When you are a business owner, freelancer, or even a side-hustler handling payouts, it is more than paperwork to develop accurate and professional paystubs that concern both credibility and compliance. An efficient paystub generator helps to save time, eradicate mistakes, and make each paycheck contain appropriate information, including taxes and deductions. However, when there are dozens of tools on the Internet, it may seem so difficult to locate the best one.

That is why we have researched the best paystub Builder sites, features, price, and usability to enable you to make a wise decision. Here, you will find the top paystub tools that go beyond being easy to use and are also reputable by both businesses and individuals.

What is a PayStub generator?

A PayStub Builderis an online program or software that enables employers, self-employed individuals, or freelancers to produce professionally formatted pay stubs quickly and easily. A paystub is a document issued by an employer, and it contains details of what an employee earned and what/has been deducted during a given pay period.

The generator usually needs to be fed with company data, staff data, earnings data, and deductions, and will automatically generate a comprehensive paystub that can be downloaded, printed, or emailed. These pay stubs are used as evidence of wages, gross, taxes paid, deductions, and net pay, and are used in record keeping, tax filing, loan applications, and to confirm employment earnings.

Benefits Of Paystub Builder?

- Efficient Payroll: Automates payroll computation, minimizes human error, and costs less time to the accounting staff, enhancing efficiency and employee confidence.

- Improved Record-Keeping: Digitizing payroll records improves the process of record-keeping as it is now easier to keep, retrieve, and access vital financial information without the burdens of keeping physical records.

- Financial openness: It gives transparent pay structures, such as wages, deductions, and taxes, which enhances confidence and job satisfaction among employees.

- Cost Reduction: This saves labor and overhead of administration through the automation of paystub generation.

- Employee Satisfaction: Quick, precise, and understandable employee payment statements, supported by secure payment gateways, boost morale and decrease payroll arguments.

- Security and Confidentiality: Secures confidential data of the staff by means of secure encoding in digital platforms.

- Customization Options: Gives businesses the option of customizing their paystubs by business logos, formats, and setting pay period options.

- Convenience and Accessibility: It allows the employer and employees to access and write pay stubs anywhere one has access to the internet.

- Environmental Responsibility: This company is environmentally friendly and does not utilize paper because it issues digital pay stubs, which contributes to environmental responsibility.

Characteristics to Consider in The Most Suitable Paystub Generator.

- Accuracy and Compliance: Calculations of payroll and taxes are automatically under federal, state, and local laws to ensure that all deductions, taxes, and contributions are correct and up to date.

- Customization: Ability to customize pay stubs with company logos, customize templates, colors, and fields to match a brand in a manner that is identifiable to a profession.

- Intuitive Interface: Ease of use, time saving, user can make pay stubs with minimum training and in a short period of time.

- Security: Data security is ensured by good data protection, encryption, secure access control, and secure storage to ensure that sensitive payroll data is safe.

- Integration Capabilities: The ability to combine positively with payroll, accounting and HR software to reduce manual data entry and errors.

- Multi Pay Periods and Formats: several pay periods (weekly, bi-weekly, monthly, etc.) and the ability to save or print and use formats such as PDF.

- Other Features: The platform is further beneficial with a self-service portal, direct deposit data, time off, year-to-date calculations, audit information, and reporting.

- Customer Support: Customers have easy and efficient customer support through live chat, email, or phone concerning a problem that arises.

List of 10 Best Paystub Generators in 2025

1. PaystubHero

PaystubHero is an easy-to-use online paystub creation platform that targets small businesses, freelancers and self-employed people who require immediate, professional income-proving documentation to secure loans, rentals, and financial records. It provides clear-cut pricing with no additional charges and provides the customer to build an accurate paystub within minutes with options of the customizable templates to fit anyone with different preferences.

Key Features

- Customize 10 professional paystub templates, as included features.

- Each paystub includes functions such as deposit slip, time-off tracking, earnings customization, and secure dashboard access, which is included to the default price.

- The service does not charge extravagant costs that they will write on your bill.

- Create W-2s, 1099s, invoicing, employment validation letters, and offer letters.

- Live chat with skilled customer care team to get prompt help.

- Documents and all paystubs saved securely to be accessed later.

Pricing:

- Pay stub: $7.50 each paystub (no subscription required).

