As discovered by the present study, financial statement analysis tools have become vital currently for various firms, investors, and financial analysts. These tools simplify the different aspects of the financial value of a certain business through the services of profitability, liquidity, solvency and performance. They assist users in understanding certain figures on balance sheets, income statements and cash flow statements amongst other financial statements for decision-making processes.

However, with the progress of artificial intelligence and machine learning, present day tools provide forecasting, pattern, and progress capability with real-time result presentation. These tools apply when you are an investor sizing up a firm, a manager seeking ways to reduce costs, or a lender making credit decisions as they condense otherwise complicated data into useful information.

The expected tools are intended to fulfill various requirements industry sectors, from small business to developing economies and investors. Since the four walls of organizations, businesses, institutions, and other establishments are fast being flooded with data, such tools enhance competitiveness with sound financial management.

What Are Financial Statement Analysis Tools?

Financial statement Analysing tools are defined as programmes or models used to analyse the data on financial statements and interpret the results in a structured manner. It helps businesses and other stakeholders comprehend the health of the company through income statements, balance sheets and cash flow statements. These tools help in making trends analysis, risk assessment, and prospective financial performance analysis.

It uses ratio analysis, trend analysis and comparative analysis in its work. These tools enable the user to discover hidden data including performance trends of profitability, debt status, and operational effectiveness. In the future, these tools feature enhancements such as artificial intelligence, real-time data processing and adaptation based on the needs of industries which makes them must have in financial processes.

Key Benefits of Financial Statement Analysis Solutions

1. Enhanced Decision-Making: Ensures users make sound economic decisions since the insights included are always correct and up to date.

2. Risk Mitigation: Explains the financial hazards that might lead to the loss and reveals possibilities to avoid them.

3. Time Efficiency: Computationally enhances data handling; the data analyst would take a longer time to calculate manually.

4. Improved Accuracy: This system eliminates possibilities of human error in the overall analysis of accounts as computations are accurate.

5. Trend Forecasting: Makes use of past data along with analysis to forecast the future trends in financial status.

6. Competitive Advantage: Affords market intelligence that enables a company to remain competitive in the existing market.

Top 10 Financial Statement Analysis Tools

1. Tableau

Tableau is an exceptional BI Financial statement Analysing tool that works best in visual analytics to create current and real-time figurative charts, graphs, and dashboards. It works well with different types of data sets; users can display the insights skillfully. People cherish Tableau because of the graphic portraits and the drag-and-drop manner or working on it. It is perfect for things like infographics and is great for instance in creating reports with a few clicks.

A strong community is built on the platform, and lots of material is freely available to learn from and for finding answers to issues that a particular person might face. However, it is not an easy-to-use program: developing the additional functions requires a great deal of experience; and it is not cheap compared to other tools. However, like most of the BI tools, Tableau also aims at data preparation additionally, making it a bit rigid in this region and consuming much time.

Features:

- A robust solution for data displaying.Integrates with different data feeds.

- Automated and dynamic charts and graphs.

- Most of the applications have a drag-and-drop interface to ease its use.

Pros:

- User-friendly.

- Excellent for data exploration.

- Strong community support.

Cons:

- Can be expensive.

- Steep learning curve for complex analyses.

- Requires data preparation.

Price: Starts at $70 per user/month.

2. Power BI

Microsoft Power BI is one of the all-purpose Financial Statement Analysis Tool that allows business analytics and provides tools for data discovery and interactivity. It is compatible with the Microsoft suite including Excel and Azure and the user interface is fluid between these applications. Easy to use with Natural Language Processing and user-friendly interface that makes query on data easy and quick.

It is best for fashioning data stories and could be effectively used in organisations that employ between fifty- two hundred employees. While it is user friendly and supports onboard analytical models, it has less elaborate analytics compared to some of its rivals and for some features you’ll have to upgrade to the pro version.

Features:

- The operative business intelligence platform, which is associated with Microsoft.

- Works well with other Microsoft products.

- Simple interface with NL questions and able to interpret results and answer within a short time-frame.

Pros:

- Affordable.

- User-friendly interface.

- Good for data storytelling.

Cons:

- Limited advanced analytics capabilities compared to Tableau.

- Some features require a Pro license.

