Over the last decade, the Indian startup ecosystem has undergone a significant transformation, emerging as one of the most dynamic entrepreneurial spaces globally. Unicorn Startups in India have emerged as the jewel in the crown of this revolution due to not only their billion-dollar rating but also the innovation and creation of jobs, as well as the development of an economy. Whether it is fintech in the form of Unicorns like Diya, ed-tech, e-commerce, or logistics, it is evident how Indians live, work, and engage with technology as a result of these unicorns.

Globally, as of October 2025, India boasts of 124 unicorn startups, collectively worth more than $350 billion, following the number 3 position to the Unicorn Capital next to the United States of America and China. This resourceful piece of information presents the history, current state, and opportunities of Unicorn Startups in India.

What Is a Unicorn Startups in India?

A Unicorn Startups in India is a privately owned business with a valuation of one billion dollars or higher and which is not publicly traded on a securities exchange. Venture capitalist Aileen Lee coined the term in 2013 to encourage more entrepreneurs to follow such successful ventures, which are likely hard to achieve, as they are rarely seen. These corporations are symbolic of startup success in the sense of exponential growth, pioneered innovativeness, and enormous market opportunity.

The Unicorn Startups in India have been recognized as symbols of business success that has attracted international attention and investment and proved to the world that India can generate child-research-university-level business at global scales.<|human|>The Unicorn Startups in India has been seen as indicators of business success which has drawn international attentions and funding and has served to indicate to the world that India is also capable of producing businesses that are of the child-research-university level.

Criteria for Becoming a Unicorn

- Valuation Threshold: Has to have a valuation of at least $1 billion (about [?]8300 crores) either through funding round or an independent valuation.

- Private Ownership: Company needs to be privately owned and not one that is traded in a public exchange; when a company is traded in a public exchange; it leaves the unicorn status.

- Innovation-Driven: Should provide some type of innovation products or services that break new markets or set up altogether new associations.

- Scalability: Business model ought to exhibit the potential to grow and expand very fast in the markets.

- Venture Capital Backing: This is usually backed up by institutional investors, venture investment companies, or even individual personal equity funds who rationalize the billion-dollar valuation.

- Strong Market Presence: Should be having substantial number of users, the ability to generate revenue or market share in their various departments.

Importance of Unicorn Startups in India for Ecosystem

- Economic Growth Catalysts: Unicorn Startups in India add up to bringing billions to the GDP, employ hundreds of thousands directly, and cause supply chain jobs indirectly.

- Innovation Hubs: Engage in technological progression and digital transformation in industries to include more significant AIs, machine learning, fintech, and other path-breaking technologies.

- Investor Confidence:The billions of foreign direct investment (FDI) will be attracted to India and hence global venture capital and other private equity firms would find it an ideal place to venture.

- Entrepreneurial Inspiration: Success stories of unicorns inspire millions of potential entrepreneurs producing a lengthy effect of startup formation and creation of innovation nationwide.

- Global Recognition: With time, launch India as the primary contributor to the global startup ecosystem, competing with Silicon Valley and other technology centers.

- Policy Impact:Policy impacts create a monastery coalition on government policies in regulations, taxation, and infrastructure provisions, which attract entrepreneurship in the country.

The Journey of Unicorn Startups in India

1st Unicorn of India

- InMobi India InMobi was a team of Naveen Tewari, Mohit Saxena, Amit Gupta and Abhay Singhal that in 2007 was a founding company of the first in unicorn start up in India.

- Sector: Mobile advertising and marketing feasibility Wild40.

- Achievement: Became the first Indian global technology company to be valued at a billion in 2011

- Significance: Established the fact that Indian startups had enough to compete in the global market and opened the way to hundreds of entrepreneurs.

- Milestone Impact: The success of InMobi was equivalent to inspire a generation of founders and remind that outcome worth trillion dollars can be achieved within India.

Milestone Unicorns — 100th & 124th Unicorn of India

100th Unicorn:

- Open (May 2022): Neo-banking excubator that entered the illustrious 100 th unicorn club in India.

- Funding: Secured 50mm of Series D fund.

- Significance: Was a milestone in the recent history of startups in India in the years 2021-2022.

- Context: After 45 unicorns were produced in 2021 alone, to startups raising $42 billion in 1,583 transactions in 2021.

- Ecosystem Impact: Targeted the influx of Mega startups in the world ecosystem.

124th Unicorn:

- According to more recent reports, there are currently 124 unicorns in India and today, some of them include:

- Netradyne: Deeptech AI firm, as an AI-based fleet safety firm (first unicorn of 2025)

- Porter: On-demand logistics facility (second unicorn of 2025)

- Drools: Pet food that is supported by Nestle (third unicorn of 2025)

- These transactions are an indication of the further expansion and diversification of the unicorn ecosystem in India in emerging industries.

Total Number of Unicorn Startups in India (2025)

As of October 2025, India is home to 124 unicorn startups, with 5 new companies achieving this coveted status in 2025. The country ranks third globally in terms of unicorn count, following the United States and China. These 124 unicorns are collectively valued at over $350 billion and span diverse sectors including fintech, e-commerce, edtech, SaaS, logistics, and healthtech.