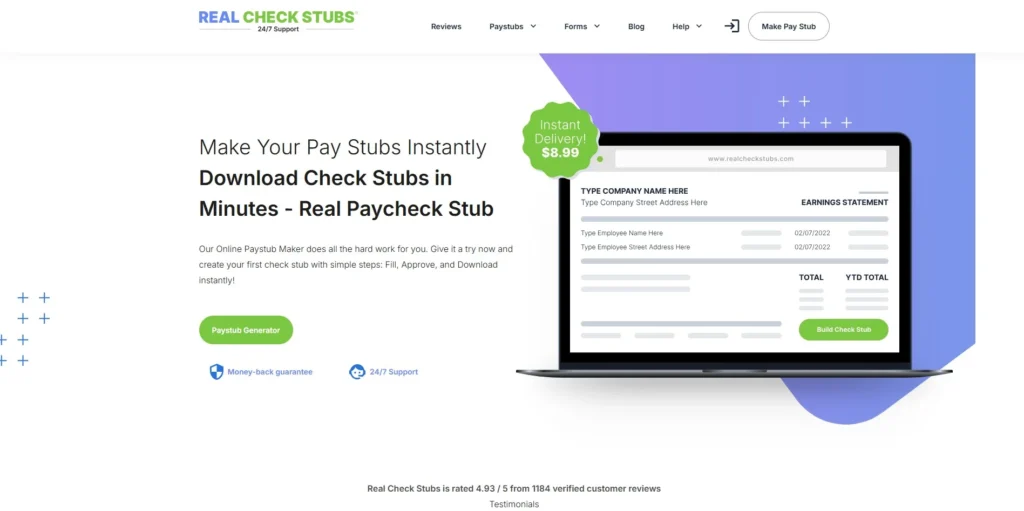

2. Real Check Stubs

Real Check Stubs is a web-based paystub creation tool that focuses on the creation of genuine and professional pay stubs. It provides numerous paystub templates (including both basic and premium), enabling users to generate pay stubs and enter the information of employees and employers.

The service offers error-free, editable templates that offer the ability to add detailed payroll information, including gross pay, deductions, and net pay. Pay stubs may be developed online in various template designs, from modern to classic and high-tech designs. The site also provides document storage in the form of a user account and provides email delivery of completed pay stubs.

Key Features:

- Several template choices are available, such as simple, contemporary, vintage, and sophisticated designs.

- Paystub templates are editable and error-free.

- Skills to enter comprehensive employee and company payroll data.

- User account-based document storage and management.

- Send out the final pay stubs via email.

- No subscription fee, pay-per-stub.

- Employee or contractor options, hourly or salary.

- Can be personalized to include such other factors as marital status and annualized earnings.

Pricing:

- Base cost approximately 8.99 per paystub. Extra charges on premium templates and functionality (e.g., 4.99 additional deposit slips). Total cost may soar to $12 to $24+ per paystub with add-ons selected.

3. PayStubs.net

PayStubs.net is a web-based paystub generation tool designed by accountants and provides a simple and fast means to generate professional paystubs containing automated payroll calculations. It has simple interface where users enter their details in order to get the paystubs done.

The site has several template color choices with automated federal and state tax calculations, but other users have complained that occasionally the calculations are inaccurate. Customer care is also provided both on chat and phone to help with questions/corrections. PayStubs.net has a per-paystub fee and focuses on a no-fuss experience and has standard security practices.

Key Features :

- Various layout paystub templates in a variety of colors.

- Automated payroll and tax computing for federal and state taxes.

- Simple user interface and a straightforward process of document creation.

- Support on phone and chat to assist the customer.

- Typical security protocols to defend user information.

- Electronic delivery of finished pay stubs.

Pricing:

- Pay-per-document, no subscriptions, and $11.99 per paystub.

4. Check Stub Maker

with professionals so that there are no mistakes when calculating payroll, and gives users the ability to customize templates to add the information on the employee and company, wages, benefits, taxes, etc., and generates detailed pay stubs to be downloaded or printed. The tool makes payroll easier and can be applied anywhere and at any time, with no subscriptions or additional expenses.

Key Features:

- Automatically computed Payrolls.

- Customizable Pay Stubs

- Direct Deposit Support

- Calculation of Tax and Withholding.