Price: Free for individuals, Pro license starts at $9.99 per user/month.

3. Qlik Sense

Qlik Sense is a fully-functional BI application that can boast of associative AI, which helps identify connections within the data. It has a user-friendly frontline that can be adopted by both the new generation and professionals when looking for and analyzing data. It also facilitates dynamic analytical processing to provide worthwhile information to organizations.

There is something worthwhile to look at when it comes to advanced data analysis where Qlik Sense is stronger and provides guided technologies for selected areas. On the other hand, this one of the popular financial statement analysis tool is very powerful but is relatively complex and necessitates significant formatting of data. It is usually priced on demand, and sometimes its premium price tag can place it strategically in the Enterprise Applications niche.

Features:

- It serves as one of the most well-known frameworks to have associative artificial intelligence features.

- Dynamic alternative, including the use of resources and guided technologies.

- Good for advanced analysis because it provides a complex, hard-working platform.

Pros:

- Intuitive interface.

- Powerful for data discovery.

- Strong for complex data relationships.

Cons:

- Can be expensive.

- Steep learning curve.

- Requires data preparation.

Price: Contact sales for pricing.

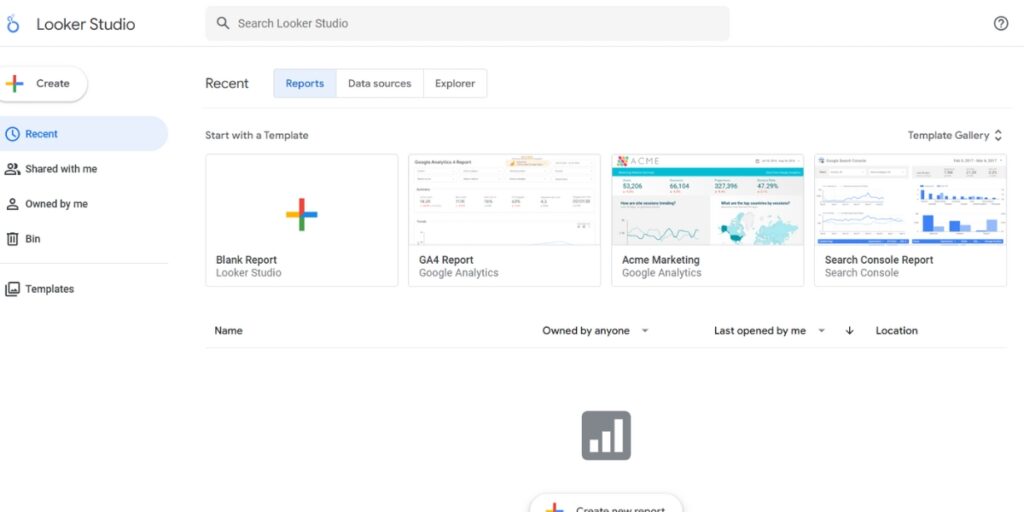

4. Google Data Studio

Google Data Studio is a free reporting tool for the preparation of straightforward reports and other graphical interfaces. It’s easily integrated with other Google applications such as Google Marketing Analytics, Google Sheets, and Google BigQuery thereby presenting a symbiotic approach to sharing the data. As one would expect from an application that focuses on data visualization it is quite intuitive which makes it ideal for novices or organizations who do not require complex features.

It is free, online, and suitable for low risk projects. Nonetheless, it has no sophisticated analysis tools, accepts lesser sources of data, and does not suit the needs of companies with complex corporate performance management necessities. All the same, due to its simplicity and fact that it can easily be integrated into any business model, makes it preferred.

Features:

- A free and easy to use service to share data visualizations.

- Moreover, it is user-friendly with interconnection of Google apps.

- Can be effectively used just for the simple reports and creation of basic dashboards.

Pros:

- Free of cost.

- Easy to learn.

- Good for simple dashboards and reports.

Cons:

- Limited advanced content analytics features.

- Fewer data sources.

- Not so developed.

Price: Free.

5. SAP Analytics Cloud

SAP Analytics Cloud is a modern BI and planning tool designed for complex business analysis, forecasting and data visualization. This financial statement analysis solution also works well with the SAP systems which makes it a go-to choice for organizations that are using many SAP products. It contains features for real-time analysis and incorporates actionable insights to cater for big enterprises to facilitate large scale planning.