Yearly Growth Trajectory

| Year | Number of Unicorns | New Additions | Collective Valuation | Key Milestone |

| 2020 | 38 | 11 | ~$110 billion | COVID-19 accelerated digital adoption |

| 2021 | 83 | 45 | ~$250 billion | Record year with highest unicorn creation |

| 2022 | 105 | 22 | ~$290 billion | Crossed 100 unicorns milestone (Open) |

| 2023 | 112 | 7 | ~$320 billion | Funding slowdown, focus on profitability |

| 2024 | 119 | 7 | ~$340 billion | Market stabilization, IPO preparations |

| 2025 | 124 | 5 | ~$350 billion | Diversification into deeptech, AI, sustainable sectors |

Complete List of Unicorn Startups in India

| Sr No | Startup | Valuation (USD) | Founded | Sector / Service | City |

| 1 | Navi | 445M | 2012 | Financial products: UPI, loans, insurance, mutual funds | Bengaluru |

| 2 | Jumbotail | 279M | 2015 | B2B marketplace connecting retailers with brands | Bengaluru |

| 3 | Drools | 60M | 2009 | Healthy & nutritious pet food (dogs & cats) | Bengaluru |

| 4 | JSW One MSME | 91.6M | 2020 | Steel products: mild, stainless, structural | Mumbai |

| 5 | Juspay | 106M | 2012 | Payment orchestration, recurring payments, checkout solutions | Bengaluru |

| 6 | Money View | 220M | 2014 | Loans, credit cards, gold investment, insurance, UPI | Bengaluru |

| 7 | Veritas Finance | 331M | 2015 | Working capital loans for small businesses | Chennai |

| 8 | Ather Energy | 502M | 2013 | Electric scooters, charging infrastructure, smart helmets | Bengaluru |

| 9 | Rapido | 574M | 2015 | Bike taxi aggregation, intra-city travel, last-mile connectivity | Bengaluru |

| 10 | Porter | 152M | 2014 | On-demand transportation solutions for goods | Bengaluru |

| 11 | Perfios | 263M | 2008 | AI-driven platform for financial analysis, verification, decisioning | Bengaluru |

| 12 | Krutrim | 51.1M | 2023 | AI cloud services, advanced AI models, AI chips | Bengaluru |

| 13 | InCred | 318M | 2016 | Financial services: personal, education, business loans | Mumbai |

| 14 | Zepto | 2B | 2020 | Online grocery delivery | Bengaluru |

| 15 | boAt | 171M | 2016 | Personal audio, wearable products, mobile accessories | Gurugram |

| 16 | Molbio Diagnostics | 124M | 2000 | Point-of-care molecular diagnostics | Salcete |

| 17 | Tata 1mg | 231M | 2015 | Online pharmacy with teleconsultation | Delhi |

| 18 | Shiprocket | 349M | 2012 | E-commerce logistics & marketing solutions | Gurugram |

| 19 | OneCard | 262M | 2019 | Metal credit cards with app interface | Pune |

| 20 | LeadSquared | 204M | 2011 | AI-driven CRM & marketing automation | Bengaluru |

| 21 | Purplle | 560M | 2011 | Beauty & cosmetic products | Mumbai |

| 22 | Physics Wallah | 312M | 2016 | Online education & test prep | Noida |

| 23 | Vivriti Capital | 205M | 2017 | Debt financing for mid-market enterprises | Chennai |

| 24 | Open | 186M | 2017 | Business payments platform | Bengaluru |

| 25 | Games24x7 | 108M | 2006 | Online games & digital entertainment | Mumbai |

| 26 | Oxyzo | 201M | 2016 | SME financial solutions | Gurugram |

| 27 | CommerceIQ | 196M | 2012 | AI platform for retail ecommerce | Bengaluru |

| 28 | Amagi | 359M | 2008 | Cloud solutions for broadcast, streaming, advertising | Bengaluru |

| 29 | Yubi | 239M | 2020 | Online marketplace for business loans | Chennai |

| 30 | Hasura | 239M | 2013 | Data access & AI integration software | Bengaluru |

| 31 | Uniphore | 727M | 2008 | Business AI cloud platform | Chennai |

| 32 | XpressBees | 356M | 2015 | Logistics & courier services | Pune |

| 33 | ElasticRun | 462M | 2014 | Rural B2B e-commerce & logistics | Pune |

| 34 | LivSpace | 527M | 2014 | Interior design & renovation services | Bengaluru |

| 35 | DealShare | 387M | 2018 | Social deal-sharing platform | Bengaluru |

| 36 | Darwinbox | 140M | 2015 | AI-powered HR management software | Hyderabad |

| 37 | LEAD School | 172M | 2012 | Integrated school edtech system | Mumbai |

| 38 | Fractal Analytics | 685M | 2000 | AI & analytics solutions for enterprises | Mumbai |

| 39 | Mamaearth | 89.4M | 2016 | Organic skincare platform | Gurugram |

| 40 | GlobalBees | 210M | 2021 | Direct-to-consumer brand builder & scaler | Delhi |

| 41 | Pristyn Care | 185M | 2018 | Healthcare appointment & consultation platform | Gurugram |

| 42 | slice | 342M | 2015 | Digital banking & financial services | Guwahati |

| 43 | Spinny | 687M | 2015 | Certified pre-owned vehicles | Gurugram |

| 44 | NoBroker | 368M | 2014 | Property rentals & sales platform | Bengaluru |

| 45 | BRND.ME | 207M | 2021 | Influencer-driven branding solutions | Bengaluru |

