Rakesh Makhija

- Headquarters: Mumbai, Maharashtra

Axis Bank is one of the largest banks in India and is popular due to its wide scale of financial products and services and market share. The bank has positioned itself as a technology-oriented bank specializing in retail and corporate banking operations in both the urban and semi-urban locales.

Services:

- Personal banking and lending

- Corporate, and investment banking

- Online banking products

- Payment services and credit cards

- Global banking activities

Key Highlights: 3 rd largest private sector bank in India with large global presence.

2. Bandhan Bank

- Year Founded: 2015

- Number of Branches: 6,000+

- Chairperson: Chandra Shekhar Ghosh

- Headquarters: Kolkata, West Bengal

Bandhan Bank is an outgrowth of the microfinance industry and it has emerged as a major force in the Indian banking sector in a small span of time. Often featured in the Private Bank List, the bank is financial inclusion oriented and caters to rural and semi-urban markets with a major focus on micro and small business lending.

Services:

- Small and micro loans of enterprises

- Agricultural and rural financing

- Current and savings bank accounts

- Online bank services

- Financial inclusion products

Key Highlights: Greatest growth rate in India in the banking sector with a special focus on financial inclusion and rural banking.

3. HDFC Bank

- Year Founded: 1994

- Number of Branches: 9,100+

- Chairperson: Atanu Chakraborty

- Headquarters: Mumbai, Maharashtra

HDFC Bank is the largest privately owned bank in India as well as one of the most valuable banks worldwide. The bank has always remained at the top of the service industry in the private banking industry through its outstanding customer care service, technological advancement, and variety of financial products.

Services:

- Retail and wholesale bank

- Investment banking service

- Online and mobile banking

- Personal loans and credit cards

- The Treasury and capital market activities

Key Highlights: It is the biggest bank in India in terms of market value and assets in the Private Sector.

4. ICICI Bank

- Year Founded: 1994

- Number of Branches: 6,100+

- Chairperson: Girish Chandra Chaturvedi

- Headquarters: Mumbai, Maharashtra

ICICI Bank is the second largest bank in the non-public sector in India and is the most innovative banking solutions and has a strong corporate banking presence. The bank is the first to roll out technology-driven banking services and is also a strong international bank.

Services:

- Corporate and retail banking

- Securities and investment banking

- General insurance

- Asset management facilities

- International banking operations

Key Highlights:Second-largest privately owned bank with a high corporate banking and international market presence.

5. IDFC FIRST Bank

- Year Founded: 2015 (merger of IDFC Bank and Capital First)

- Number of Branches: 800+

- Chairperson: Rajiv Lall

- Headquarters: Mumbai, Maharashtra

The financial institution IDFC FIRST Bank was the result of a merger between IDFC Bank and Capital First, which became a unique bank in the retail and infrastructure financing sector. Frequently mentioned in the Private Bank List, the bank has focused on digital banking and customer-oriented services with smart product offerings.

Services:

- Retail, corporate banking

- Infrastructure financing

- Online banking products

- Business and personal loans

- Advisory and investment services

Key Highlights: Incorporated as a result of a merger of similar strategies, digital-first banking and infrastructure development.

6. IndusInd Bank

- Year Founded: 1994

- Number of Branches: 3,000+

- Chairperson: Aditya Puri

- Headquarters: Mumbai, Maharashtra

IndusInd Bank, a bank founded by Hinduja Group is one of the leading privately owned banks that focus on technology and customer services. The bank has a wide client base of retail and corporate customers and provides innovative banking services and high digital capabilities.

Services:

- Personal and business banking

- Auto financing and vehicle financing

- On- Question: Online payment methods

- International banking

- Value added services, treasury and investment services

Key Highlights: A bank that is characterized by innovative solutions and processes of digital transformation.

7. Kotak Mahindra Bank

- Year Founded: 1985 (converted to bank in 2003)

- Number of Branches: 2,000+

- Chairperson: Uday Kotak

- Headquarters: Mumbai, Maharashtra

Kotak Mahindra Bank is one of the most successful and prosperous banks of India which was initially a non-banking financial company. Often included in the Private Bank List, this bank can be described as having strong capital, creative solutions, and focus on the high-income customer segments that provide them with a variety of financial services.

Services:

- Wealth management and personal banking

- Business bank products

- Investment bank business

- Online banks

- Insurance and mutual fund services

Key Highlights: Shifting NBFC to one of the most valued privately held banks in India.