The proactive analytics is for the detailed explanation of the forecast and specifically for business strategy. While quite versatile, it is cumbersome to operate and most of the time, the use of the system involves specialized SAP knowledge. Pricing is based on the size of the customers’ groups and rather high, which is suitable for large businesses.

Features:

- Proprietary business information and analysis tool that contains both internal and external data.

- Most beneficial for provisions of the enterprise level analysis and prognosis.

- Recommended for organizations with many requirements for their employees.

Pros:

- Powerful for enterprise-level planning and analysis.

- Strong integration with the SAP ecosystem.

- Proactive analysis and futuring competency.

Cons:

- Can be expensive.

- Complex to implement.

- Requires SAP expertise.

Price: Contact sales for pricing.

6. Sisense

Sisense is a business intelligence financial statement analysis tools which has a core competency in in-memory analytics, allowing for easy calculation of extensive data. It is able to analyze data in real time and provides customisable interfaces that are different from standard ones. The platform is suitable especially for organizations dealing with big amounts of data; the Hive has available deployment options for cloud or even on-premise.

Sisense provides high performance when it comes to query response time but it also lacks the data-wrangling and setting-up functionality. Despite the effectiveness of the tool, it is costly, therefore not very effective for small business organisations. Due to its emphasis on the rapid provision of information, it will be of benefit to the data-driven companies.

Features:

- A real-time data analysis platform that operates in-memory to support rapid data computation.

- Unique dashboards and analytics integrated in the software.

- Involves data preparation and a certain level of skills in data technology.

Pros:

- Fast performance.

- Good for large datasets.

- Flexible deployment options.

Cons:

- Can be expensive

- Complex to configure.

- Requires data preparation.

Price: Contact sales for pricing.

7. Domo

Domo is an innovative business intelligence software that aims at consolidating disparate data feeds and providing relevant BI in real-time. It harnesses data from different links to help the user extract value by incorporating artificial intelligence analytics. It is easy to use and the data processed there can be adjusted in real time, which is great for fast changing scenarios.

Domo’s biggest strength is that the financial statement analysis software supports heterogeneous data types and has the capability to connect with other systems. Nonetheless, it may cost a lot of money and take time to both prepare the data and hire specialized staff for it. Its pricing policy depends on organizational requirements and it is intended for mid to large organizations.

Features:

- Enables users to derive business values from data through analytics used by artificial intelligence.

- High degree of compatibility of information of different types.

- Real time processing of data for real time decisions.

Pros:

- Strong data integration capabilities.

- User-friendly interface.

- Good for real-time data analysis.

Cons:

- Can be expensive.

- Complex to implement.

- Requires data preparation.

Price: Contact sales for pricing.

8. Looker

Looker is an application for business intelligence that targets data structuring and analysis for companies and offers the opportunity to build specific data platforms. It is valuable for analyzing data connections as well as for decision making with data from different origins including social networks. The platform is highly suitable for teams which need a deep understanding of evaluation results and efficient data structuring.

Looker can support complex calculations but the workflow automation with it is difficult, a lot of preparation is needed. It is also relatively costly and is aimed at the enterprise market. However, the use of the concerned tool is more appropriate in organisations that require a higher level of analysis.

Features:

- Concentrates on the creation of models and their further exploration with the results of mathematical assessments.

- Effective for analysis of the outcome of various activities by using data acquired from social networks.

- Custom charts and graphs and adding analytical options.

Pros:

- Powerful for data modeling.

- Strong data analysis.

- Strong for data-driven decision making.

Cons:

- Can be expensive.

- Complex to implement.

- Requires data preparation.

Price: Contact sales for pricing.

9. Oracle Analytics Cloud

Oracle Analytics Cloud is an Intelligent Business Analytics Cloud Service that enables identification of data, forecasting and modeling. It also links well with other Oracle products to yield a complex analytical tool for enterprises. The platform is strong in terms of the proactive forecasting capacities which are especially valuable for organizations that work with the Oracle environment.

Oracle Analytics Cloud solution is very efficient in terms of scalability but not very easy to deploy since it involves Oracle technologies. It is cost targeted, and that is why it is most often more costly than rivals. Complicated as it is, it is a powerful weapon of choice for enterprises that require end-to-end BI solutions within the Oracle environment.