| 46 | Cult.fit | 667M | 2016 | Fitness memberships, gyms, group classes | Bengaluru |

| 47 | The Good Glamm Group | 342M | – | Beauty & personal care products | Delhi |

| 48 | Upstox | 220M | 2009 | Tech-driven trading platform | Mumbai |

| 49 | ACKO | 598M | 2016 | Insurance: car, bike, health, travel, life | Bengaluru |

| 50 | CarDekho | 60M | 2008 | Vehicle marketplace & automotive news | Jaipur |

| 51 | MobiKwik | 284M | 2009 | Mobile recharge & bill payments | Gurugram |

| 52 | Rebel Foods | 587M | 2010 | Cloud kitchen / multi-category food delivery | Mumbai |

| 53 | CoinSwitch | 302M | 2017 | Cryptocurrency exchange | Bengaluru |

| 54 | Licious | 490M | 2015 | Online meat & seafood delivery | Bengaluru |

| 55 | Vedantu | 337M | 2011 | Live interactive K-12 tutoring | Bengaluru |

| 56 | Apna | 194M | 2019 | AI-powered job platform | Bengaluru |

| 57 | MPL | 396M | 2018 | Skill-based gaming platform | Bengaluru |

| 58 | Dream Sports | 942M | 2008 | Sports content & fantasy sports platform | Mumbai |

| 59 | Zetwerk | 859M | 2018 | Manufacturing services for industrial & consumer sectors | Bengaluru |

| 60 | Eruditus | 741M | 2010 | Executive education programs | Mumbai |

| 61 | CoinDCX | 247M | 2018 | Cryptocurrency exchange | Mumbai |

| 62 | upGrad | 329M | 2015 | Professional certification & training | Mumbai |

| 63 | Mindtickle | 281M | 2012 | AI-powered sales & revenue enablement | Pune |

| 64 | OfBusiness | 776M | 2015 | B2B procurement & credit platform | Ahmedabad |

| 65 | BharatPe | 604M | 2018 | Payment processing & merchant loans | Gurugram |

| 66 | Droom | 344M | 2014 | Automobile marketplace | Gurugram |

| 67 | BlackBuck | 359M | 2015 | Digital trucking marketplace | Bengaluru |

| 68 | Blinkit | 757M | 2013 | Instant grocery delivery | Gurugram |

| 69 | BrowserStack | 253M | 2011 | Software testing & cloud solutions | Mumbai |

| 70 | Zeta | 390M | 2015 | Payment & banking solutions | Bengaluru |

| 71 | Moglix | 471M | 2015 | B2B marketplace for industrial products | Noida |

| 72 | Urban Company | 376M | 2014 | On-demand home services | Gurugram |

| 73 | Chargebee | 475M | 2011 | Billing & revenue management software | Chennai |

| 74 | Gupshup | 544M | 2004 | Customer engagement tools | Mumbai |

| 75 | ShareChat | 1.23B | 2015 | Social media platform | Bengaluru |

| 76 | API Holdings | 1.19B | 2012 | Digital healthcare management | Mumbai |

| 77 | Groww | 596M | 2016 | Investment & trading platform | Bengaluru |

| 78 | CRED | 942M | 2018 | Credit card management & rewards | Bengaluru |

| 79 | Meesho | 1.36B | 2015 | E-commerce multi-category marketplace | Bengaluru |

| 80 | Five Star Business Finance | 522M | 1984 | Consumer & business loans | Chennai |

| 81 | Infra.Market | 752M | 2016 | Building materials distribution | Thane |

| 82 | Innovaccer | 675M | 2014 | AI-powered healthcare platform | Noida |

| 83 | Digit Insurance | 467M | 2016 | General & life insurance | Bengaluru |

| 84 | Glance | 390M | 2019 | Smart lock screen platform | Bengaluru |

| 85 | VerSe | 1.9B | 2007 | Short-video platform & tech infrastructure | Bengaluru |

| 86 | Zenoti | 331M | 2010 | Salon, spa & fitness management software | Hyderabad |

| 87 | PhonePe | 1.01B | 2012 | Payments & fintech services | Bengaluru |

| 88 | Cars24 | 1.08B | 2015 | Used vehicle marketplace | Gurugram |

| 89 | Eightfold | 410M | 2016 | AI platform for talent acquisition | Noida |

| 90 | Razorpay | 742M | 2014 | Payment gateway & financial services | Bengaluru |

| 91 | Unacademy | 880M | 2015 | Online education & exam prep | Bengaluru |

| 92 | Zerodha | – | 2010 | Stock trading & investments | Bengaluru |

| 93 | Postman | 434M | 2014 | API design, testing & management | Bengaluru |

| 94 | Nykaa | 103M | 2012 | Cosmetics & beauty retailer | Mumbai |

| 95 | FirstCry | 513M | 2010 | Baby, kids & maternity products | Pune |

| 96 | Pine Labs | 1.32B | 1998 | Payment solutions & merchant tools | Noida |

| 97 | Lenskart | 1.08B | 2010 | Online eyewear brand for men, women, and kids | Gurugram |

| 98 | Rivigo | 314M | 2014 | Integrated logistics solutions (transportation, warehousing, distribution) | Gurugram |

