Buy Now, Pay Later (BNPL) services have revolutionised the way consumers shop online and in-store, offering flexible payment plans without the burden of traditional credit. Afterpay is one of the leading platforms in this space, but it may not be the ideal fit for every business or shopper.

Whether you’re seeking lower merchant fees, broader geographical support, or unique features like interest-free plans or credit checks, several viable alternatives can cater to different needs. Exploring these options helps both businesses and consumers find the right balance between convenience and financial responsibility, making shopping more accessible, secure, and budget-friendly across various industries.

In this blog, we will take a look at 10 Best Afterpay Alternatives.

What is Afterpay?

Afterpay is a popular “Buy Now, Pay Later” (BNPL) service that allows consumers to purchase products immediately and pay for them in four equal, interest-free installments over six weeks. Founded in Australia, Afterpay has rapidly gained popularity across multiple countries, including the United States, United Kingdom, and Canada.

It offers a seamless checkout experience both online and in-store, making it attractive for retailers and shoppers alike. Users simply link their debit or credit card, make an initial payment at the time of purchase, and the remaining payments are automatically deducted every two weeks.

Afterpay appeals especially to younger consumers who prefer not to use traditional credit cards. For businesses, it can increase conversion rates and average order values by offering customers more flexible payment options. However, late fees apply if payments are missed, which makes responsible usage essential for financial health.

Why look for Afterpay Alternatives?

- Global Availability Issues: Afterpay is not available in all countries, prompting users and merchants to seek globally accessible BNPL options for wider market reach.

- Limited Merchant Integration: Some retailers do not support Afterpay, so alternatives may offer better or broader integration with diverse eCommerce platforms and physical stores.

- Strict Spending Limits: Afterpay imposes low initial spending caps which may not suit high-value purchases, whereas alternatives may offer higher or more flexible limits.

- Late Fee Concerns: Missed payments incur late fees, and users may prefer alternatives with no fees or more forgiving payment policies to manage finances better.

- Credit Check Requirements: Some users dislike Afterpay’s soft credit checks, preferring options that do not involve any credit inquiries or impact on credit scores.

- Business Customisation Needs: Merchants may need more flexible tools or branding options that Afterpay lacks, which some competitors offer as customisable BNPL solutions.

- Customer Support Limitations: Users frustrated by Afterpay’s slow or inconsistent support often prefer alternatives that invest in faster, more reliable customer service software.

- Better Data Insights: Some competitors provide advanced analytics and insights for merchants to track customer behavior and optimise checkout experiences, which Afterpay lacks.

List of 10 Best Afterpay Alternatives

1. Klarna

Klarna, who leads the BNPL industry, gives customers the chance to use Pay in 4, Pay Now, or Pay Later in 30 days. It links with many online retailers and gives you an easy-to-use app for tracking what you buy, handling payments, and receiving interesting offers.

The company is known for guarding the interests of buyers and does not charge any interest for its quick plans. Paying by credit card and using installment loans are other services provided by fintech. Since Klarna is present in the US, UK, and Europe, people and businesses who need easy checkout options are attracted to it.

Some customers’ creditworthiness can be affected by instant checks at Amazon, but its convenience and the way it works make it a frequently used substitute for Afterpay.

Key Features:

- Pay in 4, Pay Later, and Pay Now options

- App-based purchase tracking and returns

- One-click reordering and budgeting tools

- Buyer protection and dispute resolution

- Available in-store and online

Pros:

- Multiple flexible payment options

- Strong merchant network across industries

- No interest on short-term plans

- Smooth mobile app experience

Cons:

- Approval not guaranteed for all purchases

- Late fees on missed payments

- Limited availability in some regions

2. PayPal Pay in 4

With PayPal Pay in 4, users enjoy paying for items over six weeks in four installments without paying interest, being a sensible substitute for Afterpay. The feature is a part of the PayPal checkout, so you don’t need to install any other apps.

The processing platform works easily with many businesses across the world. There is no charge or extra interest if you make your payments before the due date. Through their PayPal account, users are able to control their payments from one place.

While you can find Pay in 4 only in the U.S. and Australia, the service is supported by PayPal’s solid platforms, security, and is part of an accepted system used worldwide.

Key Features:

- Interest-free payments in 4 parts over 6 weeks

- Integrated into PayPal checkout

- Instant approval decision

- Buyer and fraud protection

- No impact on credit score

Pros:

- Backed by PayPal’s global infrastructure

- Seamless user experience

- No fees or interest

- Easy payment management

Cons:

- Available only in select regions

- Cannot modify payment schedule

- Limited to PayPal-supported merchants

3. Affirm

With Affirm, you have the chance to pay in flexible ways, either over 4 interest-free installments or with monthly payments extending from 3 to 12 months, depending on your choice. Affirm doesn’t surprise you with extra costs and performs simple credit checks that do not change your credit rating.

It teams up with many merchants who are active in digital services, travel, and fashion. Users can see their whole bill through Affirm before making any payments.