- Employee Self-Service Portal.

- Multi-State Payroll Processing.

- Calculation of overtime and Bonus.

- Deductions Management

- Production of Year-End Tax Forms.

- Secure Data Encryption

- Time Tracking Integration

Pricing:

- Check Stub Maker’s specific pricing is not usually listed, but generally inquired about or offered by subscription model, with typical paystub generators charging by the stub or through subscription plans. As an example, other services of the same kind will cost approximately $7.95 to get a single paystub or unlimited pay stubs during a session at approximately $29.99.

5. The PayStubs

ThePayStubs.com is an online paystub Builder designed by accounting professionals to give their users an easy and instant way to create customized and professional pay stubs with validated and correct calculations. It is formulated to ease payroll administration of small to medium-sized companies to produce electronic paycheck slips that can be used as evidence of revenue and also in record keeping, taxation, and in tracking remuneration to employees. It has various templates, is easy to use, and provides a preview of pay stubs prior to downloading, instantly creates PDFs, and offers 24/7 customer care.

Key features:

- Configurable pay stubs.

- Instant paystub generation

- Sound and correct calculations that are verified by accountants.

- Tax compliance and multi-state assistance.

- Information management of employees and employers.

- Deduction, contributions, and overtime computing.

- Mobile and easy-to-use interface.

- View the preview before completing paystub building.

- 24/7 phone, live chat, and email customer service.

Pricing:

- The service is generally available on a pay-per-stub or subscription model with customizable packages; specific costs depend and may be determined by calling ThePayStubs or going to their website.

6. Paycheck Stub Online

Paycheck Stub Online is an online tool that is automated and that allows the employer and the employees to create professional and custom online stubs of paychecks in a fast and simple way. It also makes it easier to use, and the user just requires a few clicks to enter the necessary payroll and generate a printable and error-free paystub in PDF format that can be downloaded or emailed instantly. The tool can be applied in the simplification of the payroll systems, tax filing, and financial accounting of any company, no matter its size.

Key features :

- Built-in professional paystub templates to generate quickly.

- Optional plans such as salary, deductions, allowance, and tax information.

- The easy download and print version is in a print-ready PDF.

- Preview facility to check everything before generation.

- Real-time delivery of stubs by e-mail.

- Correct tax filings on the federal and state levels with YTD figures.

- Several pay periods and payday choices.

- Add company logo and customised branding on stubs.

Pricing:

- Usually provides a free trial or free paystub generation to first-time visitors.Pricing plans differ with the amount of stubs produced, with the lowest prices being a few dollars per stub or a monthly subscription, depending on the provider.

7. FormPros Paystub Generator

FormPros Paystub Generator is a powerful and simple online application created to generate professional and high-quality pay stubs easily and fast. It suits best when it comes to small business owners, freelancers, and those who require trustworthy income verification papers.

Automated tax-calculation tools, such as federal, state, and local taxes, are available on the platform, and a live PDF preview will be updated with each input to ensure accuracy and adherence to existing policies. Its user-friendly nature allows the entry of complicated payroll information, including overtime, sick leaves, and other income, giving the user the ability to produce detailed and legally viable pay stubs.

Key features :

- Computerized federal, state, and local taxes.

- Real-time Live PDF preview.

- Overtime (sick) and other income that is earned are supported.

- Standardizable pay stub templates.

- Adherence to the current tax rules and regulations.

- No registration needed and no technical hassle process.

- Safe transactions on HTTPS.

- Immediate downloadable and printable pay stubs.

Price:

- $8.99 per pay stub, and bulk pricing is provided on purchases of several pay stubs.

8. 123PayStubs

123PayStubs is an online pay stub generator that targets employers, sole proprietors, and self-employed individuals in the United States. It enables fast and professional production of pay stubs with precise calculation of taxes at the federal, state, and local tax, with information as the pay period, time worked, pay rate, and tax withholdings.

The platform provides downloading or emailing pay stubs, provides an unlimited number of free corrections, and is customized with professional templates. It is easy to use and it assists in fulfilling payroll-related tax filing requirements and supports individuals who administer payroll by themselves.

Key Features:

- The first pay stub is complimentary to create.

- Correct federal and state taxes.

- Customizable templates of professional pay stubs.