| 99 | Icertis | 497M | 2009 | Contract lifecycle management platform with AI | Pune |

| 100 | CitiusTech | 1.07B | 2005 | Digital solutions and services for healthcare & life sciences | – |

| 108 | CoinSwitch Kuber | 1.2B | 2020 | Cryptocurrency exchange | Bengaluru |

| 114 | BYJU’S | 1.8B | 2011 | Edtech & online learning platform | Bengaluru |

| 116 | Simplilearn | 2.0B | 2010 | Online professional certification courses | Bengaluru |

| 117 | Toppr | 2.1B | 2008 | K-12 learning app | Mumbai |

| 118 | Doubtnut | 2.2B | 2017 | AI-based learning app | Noida |

| 119 | Ai.tech | $1.5B | 2022 | AI and machine learning startup | Bengaluru |

| 120 | Netradyne | 1.35B | 2014 | AI for driver safety & fleet management | Bengaluru |

| 121 | Turtlemint | 900M | 2015 | Insurtech platform for microinsurance | Mumbai |

| 122 | BookMyShow | 850M | 2007 | Online ticketing & entertainment services | Mumbai |

| 123 | Clear | 700–750M | 2015 | Fintech for tax & compliance automation | Bengaluru |

| 124 | Finova Capital | 700M | 2015 | Fintech for MSME lending | Jaipur |

Top 10 Unicorn Startups in India

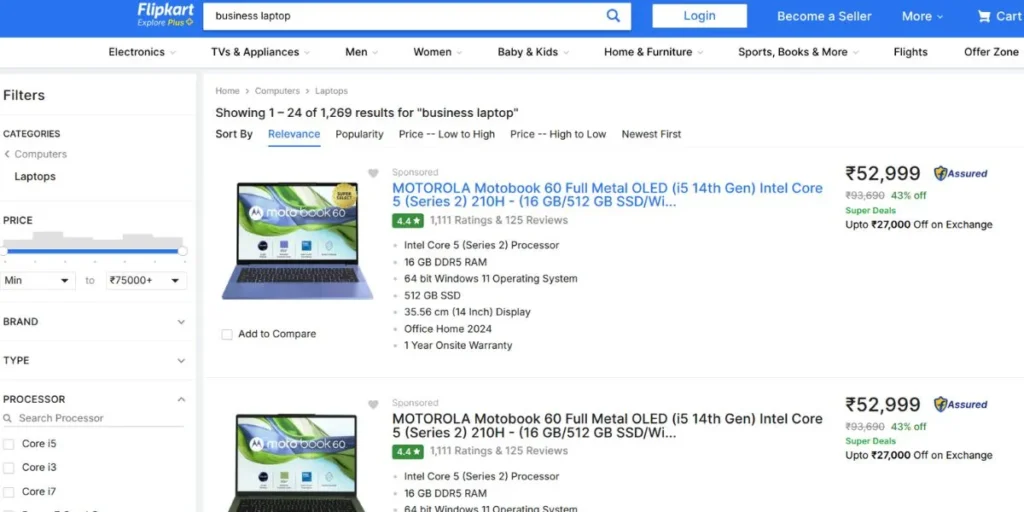

1. Flipkart

- Sector: E-commerce, Retail Technology

- Headquarters: Bengaluru, Karnataka

- Founders: Sachin Bansal, Binny Bansal

- Products and Services: Online marketplace for electronics, fashion, groceries, furniture, and more; Flipkart Plus loyalty program; PhonePe digital payments

- Year Became Unicorn: 2012

Key Investors:

- Walmart (majority stakeholder with $16 billion acquisition in 2018)

- SoftBank Vision Fund

- Tiger Global Management

- Accel Partners

- GIC (Singapore’s sovereign wealth fund)

Flipkart transformed the Indian e-commerce by introducing free delivery on cash, hassle free refunds and customer policies. It commands categories such as the fashion and electronic business with more than 500 million registered users and cutting across 19,000+ pin codes.

It has generated thousands of jobs in technology, logistics, and supply chain fields, the company receives millions of orders on the two-day flagship event Big Billion Days sale and has lessened the number of orders. Flipkart stands as one of the most successful unicorn startups in India, redefining the nation’s e-commerce landscape through innovation and scale.

Why It’s in the Top 10: India is the most valuable startup with a valuation of up to 37.6 billion, which Walmart in the greatest deal in e-commerce globally.