8. RBL Bank (Ratnakar Bank)

- Year Founded: 1943 (as Ratnakar Bank), renamed in 2014

- Number of Branches: 500+

- Chairperson: Vishwavir Ahuja

- Headquarters: Mumbai, Maharashtra

Ratnakar Bank which has now been renamed as RBL Bank has become a contemporary private sector bank with a specialization in specialized banking and niche market segments. The bank focuses on solutions that are technology-based and has both retail and corporate customers.

Services:

- Banking solutions

- Corporate and retail banking

- Digital banking services

- Loan and credit cards

- Treasury operations

Key Highlights: It was a success story and managed to change itself as a regional bank to a pan-India private sector bank.

9. YES Bank

- Year Founded: 2004

- Number of Branches: 1,200+

- Chairperson: Prashant Kumar

- Headquarters: Mumbai, Maharashtra

YES Bank was established as a corporate banking and retailing bank, which was the fifth largest private bank in India. However, the bank has been struggling to restore normalcy in its operations and it has been reorganizing its operations through a new leadership, governance and risk management.

Services:

- Banking (corporate, retail)

- Investment banking services

- Digital banking

- Trade finance operations

- Treasury and foreign exchange.

Key Highlights:Organizational transformation and modernization to strengthen and make business competitive.

B) Old Private Sector Banks

1. City Union Bank

- Year Founded: 1904

- Number of Branches: 700+

- Chairperson: Dr. Kamakodi N

- Headquarters: Kumbakonam, Tamil Nadu

City Union Bank is one of the oldest banking institutions in India with more than a century of banking experience. The bank specializes in small-medium enterprises, agricultural lending, and retail banking products mainly in the South of India.

Services:

- SME and agricultural funding

- Banking retailing services

- Digital banking

- Exchange services

- Government business functions

Key Highlights: It is one of the oldest privately held banks that have a strong presence in South India and SME financing.

2. CSB Bank (Catholic Syrian Bank)

- Year Founded: 1920

- Number of Branches: 450+

- Chairperson: Prakash P Mallya

- Headquarters: Thrissur, Kerala

The SB Bank (previously known as Catholic Syrian Bank) is a conventional localized bank with its clientele located in Kerala and other southern states. It is a retail bank with a modernization process through digital solutions.

Services:

- Personal banking products

- Farm and commercial loans

- Online banks

- Exchange services

- Investment products and insurance products

Key Highlights: Older traditional private bank that is regional and has a community banking focus.

3. Dhanlaxmi Bank

- Year Founded: 1927

- Number of Branches: 300+

- Chairperson: Sunil Gurbaxani

- Headquarters: Thrissur, Kerala

Dhanlaxmi Bank is a Kerala based retail focused and agriculture-oriented bank of the private sector. The bank specializes in the southern Indian market with conventional banking and contemporary digital services.

Services:

- Retail and farming bank

- Personal loans and business loans

- On- Question Digitals services

- The activities of foreign exchange

- Advisory services

Key Highlights: A regional-based private bank with obsession in agricultural and retail banking in the South of India.

4. Federal Bank

- Year Founded: 1931

- Number of Branches: 1,300+

- Chairperson: Shyam Srinivasan

- Headquarters: Aluva, Kerala

Federal Bank is among the large old privately-owned banks in India that have a wide presence in the nation. The bank has been able to modernize its operations and keep the traditional values and customer relations intact.

Services:

- Individual and corporate banking

- International banking services

- Online banking systems

- Wealth management and investment

- Trade finance functions

Key Highlights: Large old Indian private sector bank that is well established in retail banking and international banking.

5. Karnataka Bank

- Year Founded: 1924

- Number of Branches: 900+

- Chairperson: Preddy Srinivas

- Headquarters: Mangalore, Karnataka

Karnataka Bank is one of the oldest and leading banks in the old private sector with its stronghold in South India. The bank has been consistent in its growth as it focuses on retail banking, agricultural financing and small business lending.

Services:

- Banking and retail Italian agricultural banking

- Loans to decide on small businesses

- Digital bank offerings

- International remittances

- Investment services

Key Highlights: Regional well capitalized privately held bank with emphasis on retail and agricultural banking in South India.