- Simple download or emailing of pay stubs.

- The limitless free corrections are permitted until the conclusion.

- Pays out employee, contractor, and gig workers’ pay stubs.

- Pay stub generating mobile application.

- Payroll tax filing needs, such as the IRS Form 941.

- Safe and encrypted by SSL and regular payment.

Pricing:

- First pay stub is free, $3.99 per additional pay stub. Extra features like deposit slips, time-off management, and earnings/deductions can carry extra charges.

9. Wave Payroll (with Stub Generator)

Wave Payroll with Stub Generator is a simple payroll software created to help small businesses and freelancers, which enables the payment of employees and contractors easily, including the automatic calculation of taxes, automatic deposit of payment to the bank, and the production of pay stubs. It also provides employee self-service access to pay stubs and tax forms, it is fully integrated with Wave accounting software, and it facilitates tax filing and remittances. The program simplifies the work of payroll with such functionality as time tracking, payroll reports, and access to the mobile application to organize payroll at any time.

key features:

- Wages, taxes, and deductions in payroll processing automation.

- Direct deposits into the bank accounts of employees.

- Generation and filing payroll taxes form (e.g., W2, 1099, T4)

- The pay stubs and tax documents are available on the self-service portal for the employees.

- Time tracking integration to track actual hours logged.

- Payroll reports that show costs, deductions, and taxes.

- Full compatibility with Wave Accounting software.

- iOS and Android payroll management mobile apps.

- Auto Payroll Tax Remittances.

- Flexible transfer of data with other payroll suppliers.

Pricing:

- In the case of self-service states, a base fee of $25/month and an employee/contractor monthly fee of $6.In the case of tax service states (where Wave collects taxes), there is a base fee of $35 and a worker/contractor fee of $6 per employee/contractor/month. Free up to 10 employee payroll processing (limited tier), 30-day free trial available

10. StubCreator

StubCreator is a web-based paystub Builder that can generate pay stubs of high quality, timely, and professionally customized in a short time. It serves the business, independent contractors, and self-employed people with the need to calculate all salaries, taxes, deductions, etc., with 100 percent accuracy. The site also provides templates, user-friendly addition of logos and editing software, and preview and downloading of pay stubs. It seeks to automate payroll record-keeping in a secure and easy-to-use interface.

Key features:

- Full, accurate, and professional pay stubs.

- Calculator-embedded free paystub templates.

- Simple downloading and printing of pay stubs.

- Free first paystub for new users.

- Free revisions to pay stubs

- Logo-enabled breakdowns of salaries.

- Assist with generation to employees, contractors, and self-employed.

- Safe platform with privacy of the users.

- In-built templates based on business requirements.

- Previous page to view specifications before finalizing.

Pricing:

- StubCreator provides tailor-made plans of prices according to the quotation model and not rates.

How to Choose the Best Paystub Generator

These are some of the considerations when selecting the most appropriate pay stub generator that will fit your requirements:

- When you have more than one employee, select payroll-built applications such as Wave or 123PayStubs.

- When you are a freelancer, you should choose easy stub generators such as Paystub Maker Pro or Real Check Stubs.

- When you need a fast income certification to take a loan/rent: Paycheck Stub Online.

- In case you would like to be branded, use StubCreator or ThePayStubs.com.

Conclusion

The most effective paystub generator is determined by your requirements, whether you are an employer, freelancer, or individual. To have the payroll processed regularly, use such integrated systems as Wave or 123PayStubs. In case you just need a couple of stubs, a one-time service such as Paystub Maker Pro or Real Check Stubs will suit. When creating stubs in an official capacity, always be accurate, compliant, and secure.

With the right pay stub generator, you will save time, minimize mistakes, and keep professional records of the income and payroll management in 2025.

FAQs

1. Are web-based paystub generators legal?

Yes, pay stubs are valid documents provided you feed in real and accurate information. Forgery of pay stubs is illegal.

2. Is it possible to use a paystub Builder as a freelancer?

Absolutely. A lot of gig workers make stubs to present revenue to loans, houses, and taxation.

3. Do I need special software?

No, the majority of paystub Builder are fully web-delivered and available as PDFs.

4. What is the price of a paystub generator?

On average, between $5–$10 per stub. The price of subscription payroll services is between $20 and $40 per month.