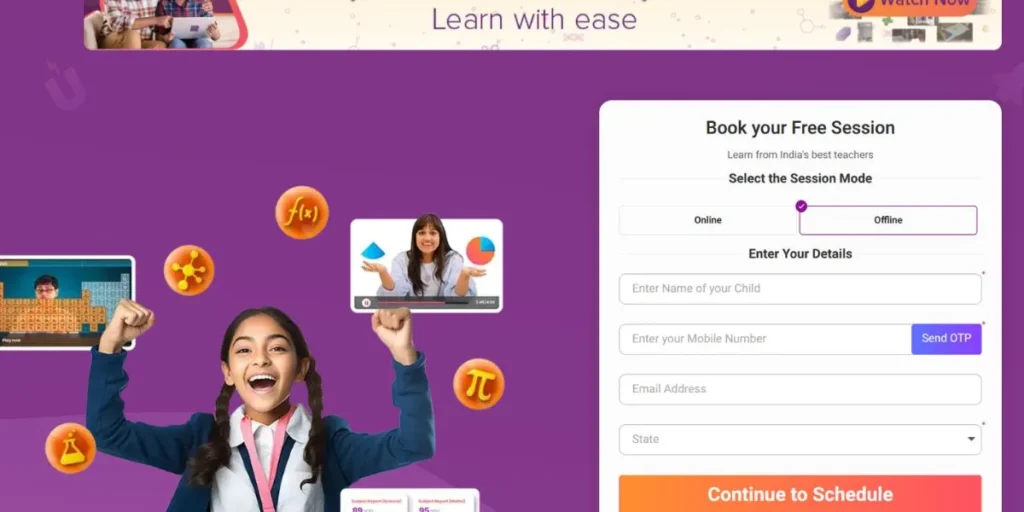

2. BYJU’S

- Sector: Education Technology (EdTech)

- Headquarters: Bengaluru, Karnataka

- Founders: Byju Raveendran, Divya Gokulnath

- Products and Services: K-12 learning app, test preparation for JEE, NEET, UPSC; coding for kids; international acquisitions including WhiteHat Jr and Epic

- Year Became Unicorn: 2018

Key Investors:

- General Atlantic

- Sequoia Capital India

- Tiger Global Management

- Silver Lake Partners

- Chan Zuckerberg Initiative

BYJU’s redefined online learning in India that entered the market offering personalized learning platforms involving video-based lessons, interactive features and AI-powered assessments. Millions of students have accessed the app in the K-12 and competitive exam preparation curriculum, thus, quality education has been realized nationally.

It continues to be a pioneer although recent challenges of valuation proved the massive potential of EdTech in India. Among the top unicorn startups in India, BYJU’S has revolutionized education by combining technology and personalized learning. BYJU’S is the best online learning tool for students.

Why It’s in the Top 10: It claims to have been valued up to 22billion (2022); it has spearheaded the EdTech revolution in India with 150 million registered users and high brand recollection.

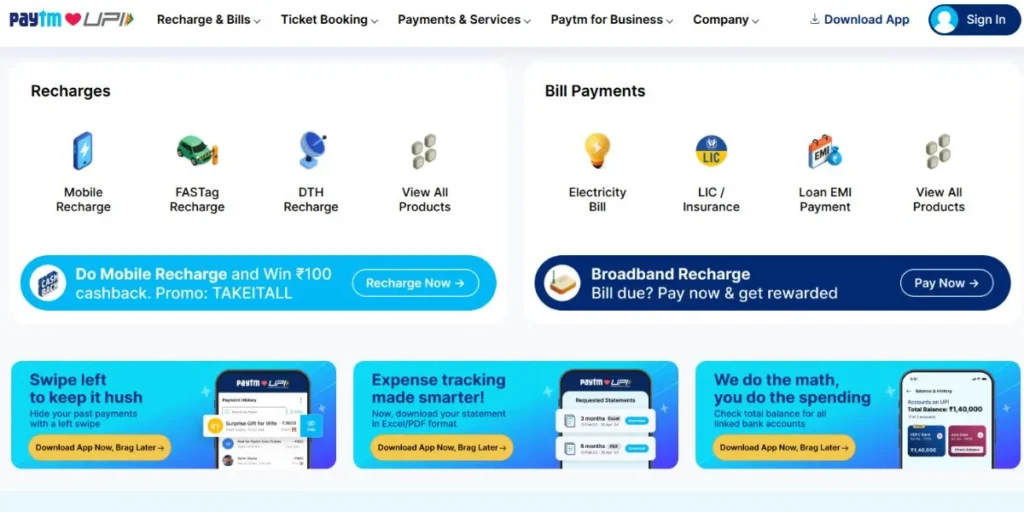

3. Paytm (One97 Communications)

- Sector: Fintech, Digital Payments

- Headquarters: Noida, Uttar Pradesh

- Founders: Vijay Shekhar Sharma

- Products and Services: Digital wallet, UPI payments, banking services, wealth management, insurance, ticketing, and merchant payment solutions

- Year Became Unicorn: 2015

Key Investors:

- Alibaba Group (Ant Financial)

- SoftBank Vision Fund

- Berkshire Hathaway

- Warren Buffett’s investment arm

- SAIF Partners

Paytm was the first player of digital payments in India that took the international system of demonetization as an opportunity to introduce millions of people to the cashless economy in 2016. It provides all financial solutions through payments and lending with more than 350 million users and 21 million merchant users.

In 2021, the company became publicly listed in one of the biggest IPOs in India worth 2.5 billion. Paytm stands tall among the leading unicorn startups in India, revolutionizing digital payments and driving the country toward a cashless economy.

Why It’s in the Top 10: First Indian unicorn company to become publicly traded since 2021, pre-IPO valuation of 16 billion synonymous with Indian digital payments.