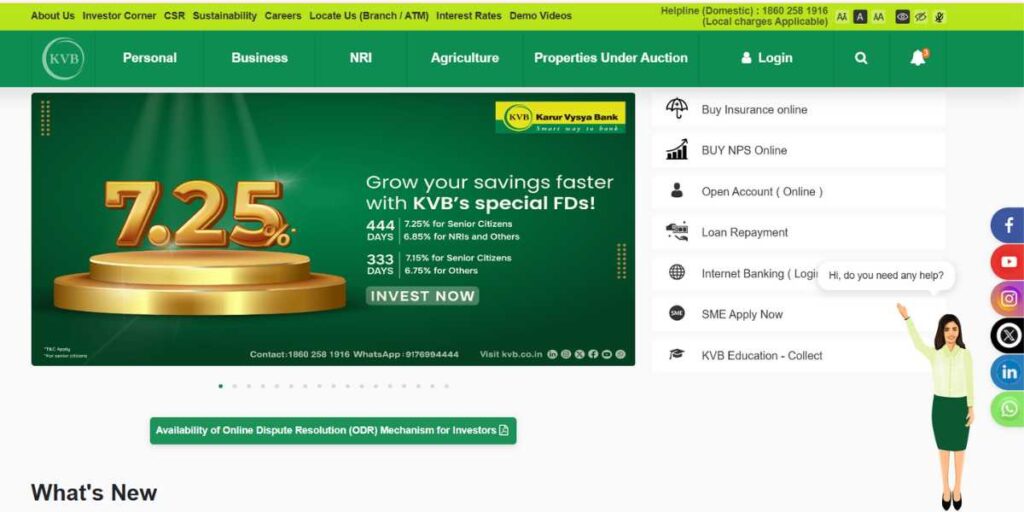

6. Karur Vysya Bank

- Year Founded: 1916

- Number of Branches: 800+

- Chairperson: Ramesh Babu B

- Headquarters: Karur, Tamil Nadu

Karur Vysya Bank has an experience of more than one hundred years of banking and is one of the oldest private banks in India. The bank specializes in retail banking, agricultural financing, and small business loans mostly in South India.

Services:

- Retail bank services

- Agricultural and small and medium enterprises financing

- Online banking systems

- Exchange services

- Business operations of Government

Key Highlights: It is an over 100-year-old privately owned bank that puts a lot of emphasis on retail and agricultural banking.

7. Nainital Bank

- Year Founded: 1922

- Number of Branches: 150+

- Chairperson: Rajkiran Rai G

- Headquarters: Nainital, Uttarakhand

Nainital Bank is a mini regional commercial bank with its significant focus in the state of Uttarakhand along with adjoining states. The bank is focused on retail banking and lending in the agricultural sector in a community approach concept.

Services:

- Bank retail services

- Agricultural financing

- Micro loans

- Digital banks products

- Government business activities

Key Highlights: It is a leading bank in the hill states with a strong community based banking.

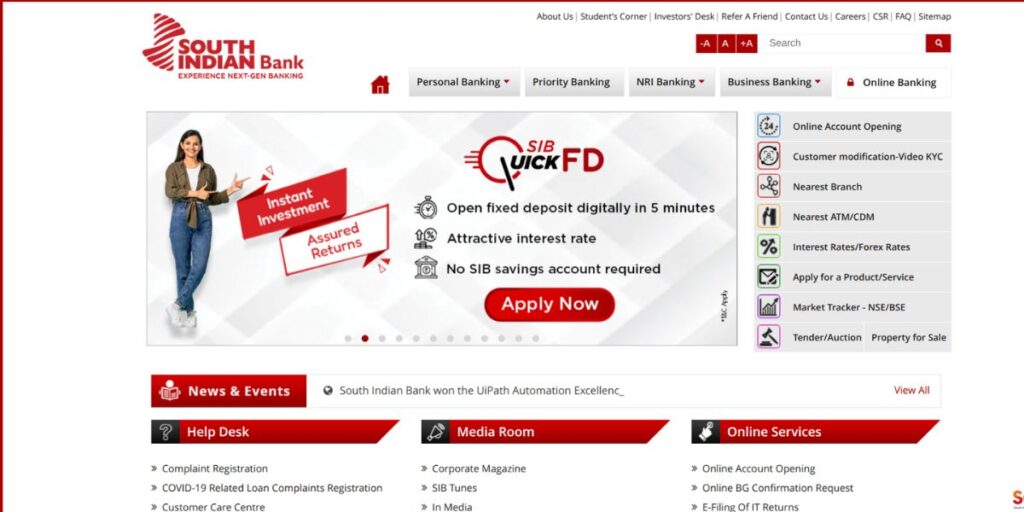

8. South Indian Bank

- Year Founded: 1929

- Number of Branches: 950+

- Chairperson: Salim Gangadharan

- Headquarters: Thrissur, Kerala

South Indian Bank is a leading old bank that has a dominant presence in South India. The bank has managed to incorporate the modern trends of banking with keeping the traditional contacts with customers.

Services:

- Individual and commercial banking

- Agricultural and business financing

- Online banking systems

- International banking services

- Wealth management

Key Highlights: Old and reputed PSB with wide presence in South India and all round banking services.