Although long-term plans may include interest rates, users appreciate the flexibility and clear terms. It’s ideal for higher-ticket items and users seeking more payment time than Afterpay or similar services offer.

Key Features:

- Financing options from 4 to 36 months

- Transparent, upfront interest rates

- No hidden fees or late penalties

- Soft credit check for approval

- Works with many top retailers

Pros:

- Ideal for large purchases

- Wide range of repayment plans

- Clear pricing and terms

- Helps with budgeting

Cons:

- Interest applies on longer terms

- Not all users qualify

- Limited merchant coverage in some regions

4. Sezzle

With Sezzle, users can split what they buy into four equal payments free of interest within six weeks, just like Afterpay. As one of the popular Afterpay alternatives, it has flexibility in mind and offers a “Sezzle Up” program that helps users develop their credit.

With wide merchant adoption in North America, Sezzle integrates with major eCommerce platforms. More youthful shoppers enjoy it because the website is easy to use and late payments cause no additional problems. Soft credit checks are used to decide on loans, and the approval happens fast.

Even if missed payments can result in your account being closed, Sezzle is a popular option for people who pay responsibly thanks to its flexibility and no-interest policy.

Key Features:

- Pay in 4 over six weeks

- Zero-interest payments

- Sezzle Up for credit-building

- Quick approvals with soft credit checks

- Merchant-friendly integrations

Pros:

- Focus on financial empowerment

- Available at thousands of stores

- No impact on credit score

- Optional credit-building support

Cons:

- Account suspension on missed payments

- Limited to supported merchants

- Not available in all regions

5. Zip

Zip helps customers break up their payments into four parts over six weeks and there is no interest charged. As an alternative to Afterpay, you can use it everywhere, including shops and online websites, because the card can be installed in Apple Pay and Google Pay.

The app is simple for users to handle spending and follow their payments. Zip stands out by charging a small convenience fee for every transaction, but this might vary with each merchant and the country.

It is well known in many countries, giving both consumers and merchants convenient options to use it. Due to its use of apps and browsers, which lets people purchase with cash, Zip differs from similar services.

Key Features:

- Four interest-free payments every two weeks

- Works in-store and online

- App-based virtual card for any store

- Real-time spending alerts

- No hard credit check

Pros:

- Wide retail acceptance

- Easy mobile wallet integration

- Flexible usage across platforms

- Transparent fee structure

Cons:

- $1 transaction fee in some cases

- Not ideal for recurring purchases

- Limited reporting tools

6. Splitit

Using Splitit, consumers can divide their payments into fixed monthly instalments, using their regular credit cards and avoiding interest or harm to their credit rating. Other BNPL providers normally create a credit line, but Splitit simply authorises the entire price and charges the card with what is used each month.

As a result, customers can use the same information and don’t have to apply for a new account. Many people with credit use it to get extra finances, rather than adding more debt through other loans.

Splitit cooperates with major worldwide brands, but its services are only available at places the merchants have joined in. You won’t need to pay anything or apply to use Splitit for paying for high-priced goods and professional services.

Key Features:

- Uses existing credit cards for installment payments

- No applications, interest, or fees

- Authorisation-only payment model

- Real-time balance management

- Global merchant compatibility

Pros:

- No impact on credit score

- No need for a new line of credit

- Instant approval

- Suited for high-value items

Cons:

- Requires available credit limit

- Fewer integrated merchants

- Doesn’t work with debit cards

7. Perpay

Perpay is a BNPL platform that caters to users with low or no credit by offering paycheck-based installment plans. As one of the notable Afterpay alternatives, it allows consumers to shop from an exclusive marketplace and pay through automatic payroll deductions over time.

It reports on-time payments to credit bureaus, helping users build or improve credit scores. There’s no interest or fees when used responsibly, and approvals are not based on traditional credit checks.

While limited to its own marketplace, Perpay provides a valuable credit-building tool for underserved consumers. It helps anyone who looks for help budgeting and wants products without the usual challenges of credit cards or loans.

Key Features:

- Shop now and pay via payroll deductions

- No interest or fees with timely payments

- Credit-building with bureau reporting

- Internal product marketplace

- No hard credit check

Pros:

- Ideal for those with limited credit

- Helps improve financial health

- Predictable payment structure

- Automatic payroll deductions

Cons:

- Only works on Perpay’s marketplace

- May take time to access higher limits

- Not usable with external retailers

8. ViaBill

People can use ViaBill to divide their online purchase payments into four equal installments, keeping the interest off. As an alternative to Afterpay, the application process doesn’t require credit checks and is very simple to use.

Fashion and lifestyle shops in the U.S. as well as Europe commonly use ViaBill. It provides automatic payments, and users who want to may sign up for a Premium plan to increase their spending limits. People who do not shop frequently can stick with the basic plan, since they will not usually have late fees from shopping late.

Thanks to its structure and easy requirements, ViaBill serves as a good option for anyone hoping to avoid complicated bills after a purchase.