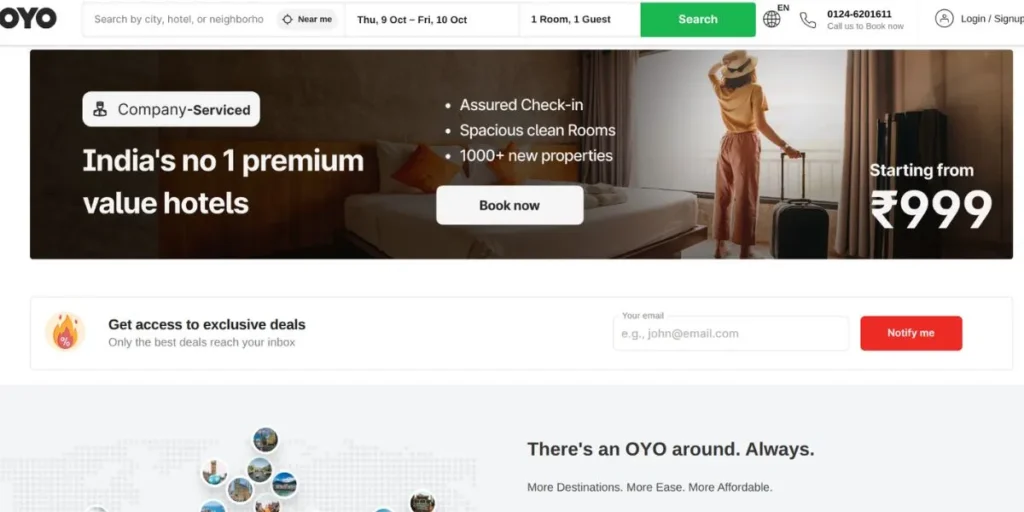

4. OYO Rooms

- Sector: Hospitality, Hotel Technology

- Headquarters: Gurugram, Haryana

- Founders: Ritesh Agarwal

- Products and Services: Standardized budget hotels, OYO Vacation Homes, OYO Workspaces, hotel management technology

- Year Became Unicorn: 2018

Key Investors:

- SoftBank Vision Fund

- Lightspeed Venture Partners

- Sequoia Capital India

- Airbnb

- Microsoft

OYO has transformed India in terms of budget hospitality by standardizing the quality of thousands of hotels and guesthouses. It serves and operates in 35+ countries with 1.2 million rooms to address the problem of trust and quality in low-end hotels utilizing technology to overcome the challenge. The company has represented the spirit of entrepreneurship in India with its founder, Ritesh Agarwal, becoming the youngest self-made tycoon in India nationally.OYO has become a symbol of rapid growth among unicorn startups in India, transforming the hospitality sector with its tech-driven business model.

Why It’s in the Top 10: Largest chain of hotels worldwide by the number of rooms, worth 9 billion dollars, branched to 35+ countries with revolutionary asset-light systems.

5. Swiggy

- Sector: Food Delivery, Quick Commerce

- Headquarters: Bengaluru, Karnataka

- Founders: Sriharsha Majety, Nandan Reddy, Rahul Jaimini

- Products and Services: Food delivery, Swiggy Instamart (groceries in 15 minutes), Genie (pick-up and drop), restaurant supply chain

- Year Became Unicorn: 2018

Key Investors:

- Prosus Ventures (Naspers)

- SoftBank Vision Fund

- Accel Partners

- Elevation Capital

- Tencent

Swiggy revolutionized the food delivery industry by offering dependable service and restaurant chains as well as having a strong infrastructure of delivering food within a short line. Outside of food, its moves to expand to quick commerce with Instamart have allowed it to challenge Zomato and be able to retain a significant number of customers.

In 2024, the company was IPO-filed with a valuation estimated to be greater than 12+ billion in known markets. Swiggy is one of the leading unicorn startups in India, reshaping the online food delivery experience with speed and convenience.

Why It’s in the Top 10: Valued at $10.7 billion, available in 500+ cities, became the first company to offer 10-minute grocery deliveries with its One-Minute Instamart app, good IPO prospects.

6. PhonePe

- Sector: Fintech, Digital Payments

- Headquarters: Bengaluru, Karnataka

- Founders: Sameer Nigam, Rahul Chari, Burzin Engineer

- Products and Services: UPI payments, merchant payments, insurance, mutual funds, gold investment, recharge and bill payments

- Year Became Unicorn: 2020

Key Investors:

- Walmart (majority owner through Flipkart separation)

- General Atlantic

- Tiger Global Management

- Ribbit Capital

- TVS Capital Funds

PhonePe has a market share of 47% in the UPI ecosystem in India and transacts billions of dollars on a monthly basis. It is considered one of the most valuable fintech companies in India after separating with Flipkart in 2022 and is valued at $12 billion, raising 850 million dollars. Millions of Indians cannot do without the app as it is simple and has an extensive network of merchants.

Why It’s in the Top 10: The greatest UPI payments service with market acknowledgment of 47 percent and worth of $12.6 billion, every months processes in excess of 5 billion payments..

7. Razorpay

- Sector: Fintech, Payment Gateway

- Headquarters: Bengaluru, Karnataka

- Founders: Harshil Mathur, Shashank Kumar

- Products and Services: Payment gateway, banking services for businesses, payroll, vendor payments, corporate credit cards

- Year Became Unicorn: 2021

Key Investors:

- Sequoia Capital India

- Tiger Global Management

- Y Combinator

- GIC (Singapore)

- Lone Pine Capital

Razorpay is a platform that streamlines online business payments, processes payments on behalf of more than 8 million businesses including the largest e-commerce site competitors and startups. Although it started small with only one payment gateway it has expanded its business to provide a full range of financial services to its businesses. The developer-friendly APIs and SME-oriented character of the company give it an edge over other companies in the competitive fintech environment.