Features:

- Oracle has developed business intelligence in the form of a cloud-based platform.

- Analysis for data identification, model building and forecasting.

- Complements other Oracle apps well and forms a good addition to a range of Oracle offered solutions.

Pros:

- Strong integration with Oracle products.

- Good for enterprise-level deployments.

Cons:

- Can be expensive.

- Complex to implement.

- Requires Oracle expertise.

Price: Contact sales for pricing.

10. Microsoft Excel

Microsoft Excel is a basic data analysis and data visualization tool which is very popular among users. It sustains features such as the pivot table, charts and calculating difference through its formula option and is ideal for limited use and analysis in reports. Excel is inexpensive; in fact, many times it comes with the Microsoft Office package. Well, for basic operations, it is helpful, yet at the same time it has limited analysis features and may contain mistakes at complex operations.

The financial statement analysis tool is suitable for handling large datasets but it is time consuming hence not suitable for large data sets. Although Excel has many drawbacks it continues to be popular for individuals and small businesses since they do not have to relearn anything new.

Features:

- Simplified business intelligence data manipulation and data visualization tools.

- Algebra formulas, pivot table, and charts.

- Good for simple analysis, making tables and carrying out simple reporting jobs.

Pros:

- Widely used, affordable

- Good for basic analysis.

- Simple reporting.

Cons:

- Limited advanced analytics capabilities.

- Can be time-consuming for complex analysis.

- Prone to errors.

Price: Included in Microsoft Office suite.

How to Choose the Best Financial Statement Analysis Tools

- Understand Your Needs: Specify whether the tool will be used as a budgeting tool or a forecasting tool or as a tool that includes the overall outlook of a company.

- Assess Features: Some of the things that you should be cautious to check include Artificial Intelligence, real-time data, and the ability to be customized.

- Evaluate User-Friendliness: Make sure the tool has a friendly and easy to use working environment.

- Consider Scalability: For optimization choose tools that can scale to your business or handle more data flow in the future.

- Check Integration Capabilities: Check whether the tool is compatible or not with the current accounting software being imported.

- Review Pricing and Support: Check the prices per plan for the proxy service and confirm that the provider has dependable customer support.

Conclusion

In the future, there is a specific need for efficient financial statement analysis tools for companies that plan to operate at the highest level, financially and strategically. These tools deliver precise information that when used it directs the decision maker towards a right decision.

They earn time and computation of the financial data hence ensure that the users plan in the best strategic way. Considering the features to look for and rating those features helps to select the right tool which meets your needs and can be integrated and scaled.

The right tool not only underlines the comparison between the two approaches to financial analysis, but will also help the businesses to provide adequate and effective responses to the changes on the market. Accepting these tools is moving toward better understanding, a stronger financial position, higher performance and sustainability.

FAQs

1. What are the top financial statement analysis tools for 2025?

The most promising financial statement tools are QuickBooks, Xero, Zoho Books, FreshBooks, Sage Intacct, Fathom, Adaptive Insights, TallyPrime, Float, and Prophix. These tools are renowned for their ability to provide statistical analysis for users, rich graphical interfaces and are tailorable to different industries.

2. In what way do financial statement analysis platforms enhance decision making?

These tools help offer precise financial information about efficiency and health of a company in real time to facilitate informed decisions. They assist in establishing trends, market results and predicting risks and therefore are useful to business organisations as it enables them to.

3. Where and are these tools applicable, for instance, are they good for small businesses?

Yes, there are many specialized software for small businesses tool, where you can do your financial analysis, namely QuickBooks, and Xero. They are low cost, convenient, and flexible, which gives credit to the fact that SMEs have constrained funds at their disposal.

4. Can those tools give indication of future trends?

Yes it does, modern tools incorporate technologies, such as artificial intelligence and machine learning in deciphering past data to foresee future trends in finance. They guide investment in needed infrastructure, control hazards, and keep companies on guard to retain market share.

5. What considerations should one make before choosing a tool?

The criteria to be considered include business requirements, necessary and sufficient functionality, ease and flexibility, compatibility with the business environment, cost of implementation, and source of help or assistance. This way, the tool follows the laid goals and financial plan in order to meet expectations.