Key Features:

- Pay in 4 over 4 months

- Instant account setup

- No interest for timely payments

- Minimal personal information required

- Premium upgrade for higher limits

Pros:

- Low entry barrier

- Simple and fast sign-up

- Works well for low-ticket items

- Automatic monthly payments

Cons:

- Limited merchant acceptance

- Late fees for missed payments

- Spending limits may be low for new users

9. Laybuy

With Laybuy, you can pay for things in six weekly installments and without paying interest. It’s used in New Zealand, Australia, and the UK, and it is gradually becoming more common in other places too.

Signing up for Laybuy includes a soft credit check that could affect one’s qualification, and the approval is usually given instantaneously. The dashboard is tidy and user-friendly, and it gives reminders to ensure you never miss a payment deadline.

Although Laybuy does charge for late payments, it encourages people to be organised with the way it operates. Weekly users who like having six months to repay their balance and prefer this option to the regular 30-day period will benefit from this service.

Key Features:

- Six interest-free weekly payments

- Soft credit checks at signup

- Payment reminders via app and email

- Works in-store and online

- Real-time payment tracking

Pros:

- Longer repayment duration

- Strong in Australia, NZ, UK

- Budget-friendly structure

- User-friendly platform

Cons:

- Late fees apply for missed payments

- Smaller merchant pool in the US

- Credit score may affect approval

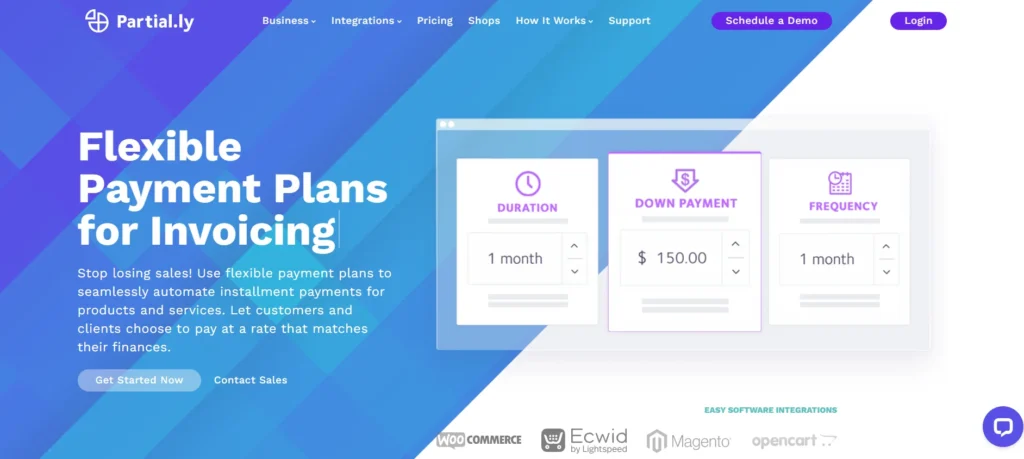

10. Partial.ly

Partial.ly offers customisable payment plans for merchants and consumers alike. It allows businesses to define payment terms, down payments, and installment durations, offering flexibility unmatched by many BNPL providers.

It’s possible for consumers to pay gradually by automatic deduction, because no credit check is required for approval. A useful integration with Shopify, WooCommerce, and BigCommerce makes Partial.ly suitable for online shops.

Even though many people haven’t heard of SplitIt, its ability to be modified for specific businesses or big transactions makes it worth considering. It is especially helpful for such businesses since they often need more tailored ways to receive payments.

Key Features:

- Flexible payment terms set by merchants

- Supports down payments and deposits

- Full integration with eCommerce platforms

- Recurring billing support

- No credit checks

Pros:

- Fully customisable payment plans

- Great for high-ticket or niche items

- B2B and service-friendly

- Global usage and integration support

Cons:

- Limited consumer-facing marketplace

- Dependent on merchant participation

- Lacks mobile app for users

Ending Thoughts

Choosing the right alternative to Afterpay depends on your spending habits, credit preferences, and the flexibility you seek in managing payments. While all the listed platforms offer convenient “buy now, pay later” models, they vary in terms of payment schedules, interest charges, credit checks, and merchant coverage.

Exploring these options ensures you find a service that aligns with your financial goals-whether you’re looking for zero-interest plans, credit-building features, or broader acceptance across stores. It’s essential to review terms carefully, as missed payments can lead to penalties. Overall, these Afterpay alternatives empower smarter budgeting, greater financial control, and access to goods and services without the pressure of upfront payments.

FAQs

Are Afterpay alternatives safe to use?

Yes, most alternatives like Klarna, Affirm, and Zip are regulated, use encryption, and follow strict privacy standards to protect your personal and payment information.

Do these alternatives require a credit check?

Some services like Affirm and Perpay perform soft or hard credit checks, while others like Sezzle and Splitit do not require traditional credit checks.

Can I use BNPL services for in-store purchases?

Yes, many alternatives offer virtual cards or mobile apps that let you use BNPL services at physical retail locations.

Do Afterpay alternatives charge interest or late fees?

Some platforms are interest-free but may charge late fees. Others like Affirm may offer interest-based plans depending on your creditworthiness.