Why It’s in the Top 10: Valuated at $7.5 billion, processes 90b+ every year, has 8 million+ businesses, Y Combinator success story.

8. Dream11

- Sector: Gaming, Fantasy Sports

- Headquarters: Mumbai, Maharashtra

- Founders: Harsh Jain, Bhavit Sheth

- Products and Services: Fantasy sports platform for cricket, football, kabaddi, basketball, hockey; daily fantasy contests

- Year Became Unicorn: 2019

Key Investors:

- Tiger Global Management

- Steadview Capital

- TPG Growth

- Kalaari Capital

- Tencent

Dream11 has been the first to introduce fantasy sport in India and made a multi-billion industry out of it. It became mainstream and fantasy gaming became standard during seasons of cricket and also IPL with over 140+ million users.

The legal war and procedures with regulations that the platform had to battle pave the way in the online gaming industry of India in terms of setting precedent regarding the legitimacy of online gaming and implement connections of skill-based gaming. Dream11 is one of the most successful unicorn startups in India, transforming the online fantasy sports industry with innovation and scale.

Why It’s in the Top 10: India has been led to have the first gaming unicorn, worth 8 billion USD, 140 million users, a title sponsor of IPL over several seasons..

9. Zomato

- Sector: Food Delivery, Restaurant Discovery

- Headquarters: Gurugram, Haryana

- Founders: Deepinder Goyal, Pankaj Chaddah

- Products and Services: Food delivery, restaurant discovery and reviews, Zomato Gold membership, Hyperpure (restaurant supply chain), Blinkit (quick commerce)

- Year Became Unicorn: 2018

Key Investors:

- Info Edge India

- Uber (exited India operations to Zomato)

- Sequoia Capital India

- Temasek Holdings

- Fidelity Investments

Zomato was the first of its kind to offer an Indian restaurant, and it now transformed its business into a food delivery service that is holistic. In the year 2021, it was the first tech unicorn that was successfully listed in the country at a valuation of eight billion dollars.

The move to strategically acquire Blinkit (in its previous state before being renamed as Grofers) early added to its portfolio in the quick commerce business and it directly competed with Swiggy. Zomato continues to dominate the food-tech scene as a major player in the list of unicorn startups in India, blending technology with taste.

Why It’s in the Top 10: First food-tech unicorn to IPO at a successful valuation, markets worth US $900 billion, versions in 1,000+ cities, purchased by Blinkit in a US5 70-valuation deal.

10. Zerodha

- Sector: Fintech, Stock Broking

- Headquarters: Bengaluru, Karnataka

- Founders: Nithin Kamath, Nikhil Kamath

- Products and Services: Discount stock broking, mutual funds, bonds, IPO applications, trading platforms (Kite), investor education

- Year Became Unicorn: 2021

Key Investors:

- Bootstrapped (no external investors)

- Self-funded by founders

- Profitable since inception

- No venture capital backing

- 100% founder-owned

Zerodha came in and rocked the India broking business with zero commission charges on equity delivery trades to the old models made by traditional brokers on their commissions. It has 6+ million active clients and a highly profitable business which makes it South India biggest stock broker in terms of trading volumes.

The inspiration of the bootstrapped success story at the company is such that it should encourage entrepreneurs to create successful, well-sustained businesses without using external funding. Zerodha has earned its place among top unicorn startups in India, revolutionizing the stock trading space with transparency and innovation.

Why It’s in the Top 10: India is the most lucrative startup with a valuation of 8.2 billion; all this is bootstrapped with no external investment, 6+ million active clients.

Unicorn Startups in India 2025 — Sector & Trend Analysis

Industry-wise Breakdown

| Industry | Key Players | Contributions |

| Fintech (35 unicorns) | PhonePe, Paytm, Razorpay, Cred, Zerodha, BharatPe, Groww, Pine Labs, CoinDCX, Slice, Jupiter | Revolutionized digital payments, democratized investing, enabled UPI ecosystem, provided credit access to underserved segments, digitized merchant payments |

| E-commerce (18 unicorns) | Flipkart, Meesho, Nykaa, Lenskart, FirstCry, Snapdeal, Purplle, Licious | Transformed retail, created supply chain infrastructure, enabled D2C brands, brought rural markets online, generated lakhs of jobs |

| EdTech (13 unicorns) | Byju’s, Unacademy, Vedantu, PhysicsWallah, Eruditus, upGrad, Lead School, Teachmint | Made quality education accessible, personalized learning experiences, upskilled professionals, created vernacular content, expanded beyond metros |

| SaaS (12 unicorns) | Freshworks, Postman, Chargebee, BrowserStack, Darwinbox, Zenoti, Icertis, Whatfix | Showcased Indian product capabilities globally, served Fortune 500 companies, created high-value employment, established India as SaaS product hub |

| Logistics (10 unicorns) | Delhivery, Xpressbees, Porter, Shiprocket, BlackBuck, ElasticRun, FarEye | Built last-mile delivery networks, optimized supply chains, enabled e-commerce growth, digitized trucking industry, reduced logistics costs |

| FoodTech (5 unicorns) | Swiggy, Zomato, Rebel Foods, Licious | Created gig economy jobs, transformed restaurant industry, pioneered cloud kitchens, standardized food quality, introduced quick commerce |