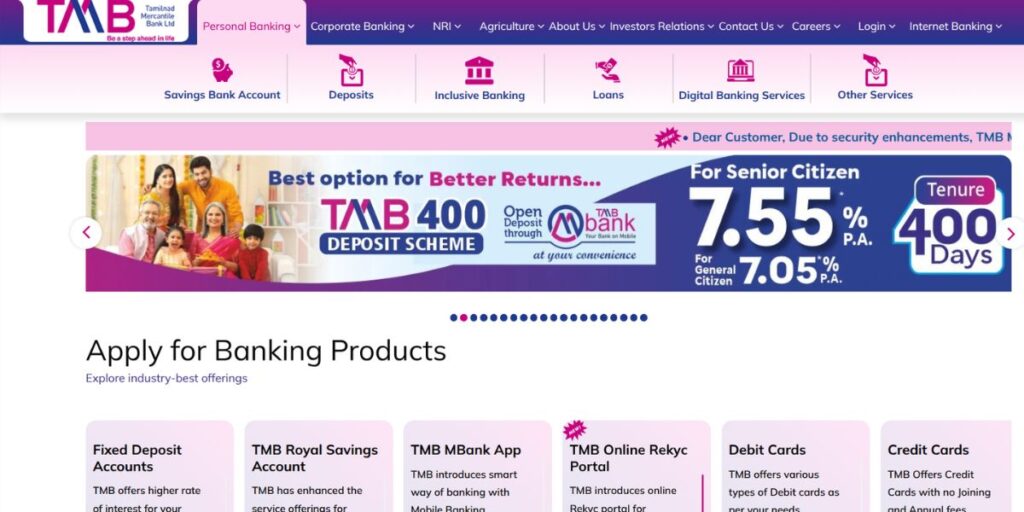

9. Tamilnad Mercantile Bank

- Year Founded: 1921

- Number of Branches: 550+

- Chairperson: K V Rama Moorthy

- Headquarters: Tuticorin, Tamil Nadu

Tamilnad Mercantile bank is a 100-year old privately owned bank with its customers based mainly in Tamil Nadu and other southern states. The bank specializes in retail banking, finance to the agricultural sector and small business lending.

Services:

- Retail, farming and agricultural banking

- SME financing solutions

- Online banking products

- Exchange business

- Investment advising

Key Highlights: A century-old privately-owned bank that operates mostly in the region with a retail-oriented focus.

First Private Bank in India

During British colonial rule, the first privately owned bank was started in India in 1786: the General Bank of India. Among the present-day surviving private banks, some of the oldest private banks include Karur Vysya Bank (1916) and Catholic Syrian Bank (1920).

These institutes have helped to establish the Indian banking sector in the private mode and remain an important part of the overall Private Bank List, serving millions of clients throughout the country.

Largest Private Bank in India

With market capitalization and assets, HDFC Bank is the largest privately owned bank in India as at 2025. The bank has been in the lead position in the list of private banks by virtue of its wide variety of services, large network of branches, and robust financial performance.

HDFC bank has more than 9,100 branches and 21,000 ATMs countrywide, serving more than 68 million customers and has established itself in the realms of excellent private banking in India.

Conclusion

The list of private banks in India is an active and developing industry that has changed the face of banking in India. Having 21 banks in the private sector with different market segments, the said institutions have played a crucial role in financial inclusion, innovation, and economic growth. From well-established players such as HDFC Bank and ICICI Bank to newer entrants such as Bandhan Bank, each of the banks on the list of the best private banks in India adds something useful to the banking industry in India.

The technology adoption, customer service excellence and innovative product offerings have led to an upward shift in the standards of the industry and served millions of customers. With India striving to become a developed economy, the Private Bank List featuring the top 10 private banks is sure to help the nation in these efforts through effective intermediation of finance and progressive banking innovation.

FAQs

In 2025, what is the number of the private banks in India?

India has a total of 21 private sector banks (consisting of new and old) as of 2025.

Which is the largest privately owned bank in India?

HDFC Bank is the largest private bank in India in terms of market capitalization, assets and branch network.

What are the differences between the old and the new privately owned banks?

Before 1969, there existed old private banks, whereas the new private banks were established after the economic liberalization took place in 1991.

What is the largest market capitalization private bank?

Among the private banks in India, HDFC Bank has the largest market capitalization in India at more than Rs. 12 lakh crores.

Are government banks less safe than the private ones?

Deposits in both the private and government banks in India are insured and regulated by RBI, therefore, equally safe to the depositors.