| HealthTech (6 unicorns) | PharmEasy, Pristyn Care, Innovaccer, Digit Insurance, Acko | Improved healthcare access, digitized pharmacies, enabled telemedicine, simplified health insurance, streamlined hospital operations |

| Gaming (4 unicorns) | Dream11, MPL, Hike, Noise Gaming | Legitimized skill-based gaming, created entertainment options, generated revenue for sports leagues, attracted global gaming investors |

| B2B Commerce (8 unicorns) | OfBusiness, Moglix, Infra.Market, Zetwerk, Udaan | Digitized traditional B2B sectors, improved working capital for SMEs, created transparency in pricing, optimized procurement processes |

| Auto-tech (5 unicorns) | Ola Cabs, Cars24, Spinny, CarDekho, CarTrade | Revolutionized urban mobility, simplified used car buying, created driver partner ecosystem, digitized vehicle classifieds |

| Social Media (3 unicorns) | ShareChat, Moj, Dailyhunt | Provided vernacular content platforms, challenged global platforms, created creator economy, focused on Bharat users |

| D2C Brands (7 unicorns) | Mamaearth, Boat, Sugar Cosmetics, GlobalBees, Mensa Brands, Good Glamm Group | Built Indian consumer brands, competed with MNCs, leveraged digital marketing, created brand aggregation models |

Emerging Sectors and Trends

- Artificial Intelligence & Deep Tech: Krutrim AI (LLM in Olas), Netradyne (AI fleet safety), and startups that use AI, including generative AI applications, and offer applications that are industry-specific are gaining traction.

- Climate Tech & Sustainability: Increasing attention to electric vehicles, renewable energy sources, sustainable packaging and carbon credits as well as businesses aimed at the circular economy with a great level of funding.

- Web3 & Blockchain: CLE: With uncertain regulations, usually crypto exchanges such as CoinDCX and CoinSwitch become unicorns; non-fungible token domains and decentralized financing ‘appstores’ are on the rise.

- Creator Economy: A set of platforms that allow the creators of content, influencer marketing platforms, creator-oriented fintech, and social commerce to be integrated with short-video platforms.

- Quick Commerce: 10-15 minutes delivery is becoming normal with Swiggy Instamart, blurry with Blinkit, Zepto, and groups with other categories adopting it.

- Pet Economy: Drools goes unicorn in 2025 spells increased pet care market; pet food, accessories, health, and services attracting investors.

- Rural & Bharat-Focused: Startups that focus on rural areas (tier 2 3 cities) with vernacular-interfaces, cash-friendly services, and the localization of products will become increasingly popular. Learn more about India’s startup ecosystem on Startup India.

- ture: Diagnostic chain, telemedicine application, mental health application, and preventive healthcare solution focus in the aftermath of the pandemic.

- Space Tech: Space startups such as Skyroot, Pixxel and Agnikul were attracting major investment and could take India to space-tech.

- Defense Tech: The rising role of the privates in manufacturing and technology of the defense and the push of government in Atmanirbhar is opening up avenues.

Conclusion

How Unicorn Startups managed to penetrate India is one of the unbelievable stories of entrepreneur success in the world. Since the first things began to gain popularity in 2011, InMobi, and ever since, the number of unicorns worth more than 350 melts in a single country, India has turned into the third-largest startup environment across the globe.

These unicorns cover various industries, including fintech that transforms how we pay and edtech which democratizes education as well as SaaS businesses that support businesses at a global level and members of D2C brands that threaten multinational companies. Other than valuations, Unicorn Startups in India have enabled millions of jobs, being at scale-driven solutions to real problems, and motivating millions of entrepreneurs.

The battle continues through the winter funding difficulties, profit maximization and regulatory hurdles but the dynamics of industriousness and entrepreneurship that have marked the Indian startups means that future growth would remain consistent. Elaborating on new trends and areas such as the fields of AI, climate technologies and space technology, the coming decade guarantees even more intriguing results.

India has a unicorn story, as well as, many Startup Firms in India which is eventually about ambition, implementation, and faith in the possibility of Indian entrepreneurs establishing world-level corporations and successfully competing in both national and international markets.In conclusion, unicorn startups in India are driving the nation’s digital transformation, fueling innovation, and inspiring the next generation of entrepreneurs.

FAQs

How many unicorn startups does India have in 2025?

There are currently 124 unicorn startups in India, including 5 new companies becoming unicorns this year, such as Netradyne, Porter, and Drools.

Which was India’s first unicorn startup?

Indian startups made a visit to golden heights, InMobi in 2011 was the first unicorn company in India and it was breaking available mobile advertising technology and proving that Indian startups could show-up with a billion-dollar valuation.

Which Indian city has the most unicorns?

Bengaluru has more than 50 unicorns, with Mumbai, Gurugram (NCR region), and Chennai being close behind, making it the unquestioned aptitude of the startup capital in India.

What is the most valuable Indian unicorn?

Flipkart is the most valued firm with a post acquisition valuation of 37.6 billion (Walmart) and Byju (still struggling with the recent issues) and PhonePe with 12.6 billion.

Can unicorns remain private forever?

No, the majority of unicorns end up doing IPOs (such as Zomato, Nykaa, Paytm) or being acquired by other proven companies (such as BigBasket by Tata). Others can incur down-rounds or an extended time to be in private in case the market is unfavorable to list.